CRISPR Therapeutics (NASDAQ:CRSP) shares were recently dumped by star-stock picker Cathie Wood. So, does this mean its bull run is over? I don’t think so. Let’s take a closer look at recent performance and explore why I think investors should consider CRISPR.

What is it?

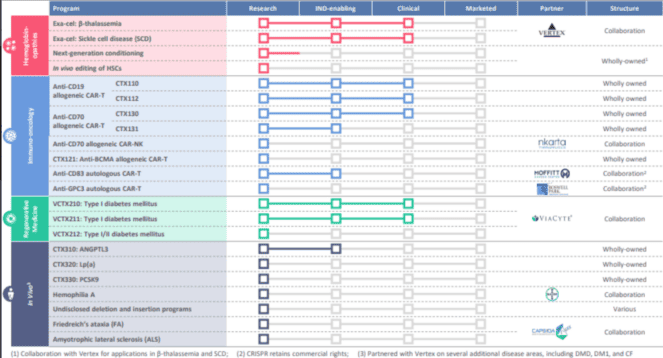

The business is a clinical-stage biotech company that’s using the CRISPR-Cas9 gene editing system to create treatments for hereditary hematologic disorders, cancers, and even diabetes.

Like many growth stocks, it’s been on a bumpy ride over the last few years. In 2021, the share price reached a phenomenal $210 before falling. But as we know, this was a period of speculative investment during which many growth-oriented companies achieved unsustainable valuations.

In 2023, CRISPR began the year with a valuation reflecting the company’s position — a highly promising biotech without a regulator-approved treatment. But since January 3 — the first day of trading this year — the stock has just 65%.

So, if I’d invested £1,000 in it on that day, then today I’d have around £1,650. Well almost. The pound has appreciated around 2% against the dollar. I’d actually have a little less than that.

The share price kicked forward in April after the company and partner Vertex submitted their CRISPR-based ex vivo cell therapy exagamglogene autotemcel (exa-cel) for FDA approval, for sickle cell disease (SCD) and beta thalassemia.

Why so promising?

Why did Wood sell?

Firstly, it’s important to note that Wood had been topping up her position in April. And her ARK portfolio still has a sizeable position in the company even after the sales. The biotech makes up around 3.4% of Wood’s ARK ETF and its stake it still worth worth $423.9m.

So, it may be the case that Wood was cashing in on short-term gains. It certainly doesn’t look like she’s lost faith in the firm.

If exa-cel receives FDA approval, then it would mark a major milestone — the company’s first approved treatment. Analysts are already suggesting the functional cure could bring in an average of $264.8m in sales during 2024.

Obviously, there’s no guarantee that the treatment will be approved. But trial data was positive — of 44 patients, 42 were “functionally cured” of their disease — and support appears to be growing for the gene-editing therapies.

Traditionally, only one out of 10 drug candidates successfully passes clinical trial testing and regulatory approval. So, it’s worth noting that CRISPR has a pipeline of 22 other treatments. Many will fail, but some, I’m hopeful, will reach the market. It also has $2bn in cash to aid development.

I bought some of the shares earlier in the year. And I’m fortunate they’re doing rather well despite a strengthening pound. It’s always hard to put a valuation on companies at this stage of their development, but I’m positive about the potential of this gene-editing firm. Although I’m low on capital so won’t buy more for now, I still think there’s value at $65.