abrdn (LSE: ABDN) shares sport an eye-catching dividend yield right now. Currently, the trailing yield here is about 7.1% – roughly twice that of the FTSE 100.

Are the shares worth buying given this bumper yield? Let’s discuss.

Two reasons to be bullish

From an investment perspective, there are things I like about abrdn and things I don’t.

On the positive side, I like the company’s strategy.

Abrdn is focused on four key areas today. These are:

- Asia

- Sustainability (ESG investing)

- Alternative investments and real assets

- UK savings and wealth

I see this as a solid strategy. All four areas should offer growth potential in the years ahead and help the company get bigger.

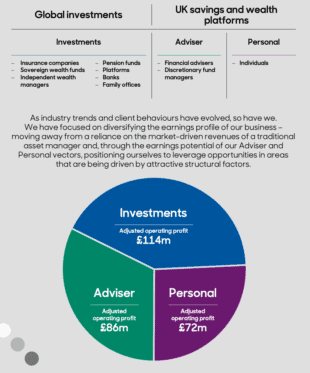

Another thing I like about it is that the company is more diversified than it used to be. In late 2021, the group spent £1.5bn to buy UK retail investment platform Interactive Investor. This was a great move, to my mind.

Interactive Investor is a top-notch platform with over 400,000 customers. And, currently, it has assets under administration of over £60bn.

This acquisition should help the group scale up. It should also enhance earnings stability as abrdn now has three sources of income – investments, financial adviser services and retail customers.

In recent years, the company’s earnings have been volatile.

Two negatives

On the downside, the performance of the company’s investment business has been poor recently.

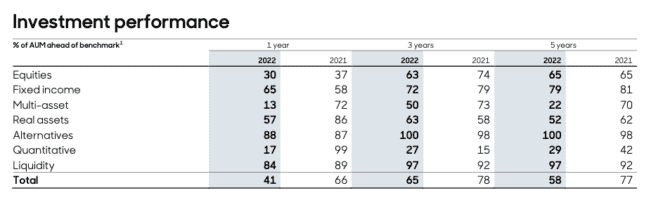

The table below shows the performance of its investments over one, three, and five years, relative to their benchmarks (to the end of 2022).

Over those five years, just 58% of its products outperformed. That’s not a great result. To put that number in perspective, rival Schroders achieved a figure of 73%.

The company desperately needs to improve its performance, otherwise clients will take their capital elsewhere.

Costs are also too high in this area of the business. Last year, the cost-to-income ratio was 89%.

Another negative here is a lack of dividend growth. For 2022, abrdn declared a dividend payout of 14.6p per share – the same as in 2021 and 2020.

Often we see this kind of pattern – where there’s no growth in the payout – before a dividend cut. So I don’t think we can rely on the high yield here.

It’s worth noting that last year, dividends cost the company a total of £307m. Yet the group only generated cash from operating activities of £110m. So performance needs to improve dramatically for dividends to remain at the current level.

My view

Weighing everything up, abrdn shares aren’t a ‘buy’ for me right now.

I do think the company is heading in the right direction. However, I’d want to see its financial performance improve before investing.

Right now, there are plenty of other dividend stocks that look a little more attractive to me.