Despite rising 20% this year, Alphabet (NASDAQ:GOOGL)(NASDAQ:GOOG) shares remain 25% off their all-time high of $149. And with the stock market’s headwinds dissipating, now could be time to buy Alphabet stock before it’s too late.

Capitalising on weak sentiment

Those who’ve capitalised on Alphabet’s periods of weakness would find their stocks trading higher. One only needs to point to the several rebounds over the past couple of months to realise that the initial sell-offs from its Bard hiccup and better-than-expected Q1 figures were buying opportunities.

For starters, its Q1 results showed everyone why writing Alphabet stock off so soon is a mistake. Both the company’s top and bottom lines beat analysts’ estimates. Earnings per share (EPS) blew past consensus despite the tougher operating environment.

| Metrics | Analysts’ consensus | Q1 2023 | Q1 2022 |

|---|---|---|---|

| YouTube revenue | $6.64bn | $6.69bn | $6.87bn |

| Google Cloud revenue | $7.49bn | $7.45bn | $6.81bn |

| Total Google Ads revenue | $53.75bn | $54.55bn | $54.66bn |

| Revenue | $68.90bn | $69.79bn | $68.01bn |

| Diluted EPS | $1.08 | $1.17 | $1.23 |

Future streams of income

Nonetheless, the biggest takeaway would be that Google Cloud is now profitable, due to some accounting alterations. This now paves the way for the segment to expand the firm’s overall margins moving forward, which should provide some upward momentum for EPS to rise over time.

Nonetheless, it’s the future that gets me excited about buying Alphabet stock. There’s no doubt that Microsoft has been head and shoulders above the rest of the industry in terms of its offerings, but one shouldn’t discount the potential of the Mountain View corporation either.

The group is beginning to incorporate more sophisticated artificial intelligence (AI) into its services. One example is its chat bot, Bard, which can now help users with programming and software development tasks, including code generation. There are also other areas for AI to seep into, such as Google Cloud and YouTube.

YouTube in particular, has me most excited for Alphabet stock, as the service boasts an array of exciting profit avenues. Although its short-form content continues to cannibalise advertising revenue from its long-form videos, this is expected to taper off soon as YouTube TV picks up momentum.

The living room remained YouTube’s fastest-growing screen in 2022 in terms of watch time, and it has seen its growth continue in Q1, with more advertisers also coming on board. And with more offerings (MultiView, YouTube TV, NFL Sunday Ticket), there’s plenty of earnings potential in the pipeline.

Should I buy Alphabet stock?

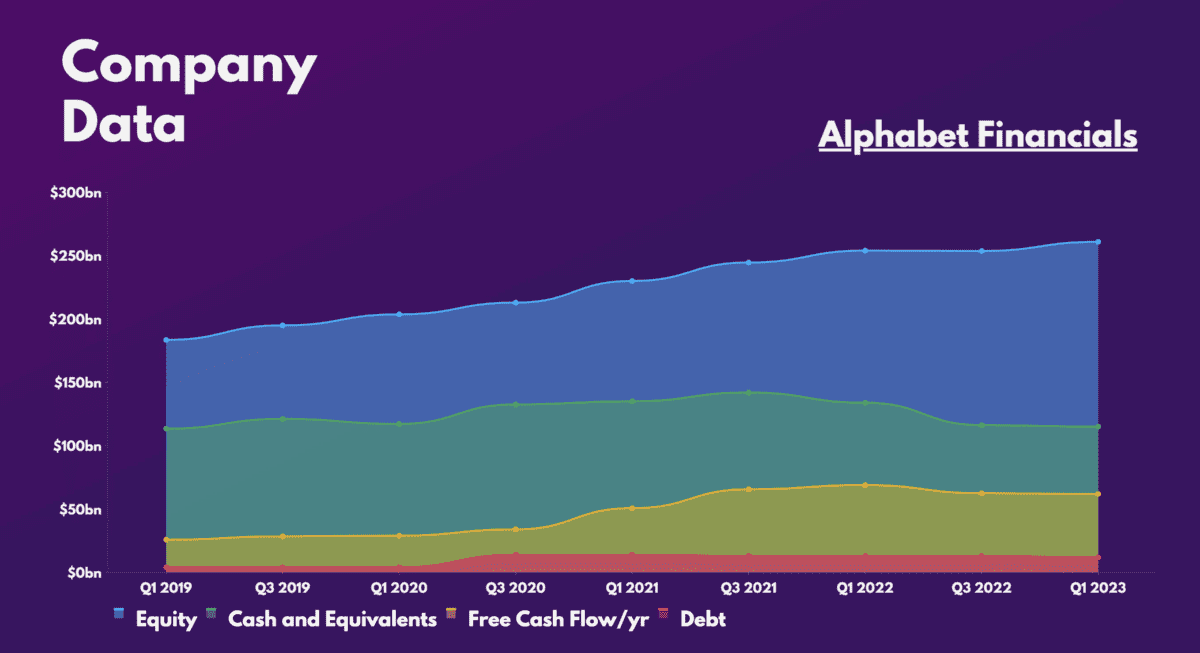

To complement its exciting opportunities, the tech giant also boasts an excellent balance sheet with an impeccable debt-to-equity ratio of 4.5%. Additionally, the conglomerate’s robust free cash flow and increasing shareholder returns via stock buybacks makes Alphabet stock very appealing.

After all, brokers have an average ‘buy’ rating on the shares with an average price target of $130, indicating an approximate gain of 20% from its current share price. And with its current and forward multiples trading at a relative discount to its 10-year average, it’s easy to understand why.

| Metrics | Alphabet | Industry average |

|---|---|---|

| Price-to-earnings (P/E) ratio | 23.4 | 21.2 |

| Forward price-to-earnings (FP/E) ratio | 19.4 | 30.9 |

More importantly, the Federal Reserve seems to be done with its rate hiking cycle, with markets now pricing in a couple of cuts by the end of the year. This should reduce the headwind and foreign exchange pressures on Alphabet stock, which is why I’d buy more of its shares while they’re cheap today.