FTSE 100 shares have made a promising start to 2023. The UK’s blue-chip benchmark has climbed 5% this year to date, breaking through the 8,000 point barrier for the first time in its history.

Although the index is reaching new highs, I think there are still plenty of cheap shares to buy.

With that in mind, let’s take a look at two Footsie stocks on my watchlist.

London Stock Exchange Group

The London Stock Exchange Group (LSE:LSEG) share price has climbed 18% in a year. Despite the impressive gains, I believe there’s still plenty of growth potential for this FTSE 100 stock.

As the name suggests, this company owns and operates the London Stock Exchange. The group also owns financial market data provider Refinitiv as well as LCH (London Clearing House), which operates across multiple jurisdictions, asset classes, and currencies.

One recent positive development is Microsoft‘s acquisition of 21.2m London Stock Exchange voting shares, valued at £1.6bn. This comes on top of a new 10-year strategic partnership announced late last year. The duo will combine Microsoft’s cloud infrastructure and London Stock Exchange’s analytics capabilities to develop new solutions for financial institutions.

The US tech giant recently made a foray into the artificial intelligence space with a big investment in Open AI — the developer of ChatGPT. As the UK’s financial sector embraces machine learning, London Stock Exchange is hoping to capitalise on this trend with its recent transatlantic tie-up.

When you think about some of the possibilities in things like ChatGPT and AI, you start to imagine a world where we can shorten timelines.

Emma Miller, head of investment banking and capital markets at London Stock Exchange

A lack of fresh IPOs continues to act as a drag on London Stock Exchange’s share price growth. If new listing activity remains low in 2023, this could prevent the group from realising its full potential. Nonetheless, that’s a risk I’m prepared to take. With some spare cash, I’d invest in the company today.

Scottish Mortgage Investment Trust

The Scottish Mortgage Investment Trust (LSE:SMT) share price plummeted 26% over the past year. I think now could be a good time for me to load up on more shares in Baillie Gifford’s flagship growth stock fund.

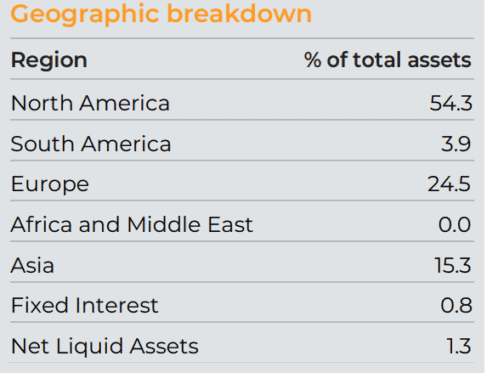

One attractive feature of Scottish Mortgage shares is the international exposure they offer.

Although many FTSE 100 shares earn revenue from overseas, this investment trust is especially globally diversified given the nature of its stock market positions. These include familiar names such as Tesla and Moderna in addition to less well known shares.

Beyond geographic diversification, Scottish Mortgage also provides exposure to private equity investments, which represent 28.1% of its portfolio.

For example, shares in Elon Musk’s company, Space Exploration Technologies (commonly known as SpaceX), aren’t available to buy on public markets, but they’re the fund’s seventh-largest holding.

Worldwide, many growth stocks have taken a beating over the past year. In turn, this has depressed the Scottish Mortgage share price. If central banks continue hiking interest rates, there’s a risk there could be further pain ahead.

Nonetheless, with the shares trading around £7 today, I think the risk/reward profile of Scottish Mortgage looks appealing. I’ll be looking to buy more.