British Airways owner, IAG (LSE:IAG) is set to share its full-year results later this week. Given the positive reports from its local and international peers, it’s no surprise to see the stock already up 30% this year. Even so, I may still start a position before earnings are released.

Pre-departure numbers

Since IAG last reported its Q3 figures, its shares have rallied by approximately 40%. As such, there are high expectations for the company’s Q4 figures, with capacity forecast to be at 87% of 2019 levels. In fact, analysts are even projecting higher numbers than the original outlook provided by the board in October.

| Metrics | FY22 (Consensus) | FY19 | Projected growth |

|---|---|---|---|

| Revenue | €24.38bn | €25.51bn | -4% |

| Operating income | €1.20bn | €3.29bn | -64% |

| Basic earnings per share (EPS) | €0.09 | €0.78 | -88% |

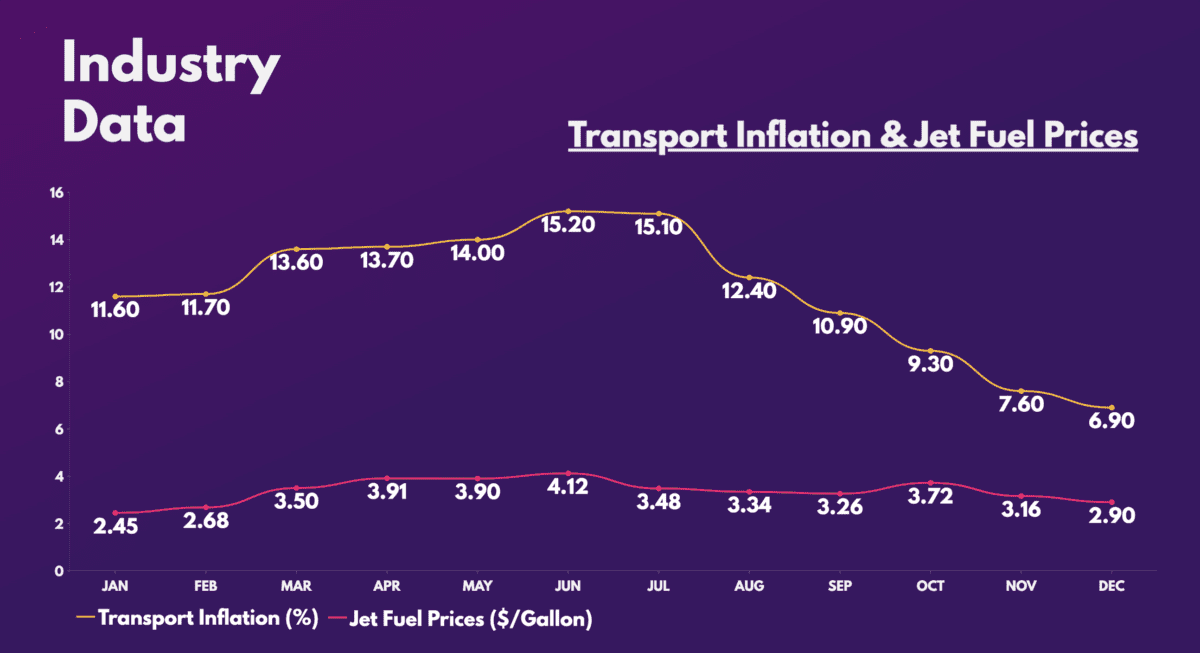

These higher expectations can be attributed to a number of factors. These range from lower air fares to cheaper fuel prices. All of this should have encouraged demand while improving the firm’s bottom line.

That said, the IAG share price will be heavily dependent on the outlook provided by management for Q1 and the year ahead. Currently, CEO Luis Gallego is anticipating the group’s capacity to hit 95% of 2019 levels in Q1. But Deustche‘s recent upgrade on easyJet shares, citing a better economic outlook, could result in an upward revision for IAG’s Q1 capacity.

