Lloyds (LSE:LLOY) shares have been among the casualties of the Silicon Valley Bank fallout. The stock is down 8% over one month. That’s clearly not positive, but it’s less than other UK banks, notably Barclays and HSBC.

So, why do I think Lloyds is a buy? Let’s take a closer look.

Interest rates

Rising interest rates are good for banks until they’re not. What do I mean by this?

Well, higher Bank of England rates allow Lloyds to increase its net interest margins (NIMs). Higher NIMs mean higher net interest income (NII). Right now, this is one giant tailwind and we’re seeing bank revenues rising considerably as a result.

But these higher rates also mean that borrowers struggle. Good debt turns bad and impairment charges rise. There’s an interest rate sweet spot for banks. It’s around 2%-3%.

Thankfully, the medium-term forecast sees central bank rates somewhere near this sweet spot.

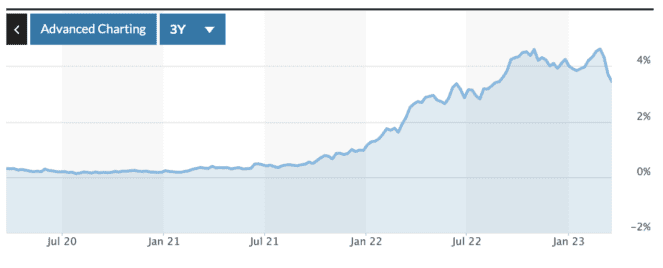

But there’s something else that is now worrying investors as interest rates reach their highest since 2008: unrealised bond losses. This is because bond prices and bond yields are inversely related.

If it wasn’t for SVB, probably nobody would be talking about unrealised bond losses. But after the tech financier ran into trouble, and had to sell bonds at a loss, investors began to worry about the health of other banks’ holdings.

Lloyds isn’t SVB

Lloyds shares have fallen, but it’s not entirely fair. There’s a few reasons for this.

Firstly, European banks have around 6% of assets invested in “available for sale” portfolios on average, according to ABN Amro. Total investments make up 18% of their total balance sheets.

Meanwhile, the fiasco at SVB started when the company needed to shore up its finances. SVB’s $21bn bond portfolio had a yield of 1.79% and a duration of 3.6 years — currently the 3-Year US Treasury note yields 3.4%.

SVB had around 14% invest in “available for sale” investments. Investments as a share of assets were 57%.

It’s also worth noting that unrealised bonds losses don’t need to be included on bank results — not until they’re sold anyway. The thing is, most won’t be sold, because big banks don’t need to, and will be held until maturity.

Lloyds is a fairly middling European bank in some respect. It’s largely less exposed to risk than big US counterparts and has a strong liquidity coverage ratio of 141.8%, up from 135% at the of end-2021.

In reiterating why Lloyds looks like a solid institution right now, we can also look at the commentary. One European banking chief dismissed concerns about the sector last week, telling The FT, “We have between five to eight times as much liquidity (…) There isn’t the sector-wide sickness that was the US subprime mortgage problem of 2008”.

Buying more

I’m buying more Lloyds stock as the stock dips following the SVB fiasco. I appreciate that the current macroeconomic climate isn’t ideal because really high interest rates mean more bad debt and impairment charges. But I’m not worried about bonds.

Moreover, NII is soaring, and I’m buying with a more attractive interest rate forecast in mind. Right now, I believe this bank is considerably undervalued.