The collapse of Silicon Valley Bank (SVB) and Credit Suisse have led to a sell-off in many bank stocks. Barclays (LSE:BARC) has been no exception, falling 20% from its highs this year. But could this recent weakness be an opportunity for me to nab Barclays shares on the cheap?

Canary in the coal mine?

There’s certainly plenty of fear surrounding the financial sector. Nonetheless, the recent weakness in bank stocks could be seen as a bit of an overreaction for a number of reasons. This is especially the case with UK bank shares like Barclays.

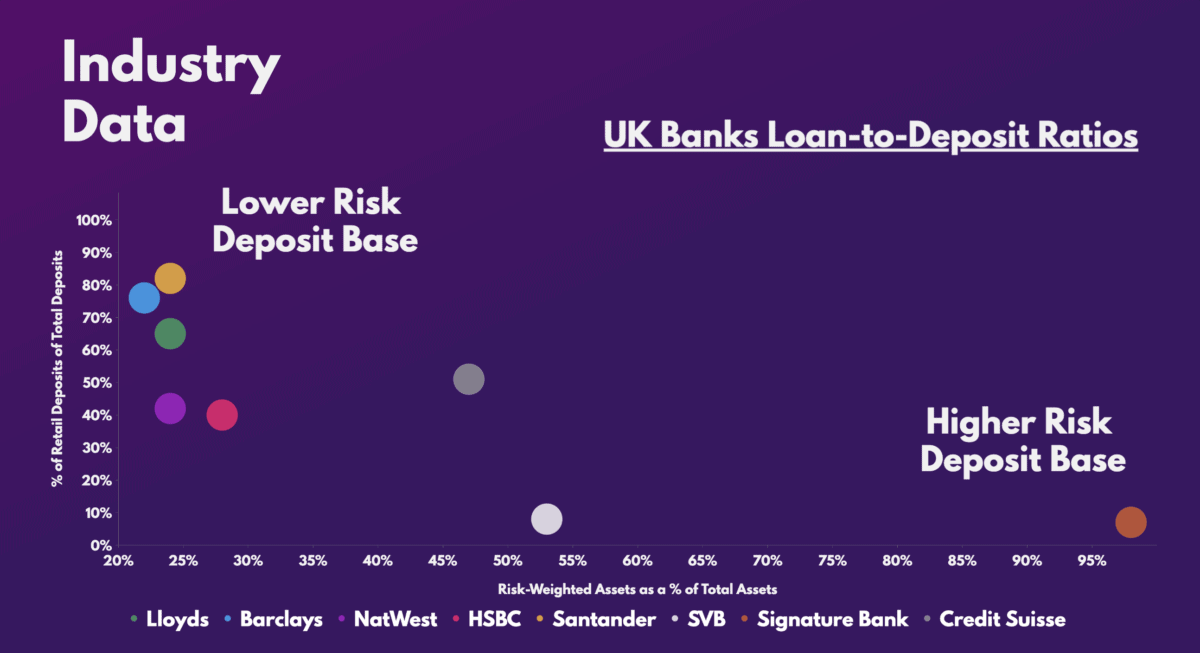

First of all, British lenders have strict capital requirements. As such, their deposit base is, by nature, less risky than their fallen counterparts. That’s due to UK companies having less exposure to risk-weighted assets.

More importantly, the share of deposits from retail customers is much higher than commercial ones. Thus, a liquidity crisis is less likely to occur due to more funds being insured by the Financial Services Compensation Scheme (FSCS).

Banking on a backstop

Having said that, it hasn’t stopped Barclays shares from falling in recent weeks. Therefore, it’s been a relief to see the authorities step in to try to put a stop to the current situation.

The US Treasury is working on insuring all US bank deposits in an attempt to stop bank runs. Meanwhile, the Federal Reserve is working very closely with central banks from Europe, UK, Japan, Canada, and Switzerland by allowing them to borrow US dollars to shore up any liquidity issues.

Either way, Goldman Sachs has reiterated its stance that UK banks are resilient. This has been backed by the fact that the Bank of England hasn’t received any bids from local firms for US dollars to shore up liquidity.

Are Barclays shares about to fly?

On that basis, Barclays shares may be oversold and could soar from here. Nevertheless, the route back up may not be entirely smooth. That’s because there are other risks involved when it comes to investing in Barclays, such as its own regulatory issues that have long been its Achilles heel.

Additionally, raising capital in the future may not be as easy for the company. The evaporation of Credit Suisse’s AT1 bonds could deter fixed income investors from buying bank bonds. Hence, those buying Barclays stock may see their positions diluted if the conglomerate opts to raise capital via equity.

That said, it’s unlikely that the FTSE 100 stalwart requires financing for the foreseeable future. This is because of its healthy asset base and liquidity. In fact, it’s even reported an uptick in customer deposits since the start of the banking crisis, as customers flood to safer organisations to store their cash.

What’s more, with such cheap valuation multiples, it’s easy to see why brokers are so bullish on Barclays shares. Citi, UBS, and JP Morgan all have a ‘buy’ rating on the stock. And with an average target price of £2.43, there’s about a 70% upside from current levels.

| Metrics | Barclays | Industry average |

|---|---|---|

| Price-to-book (P/B) ratio | 0.3 | 0.7 |

| Price-to-earnings (P/E) ratio | 4.5 | 9.1 |

| Forward price-to-earnings (FP/E) ratio | 4.7 | 6.0 |

Pair the above with a strong outlook and an eventual rebound in its investment banking division, and there are plenty of catalysts to push the stock upwards. For those reasons, I’ll be looking to buy Barclays shares for its cheap multiples, upside potential, and lucrative forward dividend yield of 6.1%.