Rolls-Royce (LSE:RR.) shares started the year trading in pennies. Today, they’re just below £1.50 each and the stock’s 12-month return stands at a formidable +57%.

The rapid growth in the Rolls-Royce share price can largely be credited to exceptional annual results released a month ago. But can the company continue to impress and outperform all other constituents of the FTSE 100 index in 2023?

Here’s my take.

The beginning of a rebound

Although there’s been a splendid share price rally in recent months, it’s notable that Rolls-Royce still has a considerable way to go in order to make a full recovery to its previous levels.

The five-year chart looks ugly. Accounting for the emergency rights issue the business undertook to raise cash during the pandemic, the valuation is around 50% of what it was half a decade ago.

But the upward momentum is positive. A £238m hike in underlying profit to reach £652m last year and a 35% uplift in large engine flying hours for civil aerospace year on year were welcome indicators of a return to financial health.

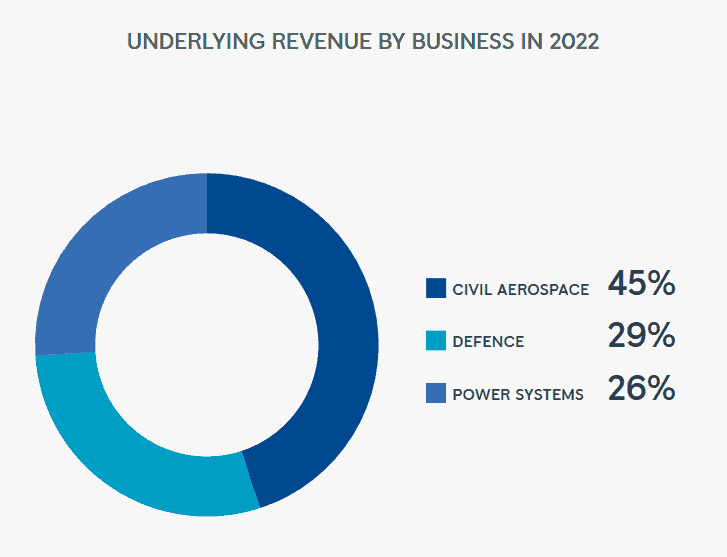

Encouragingly, the business is firing on all cylinders. Each of the company’s main divisions delivered revenue growth in 2022, and all three are now cash flow positive.

Civil Aerospace and Power Systems led the charge, delivering revenue hikes of 25% and 23%, respectively. Revenue growth was a little more muted for the firm’s Defence arm, at 2%, but this unit had a strong 2021. Indeed, Defence still has the highest underlying operating margin of the trio.

The top-performing FTSE 100 stock of 2022 was another defence contractor, BAE Systems. With signs of a recovery in Rolls-Royce’s core civil aviation business on top of a consistently robust defence offering, I think there’s a good chance the company can match BAE’s feat in 2023.

Risks

That said, there are challenges that could derail the upward trajectory of the share price. Net debt has been significantly reduced, but it’s still a concern at £3.3bn.

In addition, the company is coy in its guidance concerning the potential return of dividend payments. The business hasn’t rewarded shareholders with distributions since the pandemic.

I’m also concerned that CEO Tufan Erginbilgic’s drive to repair the balance sheet could begin to harm Rolls-Royce’s innovation potential.

Granted, debt reduction remains a necessity for the firm. However, recent news that the company closed R2 Factory (its artificial intelligence start-up) came as a disappointment to me.

Although I want to see streamlined finances and improved performance, there’s a risk Rolls-Royce could fall behind competitors in developing the technologies of the future if its cost-cutting measures are too severe.

Should I buy?

I already own Rolls-Royce shares and I’m happy to hold on to my stake in the business. I believe there’s a strong chance the company can be the top performer in the FTSE 100 in 2023, especially after such a spectacular head start to the year.

There are risks that could derail this progress, but overall I think the stock’s upside potential is strong. I’m content with my position for now and I’m not buying today. But I’m keeping a keen eye out for any dip-buying opportunities that could emerge over the coming months.