Getting back to business

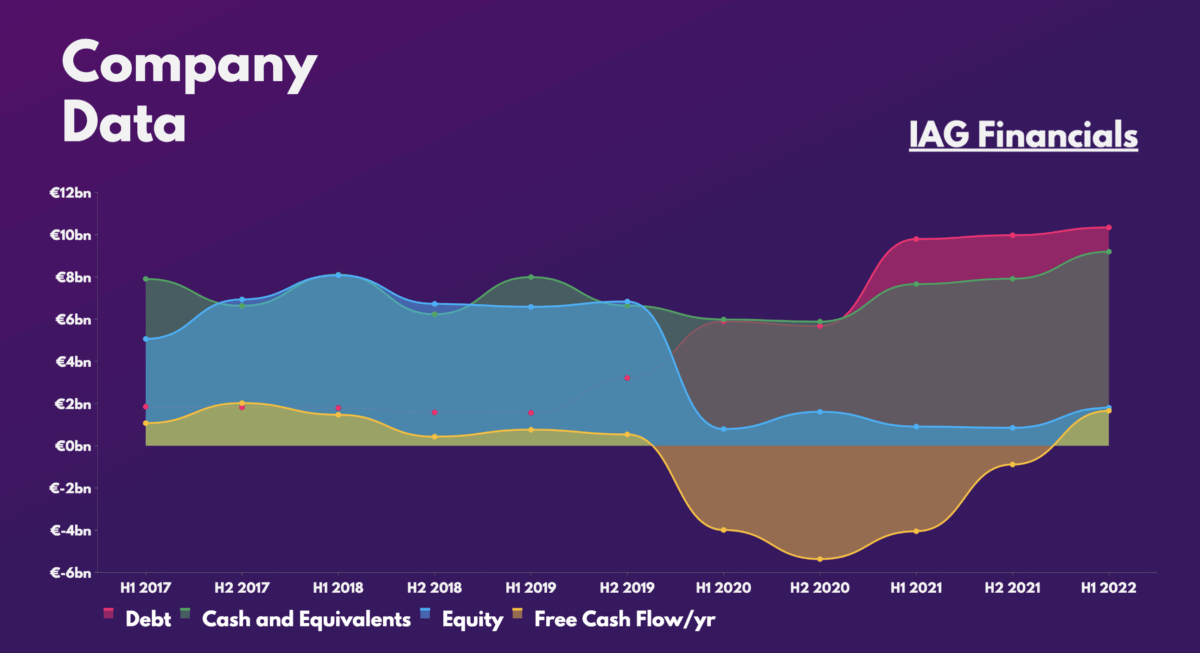

Capacity aside, I’ll be keeping a close eye on profit margins too. This will be a crucial driver in bringing the bottom-line figure back up. As of Q3, the conglomerate still has a negative profit margin of -0.6%, despite seeing a significant improvement from -89% in 2020.

This is because the airline’s long-haul routes, which yield higher profits, are still not at full capacity. And although sales for premium products such as first class and business class are back at 2019 levels, capacity is still lagging substantially. Additionally, business travel (B2B) volumes are only at 75%. This is an important area for margin expansion because B2B is more inelastic in demand and yields higher rates due to the bigger purchases of premium products. Therefore, B2B travel could be a key catalyst to lift IAG shares higher.

I wouldn’t be surprised to see B2B hit 85%-90% of pre-pandemic levels in Q4. After all, Trip Advisor, Expedia, and Marriott all reported a resurgence in business clients in their year-end results. More encouragingly, they said they see strong business demand going into the summer.

Refuelling the balance sheet

Will I start a position with IAG shares today then? Well, the FTSE 100 stalwart has an improving set of financials. While net debt is expected to edge higher in Q4, this is due to higher spending used to acquire better and more fuel-efficient aircraft. In that context, I believe IAG’s balance sheet should benefit over the long term along with its rapidly growing free cash flow.

Nevertheless, it’s worth noting that the stock’s upside remains limited for now. Goldman Sachs, UBS, and Deutsche have an average price target of £1.70, not far above current levels.

Its current and future valuation multiples may indicate a bargain. However, easyJet trades on similar multiples, and has a higher upside from its current share price. Thus, for all the potential benefits of investing in IAG shares, I won’t be buying today.

| Metrics | IAG | easyJet | Industry Average |

|---|---|---|---|

| Price-to-sales (P/S) ratio | 0.5 | 0.7 | 0.8 |

| Forward price-to-sales (FP/S) ratio | 0.4 | 0.5 | 0.7 |

| Forward price-to-earnings (FP/E) ratio | 13.2 | 20.6 | 30.4 |

| Upside to average price target | 1% | 8% | N/A |