Aston Martin (LSE:AML) shares are quite unique in the UK. That’s because there aren’t any other British car manufacturers on the FTSE 350. It’s a sad reflection on an industry that once employed hundreds of thousands of people in Britain.

The stock has been in the headlines recently after results surprised to the upside, and after investors saw value in Fernando Alonso’s F1 performance in Bahrain.

However, Aston Martin shares are still down 84% over three years — since launch — despite the rally.

So can Aston Martin stock make me rich? Let’s take a look.

A turning point

In early March, Aston Martin impressed investors with an improved set of results. The firm made a £495m loss before tax. However, the company registered a narrow operating profit of £6.6m in Q4.

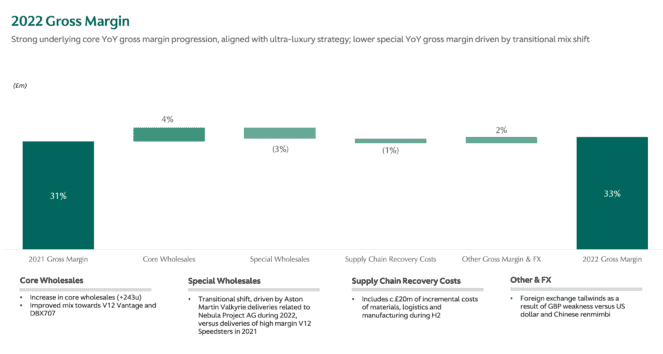

Meanwhile, gross profit increased by 31% year-on-year to £451m and gross margin increased 2% to 33%, reflecting improved pricing and gross margin for core models.

The results suggested that the firm’s fortunes were turning around. Executive chairman Lawrence Stroll has refocused the company on higher margin vehicles, the ultra-luxury market, with the DBX being core to that.

Hitting the target

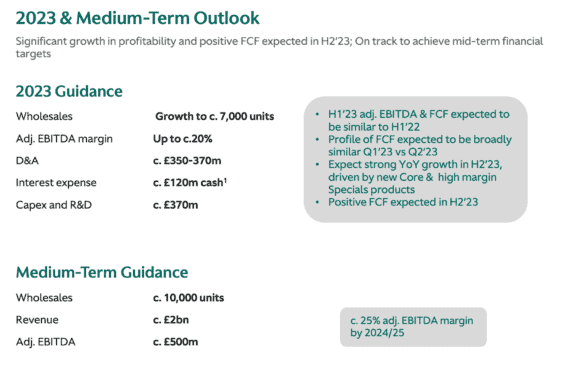

Stroll has been aiming for £2bn in revenues and £500m in adjusted EBITDA by 2024/2025. However, investors haven’t been convinced.

But things are looking up and, personally, I’m increasingly confident that the firm will hit its target. In March’s full-year report, finance chief Doug Lafferty said he was “very confident” of meeting 2025 goals.

The business expects to hit its 2024/2025 financial objectives with sales of just 8,000 cars a year, down from Stroll’s 10,000 target. Some 6,412 vehicles were sold in 2022.

A masterstroke

The appointment of former Ferrari boss Amedeo Felisa as CEO last year may turn out to be something of a masterstroke. The Italian luxury brand is known for its sizeable margins — the company earned an astounding $106,078 per unit sold in 2021.

Higher margins are key to the success of Aston’s turnaround. There were 80 Aston Martin Valkyrie deliveries during 2022, including 36 in Q4. The vehicle starts at $3m.

The DBX has also been central to this. The high margin, high volume SUV is well priced between the top end Range Rover and the Bentley Bentayga.

Can Aston make me rich?

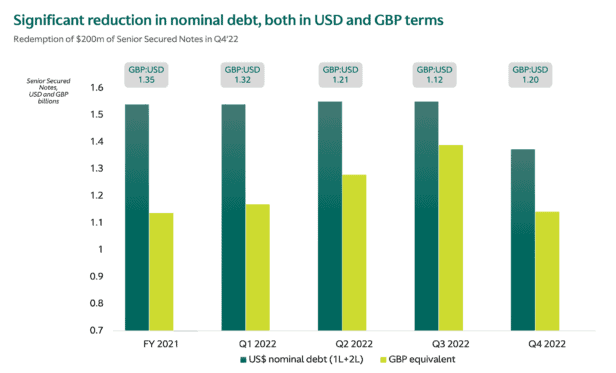

In theory, if EBITDA of £500m is achieved in the next few years, I’d expect to see the share price increase accordingly. However, the issue is debt. Debt is falling, but repayments will continue to drag on profitability for some time.

The above forecast for 2023 demonstrates the headwind presented by debt, with interest expenses expected to come in at £120m.

However, in the long run, if the guidance is sustained, I’m confident debt will fall and the business will become truly and sustainably profitable.

Can Aston shares make me rich? Well, it’s hard to tell at the moment where the share price will be in five years. But my money is on upwards. That’s why I’m buying more.

After all, Ferrari, which sells 11,000 vehicles a year, is valued at €48bn, at the time of writing. That’s around 24 times greater than Aston Martin.