I could hardly believe what I was seeing when I stumbled across this UK value stock.

Anglo Eastern Plantations (LSE:AEP) is not the kind of stock that gets talked about on the TV or at the pub.

In fact, there’s not a single analyst covering the FTSE 250 company, which owns and operates palm oil plantations in Indonesia and Malaysia.

That might partly explain why the company’s stock seems to be trading at a bargain-basement price.

A well-oiled operation

Let’s take a step back and look at how Anglo makes its money.

The company’s main produce is palm oil, which is used as a cooking oil and a biofuel, as well as an ingredient in margarine and soaps.

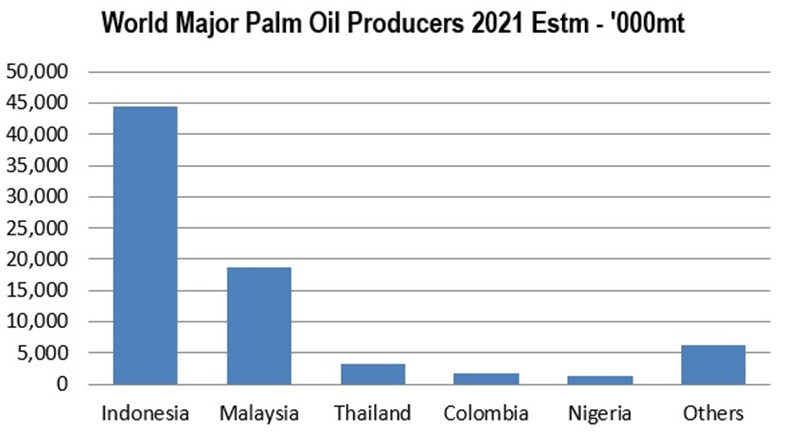

Indonesia and Malaysia are the world’s undisputed leaders in palm oil production, accounting for 80% of global production.

Within those two countries, Anglo has 16 estates that churn out close to 500,000 metric tonnes of crude palm oil (CPO) a year.

That is around 0.5% of global production. Let’s be clear: the company is very much a “price-taker” and not a “price-maker”. In other words, it is at the mercy of global supply and demand for palm oil.

Vegetable oil markets have been buoyed by the war in Ukraine disrupting sunflower production. But globally traded commodity markets can turn at any moment for a thousand possible reasons.

So, why did I buy shares in this company?

Palm and prosperity

Here’s where things get interesting.

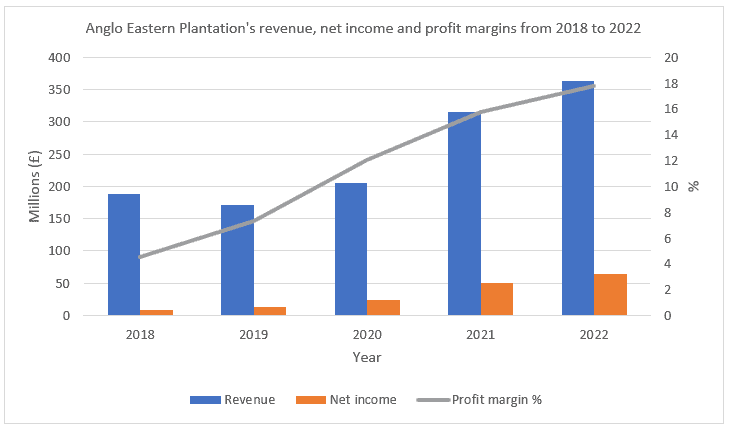

Anglo’s revenue is up 93% from 2018 to 2022. Its net income, meanwhile, has rocketed 655% over the same time period. The company achieved that feat by beefing up its profit margin, from 4.6% to 17.8% in the last five years.

But the stock’s price has not reflected that phenomenal growth in the company’s fundamentals, notching up only 7% since 2018.

That has resulted in its price-to-earnings (P/E) and price-to-sales (P/S) ratios dropping.

| Price-to-earnings (P/E) | Price-to-sales (P/S) | |

| 2018 | 26.3 | 1.2 |

| 2019 | 18.0 | 1.3 |

| 2020 | 9.3 | 1.1 |

| 2021 | 5.7 | 0.9 |

| 2022 | 4.9 | 0.9 |

The company’s P/E ratio of 4.9 is way beneath its five-year average of 13. To revert back to the mean, its share price would need to shoot up by 160%!

Anglo’s coffers are also brimming with £184m in net cash. That’s enough dough for the company to buy back its entire free-float market capitalisation of 18.1m shares.

Fly in the palm oil?

A lot of people will recognise the term “palm oil” from reading packets that boast of not containing the ingredient.

Perhaps the oil’s connection to deforestation explains ESG-conscious investors’ reluctance to touch this dirt-cheap stock. But Anglo sticks to strict zero-deforestation rules, and evidence shows such agreements are working to protect Indonesia and Malaysia’s boundless green horizons.

I can’t overlook the political risks of Anglo being mainly based in Indonesia, however. Corruption in the country has worsened since 2018, according to Transparency International. In addition, the government imposed a shock export ban on palm oil in April 2022 to secure supplies for locals. The ban has since been replaced with a quota system.

Despite that turbulence, I couldn’t resist snapping up shares in Anglo. The rock-bottom valuation and fat cash balance make me confident this palm oil investment could bear some juicy fruit.