Yalla Group (NYSE:YALA) is a Middle-East-focused tech stock that doesn’t get the attention it deserves. Last week, the company posted its fourth-quarter results, and pleasantly surprised some analysts. Despite registering year-on-year (YoY) growth in revenue and user growth, it’s a company in transition.

A transition

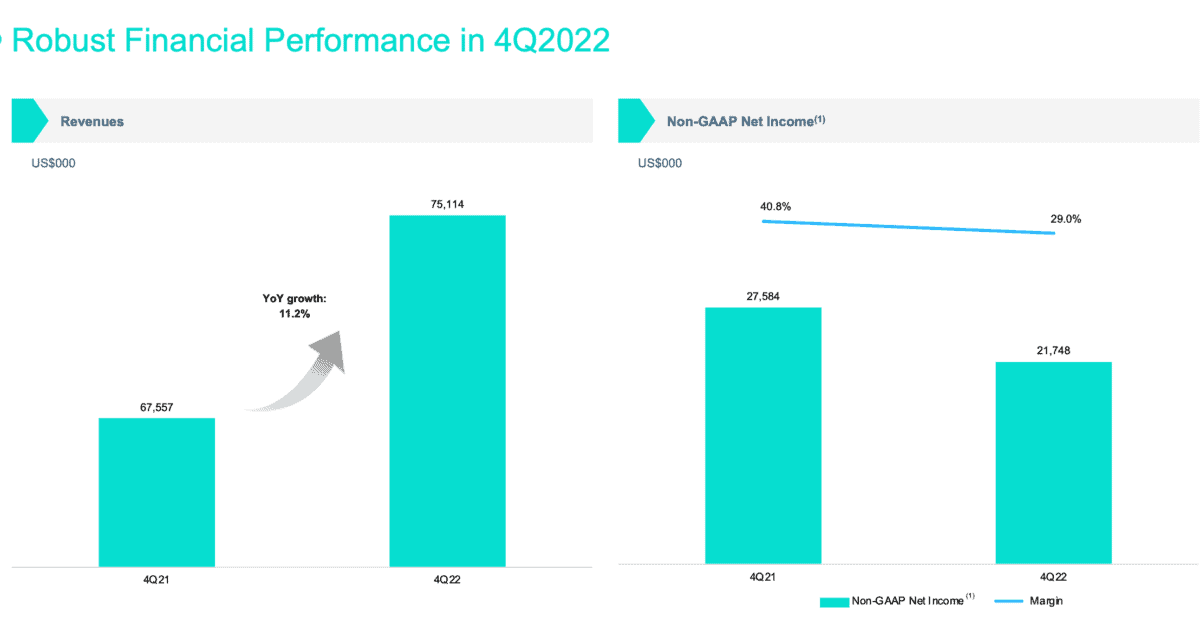

Last week, Yalla reported that non-GAAP net income had fallen from $27.5m in the fourth quarter of 2021 to $21.7m in the last quarter of 2022. This decline may concern some investors, but, for me, it’s purely reflective of the fact that Yalla is a company in transition.

The stock soared during the pandemic, reaching $39 a share — 10 times higher than the current share price. Pandemic-induced restrictions engendered a surge in social media use, and Yalla’s chatting and casual gaming platform gained hugely.

In a more challenging macroeconomic environment, revenue growth is slower and income has fallen. But we can largely attribute lower net income to higher R&D spending as the company embarks on a transition to leverage its 32m users and enter the mid-to-hard-core gaming market.

Yalla launched an internal studio for R&D in Q4, after introducing its first hardcore game, Merge Kingdom, in Q3.

Low risk

Why do I think this is a low-risk transition? Well, Yalla has impressive income generation and solid cash reserves.

The company’s flagship applications, Yalla (chatting services) and Yalla Ludo are mature parts of the business, generating reliable revenue throughout the year. Some analysts think growth may have slowed here, but users numbers are continuing to grow.

In its Q4 report, Yalla stated that quarterly paying users across the business increased from 8.4m to 12.4m, representing an impressive 47.8% YoY growth.

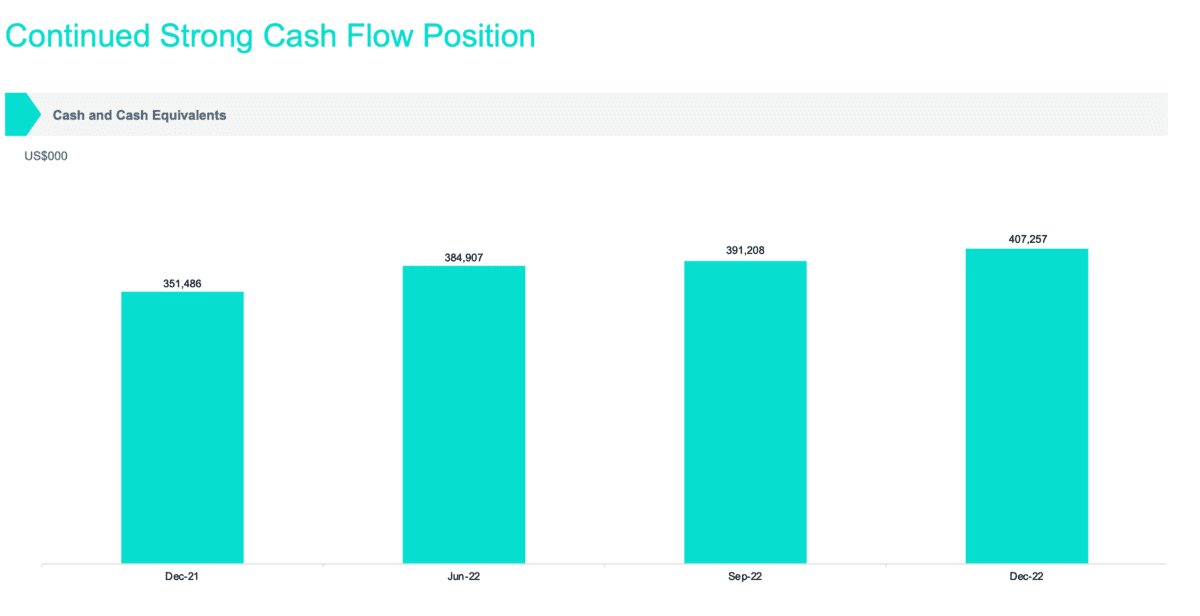

The second reason is its cash reserves. At the end of Q4, Yalla said it had more than $407m in cash and equivalents. That’s up from $57m the year before.

That’s significant because the company currently has a market value of $539m, putting the enterprise value at $122m. For a firm that has delivered about $80m in profit for two years in a row, that’s not particularly high.

These sizeable cash reserves and solid income streams make Yalla look like a relatively low-risk investment. And right now, that’s particularly important with the levels of volatility we’re seeing across the market.

Of course, there are concerns that the new gaming apps won’t deliver the success of Yalla and Yalla Ludo. There is no guarantee that new games will be successful.

However, I believe the chances are improved by the size of the existing user base and positive trends in the Middle East. The region is among the fastest growing worldwide while GCC citizens have seen rapid improvements in living standards in recent years.

Moreover, this strong financial positions provides Yalla with plenty of flexibility with regards to share buybacks and dividend payments — both of which would benefit shareholders.

Because of the above, I’m looking to add Yalla shares to my portfolio when I have the funds available. Hopefully, I can snap up shares close to the current price — $3.66 — even if the pound remains weak.

After all, like other investors, I’m always on the lookout for top quality companies to add to my portfolio.