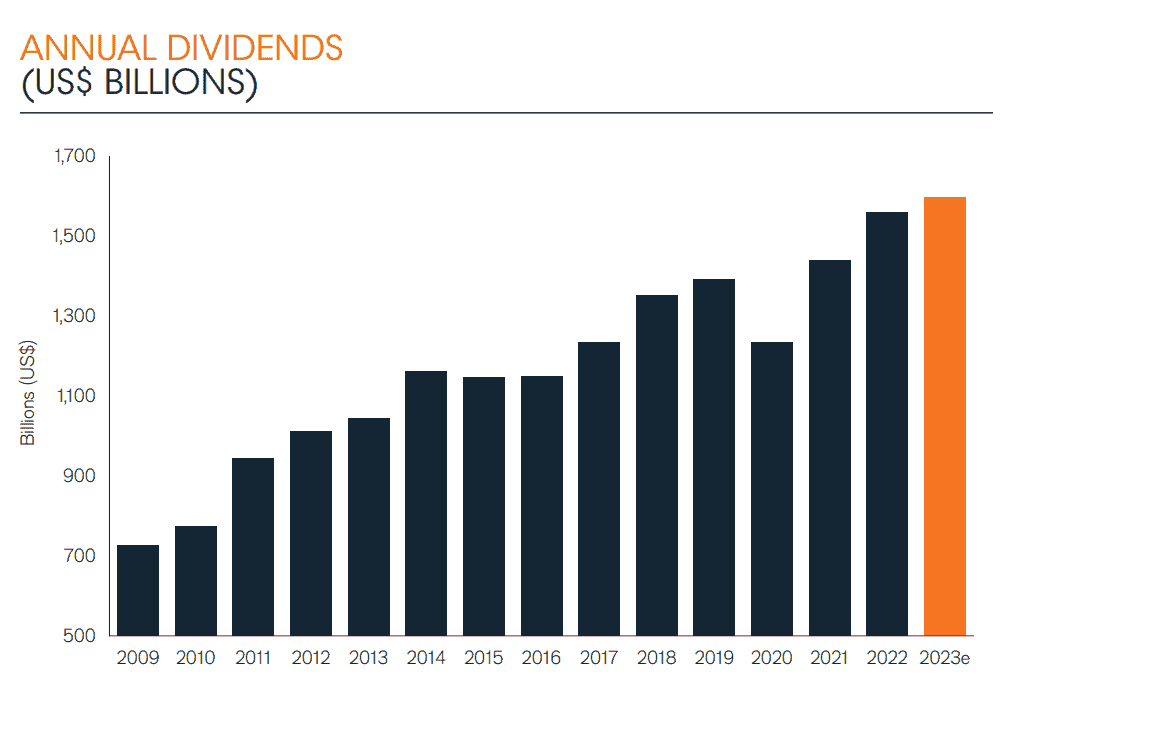

2022 was a great year for income investors. And this year could be an even better one as experts tip record payouts from dividend shares.

Global dividends hit new all-time highs of $1.56trn last year. That was up 8.4% year on year, according to Janus Henderson.

On an underlying basis payments leapt 13.9% from 2021 levels. This measure removes the impact of exchange rate movements and special dividends.

Dividends from UK shares rose a healthy 12.1% on an underlying basis, the asset manager said. And 92% of London Stock Exchange companies either increased or maintained the dividend.

Explaining last year’s rise in London, Janus Henderson said that “resurgent banking dividends were the main driver of growth, but the rise in oil payouts was also a significant contributor.” BT’s decision to restart dividends was another factor behind 2022’s increase.

Payout growth to cool?

Janus Henderson is expecting global dividends to hit new peaks of $1.6trn in 2023. However, it says that growth will slow to just 2.3% as interest rates rise further and company profits come under pressure.

On an underlying basis dividends are tipped to increase 3.4%.

The challenging backdrop actually caused dividends from UK shares to actually fall 2.6% last quarter. On a global basis comparable payouts increased 7.8%.

2 FTSE 100 dividend shares I like

Clearly British investors need to be careful where to invest their cash in 2023 to avoid dividend disappointment. As the domestic economy struggles, shareholder payouts might be limited. A fresh fall in the pound could also damage dividend income from companies that distribute in foreign currencies.

Having said that, plenty of UK dividend shares could still deliver impressive passive income in the near term. Power transmission business National Grid is one I’ll buy for my own portfolio if I have spare cash to invest.

Profits here could be hit hard if the government slaps a bruising windfall tax on the company. But I still expect its defensive operations and excellent cash generation to deliver big dividends. So do City analysts. National Grid carries juicy expected yields of 5.4% and 5.7% for the financial years to March 2023 and 2024 respectively.

Vodafone Group is another FTSE 100 dividend stock on my watchlist today. Competition is fierce in the telecoms company’s markets and the company has to invest heavily to stay ahead. This can have a big impact on earnings.

Yet Vodafone is still expected to pay market-beating dividends over the short term. Yields here sit at 8% and 7.7% for the fiscal years to March 2023 and 2024 respectively.

The firm’s essential operations have long protected profits from broader economic conditions, giving it the means to reliably pay decent dividends. Further asset sales could also help it to fund bumper payouts. Rumours abound that its Vodacom unit in Africa could be the next in a steady stream of divestments.