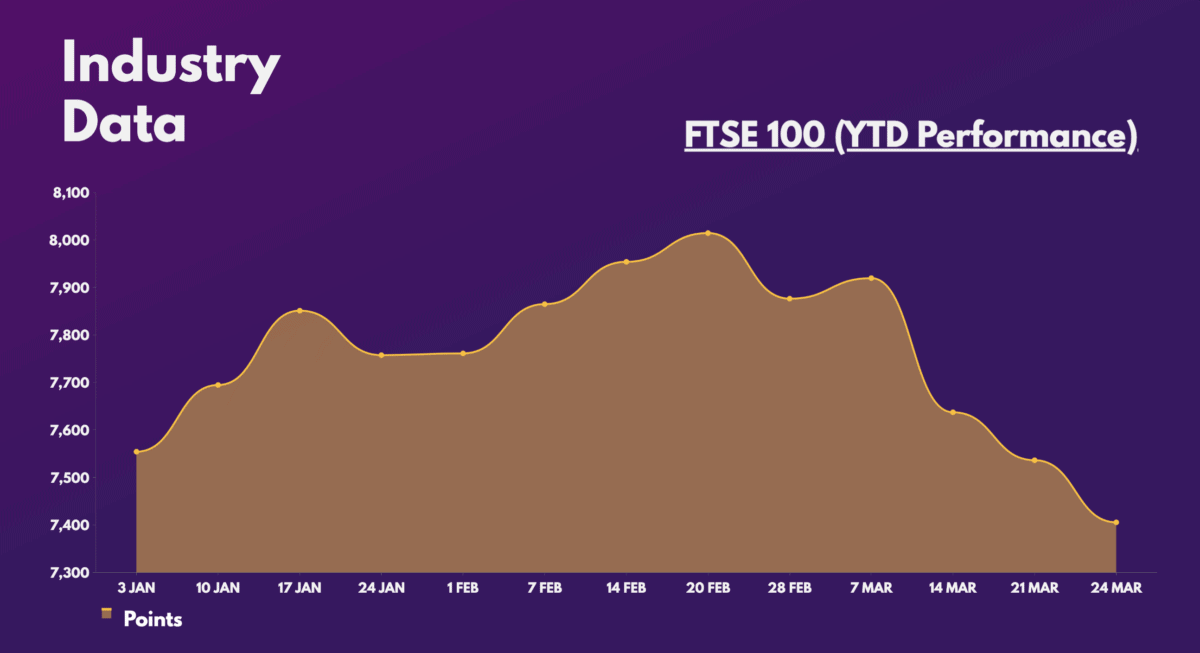

The UK’s premier index finally did it — it hit an all-time high of 8,014 in late February. However, since then, a bout of fear surrounding bank stocks, as well as a weak industrial data, has caused it to drop over 600 points. With headwinds picking up, can the FTSE 100 make it back up to its highs?

Citi analysts aren’t too bullish

Analysts from Citi aren’t too optimistic on the FTSE 100’s prospects this year. The broker has now revised its prediction for the UK market to finish the year at 7,600 points, from an initial 8,000 points. Nonetheless, there are reasons for this.

The recent banking sector turmoil has sparked contagion fears. Meanwhile, manufacturing activity has been contracting, worsened by China looking to cap commodity prices. And given that financials, industrials, and materials make up 43.4% of the FTSE 100, it’s easy to see why optimism has tapered off.

| Sector | Weight in FTSE 100 |

|---|---|

| Consumer staples | 17.9% |

| Financials | 17.8% |

| Materials | 13.4% |

| Industrials | 12.2% |

| Healthcare | 11.7% |

| Energy | 9.5% |

| Consumer discretionary | 6.9% |

| Communications | 4.3% |

| Real estate | 1.4% |

| Technology | 1.4% |

Banking on a soft landing

Thus, it’s not difficult to see why the bullishness for the FTSE 100 at the start of the year has flipped on its tail. Inflation remains high and further rate hikes from central banks aren’t being ruled out. Although this is normally good for banks, it could put further stress on the already fragile banking system.

This hasn’t been helped by a recent report released by S&P, which predicts that inflation will get worse in the UK. The credit agency anticipates inflation will remain high at least until the end of the year, which may spur further rate hikes.

On the contrary, though, the Bank of England sees inflation dropping to around the 2% mark by the end of the year. It also expects this to happen without the UK plunging into a recession, due to the strength of the consumer. The latest retail sales data is evidence of this.

Should I still buy FTSE 100 shares?

All this leads to the question of whether FTSE 100 shares are still worth buying if there isn’t much room for the index to grow. Well, the Footsie may not hit 8,000 points again in 2023, but this shouldn’t stop cheap stocks with great potential from growing this year.

After all, UK shares, which are famous for their cheap value, are now even cheaper. This is especially the case with bank stocks. The much stronger capital and buffers at British banks make their current valuations very lucrative, which presents me with a buy-the-dip opportunity.

| Metrics | Lloyds | Barclays | NatWest | HSBC | Santander | Industry average |

|---|---|---|---|---|---|---|

| Price-to-book (P/B) ratio | 0.6 | 0.3 | 0.7 | 0.7 | 0.6 | 0.7 |

| Price-to-earnings (P/E) ratio | 6.2 | 4.2 | 6.9 | 8.8 | 5.8 | 9.0 |

| Forward price-to-earnings (FP/E) ratio | 6.4 | 4.4 | 6.0 | 5.3 | 5.5 | 5.5 |

But if that doesn’t tickle my fancy, I still have an array of other cheap FTSE 100 shares to invest in, such as miners, retailers, and even housebuilders. One such stock that catches my eye is Taylor Wimpey, which has an 8.2% dividend yield and trades on great valuation multiples.

| Metrics | Taylor Wimpey | Industry Average |

|---|---|---|

| Price-to-book (P/B) ratio | 0.9 | 0.9 |

| Price-to-sales (P/S) ratio | 0.9 | 0.8 |

| Price-to-earnings (P/E) ratio | 6.3 | 9.8 |

| Forward price-to-sales (FP/S) ratio | 1.2 | 1.2 |

| Forward price-to-earnings (FP/E) ratio | 12.8 | 10.4 |

Either way, I’m not too absorbed in the short-term noise and volatility. Rather, I’m more interested in investing in companies based on fundamentals and their future prospects, and the FTSE 100 boasts plenty of stocks with just that.