Those looking to earn passive income may be interested in investing in Taylor Wimpey (LSE:TW) shares. Despite falling 40% last year, the stock still boasts an excellent dividend yield of 7.6%. The builder is set to release its full-year results next week, so now could be the time to buy.

Climbing back up

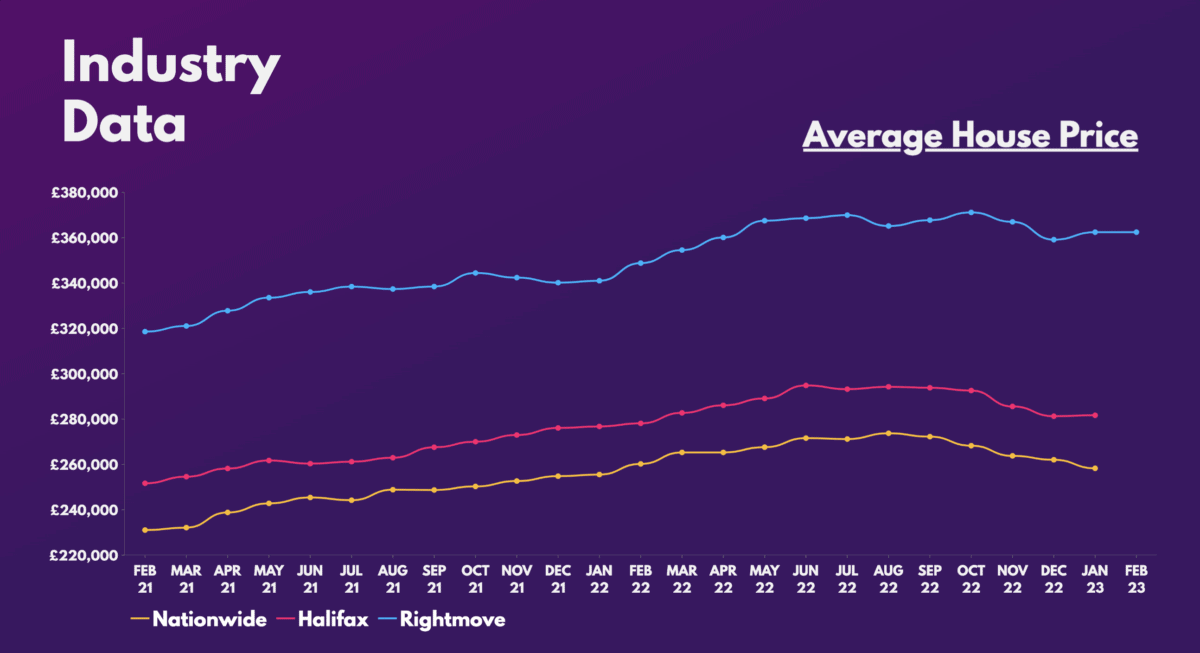

The Taylor Wimpey share price is now up 40% from its bottom, and is up almost 15% this year. This strong recovery can be attributed mainly to the better-than-expected housing data. House prices have held up steadily so far this year, which puts the company’s passive income potential in a healthy position.

Nonetheless, it remains to be seen whether the positive data will be reflected in Taylor Wimpey’s full-year numbers. The consensus hints towards positive sentiment anyway. Both the business’ top and bottom lines are anticipated to grow. However, the focal point will be the guidance provided for the year ahead. This will be crucial for projecting the firm’s passive income potential in 2023.

