I don’t have unlimited reserves of capital I can use to buy UK stocks. So for the time being I’m building a list of FTSE 100 shares I plan to invest in.

Here are two British blue-chips I plan to buy if I have spare cash to spend.

Antofagasta

The process of mining for raw materials is extremely complex. Even the biggest and best-run commodities company can endure sudden and severe problems that can take a big bite out of earnings.

Take Antofagasta (LSE:ANTO) for instance. Production at the copper giant slumped 10.4% last year to 646,200 tonnes, due to two major problems at its Chilean operations. Droughts hit water supplies while a pipeline leak affected copper concentrates supply.

This, combined with lower copper prices, caused pre-tax profit to fall 26% from 2021 levels.

Yet despite these risks, I still believe investing in big miners like this is a good idea. It’s why I own Rio Tinto shares in my stocks portfolio.

Riding the supercycle

The world is tipped to embark on a fresh commodities supercycle. Trends such as soaring demand for renewable energy and buoyant construction activity in emerging markets are tipped to turbocharge demand for industrial metals.

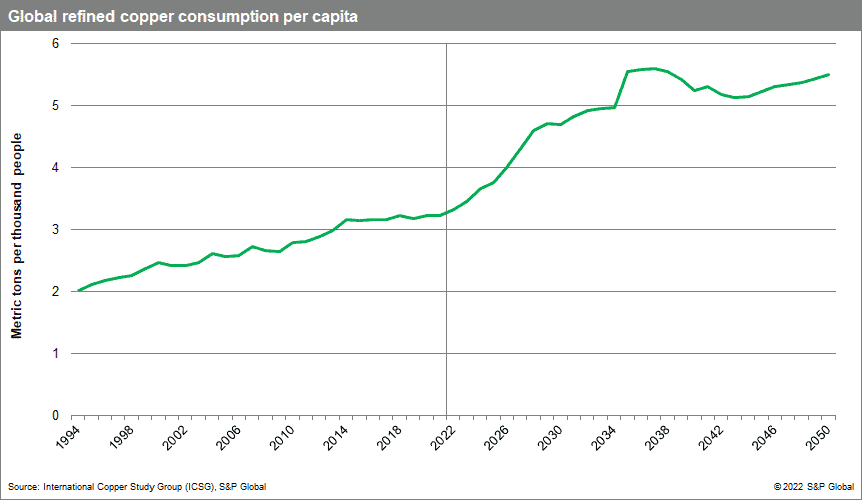

Firms like Antofagasta should be well-placed to exploit this raw materials boom. Indeed, research from S&P Global illustrates the huge earnings potential for copper producers in particular.

Analysts predict that “copper supply shortfalls [will] begin in 2025 and last through most of the following decade”, a scenario that could lift metal prices.

They also say demand will double between now and 2035 and that “substitution and recycling will not be enough to meet the demands of electric vehicles, power infrastructure, and renewable generation”.

Antofagasta is expanding its operations to take advantage of a favourable price landscape too. Ongoing expansion at its flagship Los Pelambres mine, for one, will boost annual copper production by 60,000 tonnes over the first 15 years.

Further supply issues could cause some earnings volatility. But I’d still back it to deliver exceptional long-term profits growth.

Segro

For different reasons I believe real estate investment trust (REIT) Segro (LSE:SGRO) could also be a top stock for me to own for the next decade.

This FTSE 100 share builds, acquires and then lets out so-called big box commercial properties. These are the sorts of assets for which demand is booming as e-commerce continues to grow. They are popular bases for manufacturers, retailers and couriers alike.

However, supply of these critical properties is failing to meet this growing demand. And so Segro continues to enjoy impressive rental income growth (like-for-like rents grew almost 7% last year). A weak development pipeline in the UK market means this shortfall looks set to persist.

It’s true that company profits could suffer in the near term as the economy splutters. The business could find it more difficult to collect rents from its tenants in this landscape. But over the long term I still expect Segro shares to deliver excellent investor returns.