The Glencore (LSE:GLEN) share price has experienced an unpleasant start to the new year. While the broader FTSE 100 has risen 4% in that time, Glencore shares have dropped 15% in value.

As a lover of value stocks, I believe this fresh weakness provides a great dip-buying opportunity. At around £77.50 per share, Glencore shares trade on a forward price-to-earnings (P/E) ratio of 6.3 times. This is less than half the FTSE index average of 14.5 times.

The miner also offers supreme value for money when it comes to dividends. Its 10.1% prospective yield smashes the 3.6% UK blue-chip average.

Could Glencore shares be the best bargain out there for FTSE investors?

Be prepared

Investing in mining companies can be a bumpy ride. Exploring for raw materials, developing mines, and pulling ore from the ground are all highly complex procedures. A range of problems can occur that create huge costs and damage revenue forecasts. Some issues cannot be overcome at all.

As one of the world’s largest commodity companies, Glencore can better absorb such disappointments than most others. But this doesn’t make it immune to earnings-damaging setbacks.

A bigger threat to its share price is a downturn in energy and metal prices. This is a particularly large danger now, given the uncertain economic outlook. Falling demand for finished goods from China could send prices of copper and other key commodities through the floor.

Risk vs reward

Of course, all shares expose individuals to some degree of risk. What I have to ask myself as an investor is if the dangers to a company’s profits (and thus its share price and future dividends) are reflected in a company’s share price.

I also have to consider whether the potential benefits of owning a particular stock outweigh the threats. When it comes to Glencore, I think the possibility of making big money makes it a top stock to buy.

As one of the world’s biggest commodities producers and traders it has the financial strength to overcome operational problems and better navigate market downturns.

Moreover, its wide asset base — it owns 60-plus assets across the globe — means that trouble at one or two of its mines, refineries or plants has limited impact at group level.

A top FTSE 100 value stock

It’s my belief that Glencore’s share price will surge over the long term as the new commodities supercycle clicks through the gears.

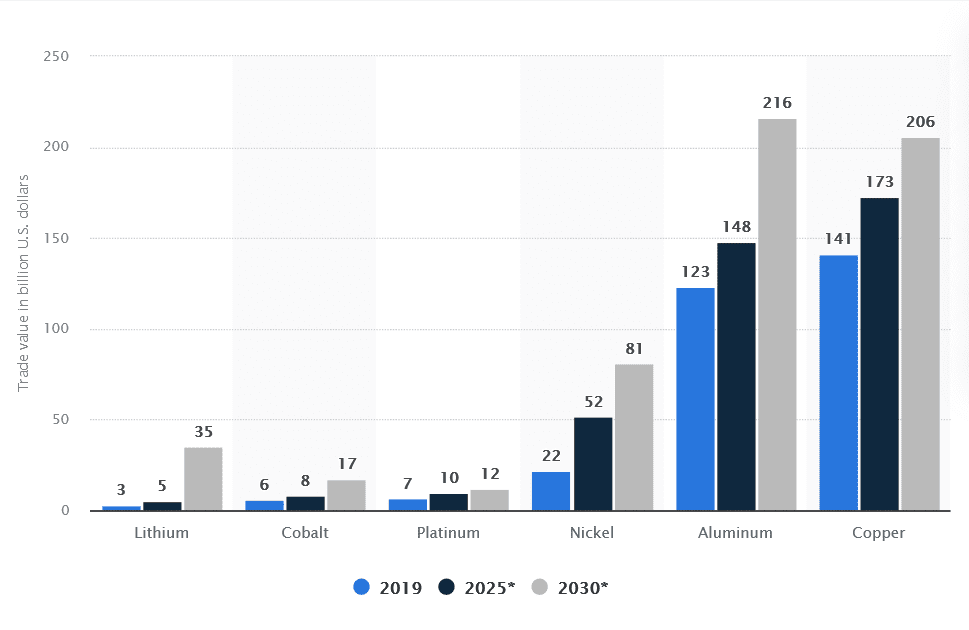

Themes like the green energy transition and rising construction spending globally mean commodities consumption is tipped to balloon. The graph below from Statista illustrates how the trading of raw materials is on course to ramp up over the next several years.

As well as higher consumption, prices of metals will also likely be boosted by the scarcity of new mine supply coming online. Glencore then can expect to make big money from its trading and mining operations. And it could deliver huge shareholder returns through steady capital appreciation and huge dividends.

There are plenty of top-quality value stocks on the FTSE 100 today. But I think this blue-chip share is one of the best.