| Metrics | FY22 (Consensus) | FY21 | Projected growth |

|---|---|---|---|

| Total completions | 14,002 | 14,087 | -1% |

| UK average selling price | £312,800 | £299,800 | 4% |

| Revenue | £4.44bn | £4.28bn | 4% |

| Profit before tax (PBT) | £900m | £680m | 32% |

| Normalised earnings per share (EPS) | 19.7p | 18.0p | 9% |

| Dividend per share (DPS) | 9.1p | 8.6p | 6% |

Dividends

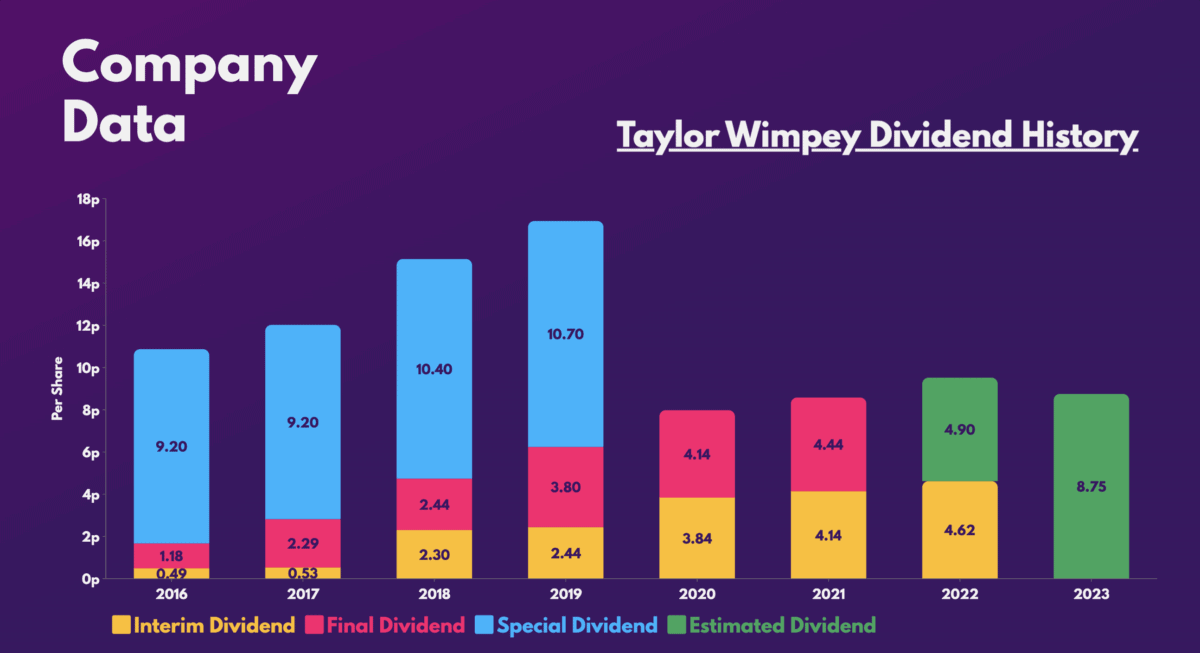

That said, analysts are expecting dividends to come in below what was initially projected (9.1p vs 9.52p). Therefore, a higher-than-anticipated dividend announcement next week could see the Taylor Wimpey share price get a boost, as passive income investors may see a buying opportunity. Analysts are also forecasting the housebuilder to generate a forward dividend yield of 7.4% in 2023, which is still extremely lucrative.

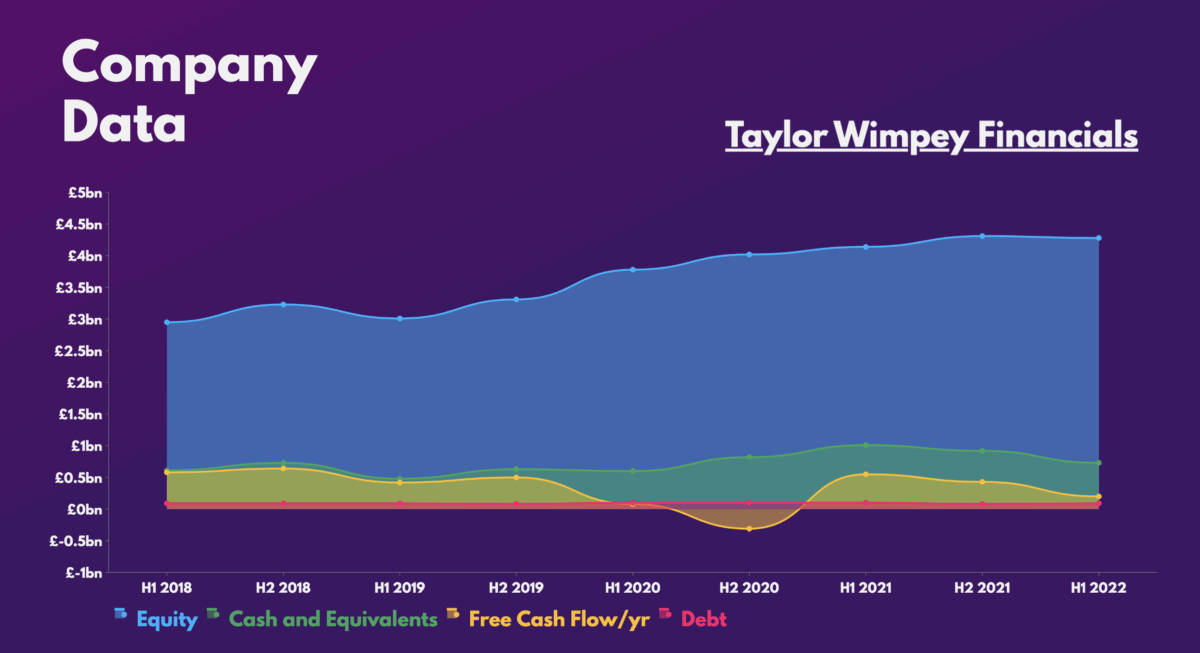

In the event of a worse-than-forecast set of results, however, Taylor Wimpey still has a couple of measures in place. The first would be the strength of its balance sheet. The FTSE 100 stalwart boasts a debt-to-equity ratio of 2%. This allows it to cover its current and projected dividend yield up to 2.1 times and 1.2 times, respectively.

Additionally, it’s got a strong dividend policy, providing investors with some dividend security. The developer is adamant on returning at least 7.5% of its net assets to its shareholders annually, which equates to about £250m per year.

Either way, a long-term investment presents a more lucrative opportunity for investors to earn passive income. That’s because when the housing market eventually rebounds, cash will start to flow in abundance. This usually results in the FTSE conglomerate dishing out special dividends, as seen from 2016 to 2019.

Strong foundations

Having said that, the stock’s valuation multiples don’t necessarily indicate a bargain, as seen in the average price target of £1.24. But given the upside potential for a market recovery over the longer term, it wouldn’t be premature to label the stock, ‘fairly valued’. After all, Jefferies has a ‘buy’ rating on the shares with a price target of £1.42.

| Metrics | Taylor Wimpey | Industry Average |

|---|---|---|

| Price-to-book (P/B) ratio | 1.0 | 1.0 |

| Price-to-sales (P/S) ratio | 1.0 | 0.8 |

| Price-to-earnings (P/E) ratio | 7.3 | 10.7 |

| Forward price-to-sales (FP/S) ratio | 1.1 | 1.2 |

| Forward price-to-earnings (FP/E) ratio | 8.7 | 9.1 |

And it’s not difficult to see why. As inflation continues to decline, interest rates are predicted to peak soon. This should have a positive impact on mortgage demand. There have been early signs of this with more mortgage products come back onto the market in recent weeks.

For those reasons, I’ll be buying more Taylor WImpey shares to earn passive income while growing my wealth. In fact, insiders have been buying shares, showing that there’s confidence in the group’s long-term growth potential.