I’m searching for the best penny stocks to add to my UK shares portfolio. Here are three I think could deliver smashing returns through to 2030.

Geiger Counter Limited

Investment fund Geiger Counter Limited (LSE:GCL) invests in companies that explore for and/or produce energy or develop energy projects. So as the global population increases and emerging markets economies power ahead — pushing electricity demand through the roof — I think returns here could impress.

The fund’s focus on uranium is especially attractive to me. As the world moves away from dirty fossil fuels, demand for the radioactive material should soar. Some of the businesses Geiger has invested in are Canada’s NexGen Energy and Cameco and US-focused Ur-energy.

Operational problems at any of the companies Geiger Counter is invested in could damage the fund’s returns. Yet I believe the rate at which nuclear power is forecasted to rise still makes it an attractive growth stock to buy. The International Atomic Energy Agency thinks nuclear capacity will rise 73% between 2021 and 2040.

Gensource Potash

More people on the planet means that food demand is also rising strongly. With maximising crop yields becoming increasingly important I think Gensource Potash (LSE:GSP) could be a top penny stock to buy.

Potash has a variety of qualities that makes it great for farming. Plants that are fertilised with the mineral require less water. They also have improved disease resistance. Potash is also effective in improving crop quality and influencing the taste, size, and quality of produce.

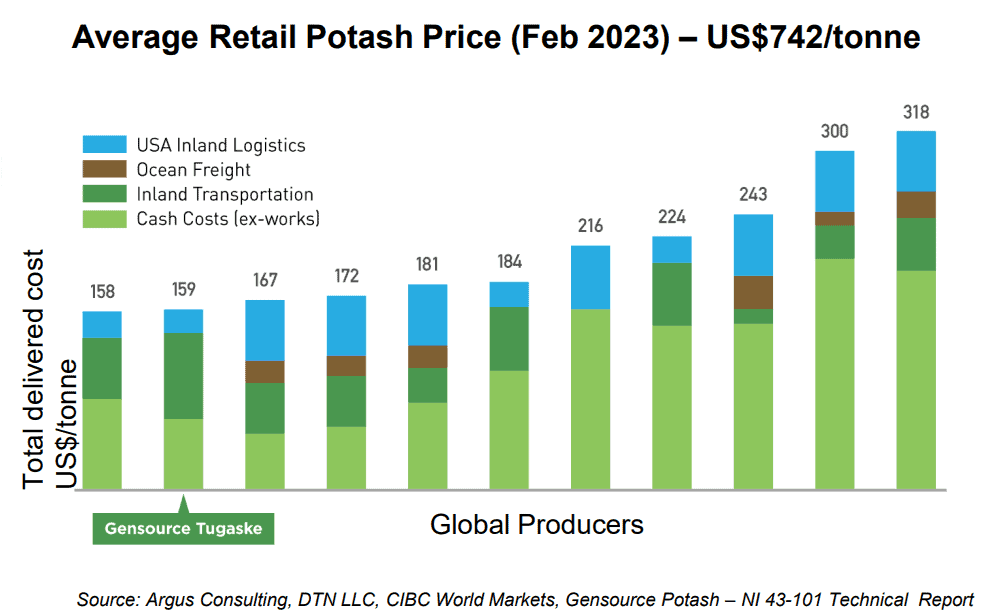

Gensource Potash owns the Tugaske potash mine in Canada. Development here is ongoing with maiden output scheduled for next year. When it finally begins producing the project will have one of the lowest cost bases in the business.

A potential wave of new potash supply over the next decade could hamper Gensource’s profitability. But that low cost base will limit any possible impact and help the business deliver strong investor returns.

European Metals Holdings

Sales of electric vehicles (EVs) are soaring. And UK investors have multiple ways to capitalise on this trend, like purchasing shares in auto component manufacturers or strategic metal producers.

European Metals Holdings (LSE:EMH) is one such stock on my radar today. As a prospective lithium producer it could enjoy exceptional earnings growth as car battery manufacturing booms. The EV sector accounts for 80% of all lithium demand.

The firm’s gigantic Cínovec mine is located close to the Czech-German border. This puts it in the heartland of Europe’s booming EV industry. Sales of low-emissions vehicles are accelerating and battery vehicle purchases soared 58% in March, latest European Automobile Manufacturers’ Association data shows.

Development problems at Cínovec could play havoc with European Metals Holdings’ earnings prospects. But on balance I think the potential rewards of owning this share outweigh this danger.