The BP (LSE:BP) share price is up by almost 200% since October 2020, and has ripped even higher over the past week thanks to another solid quarter of profits. With its solid dividend yield and large share buyback programme, I may buy BP stock for passive income and prospective medium-term growth.

Big barrels of profits

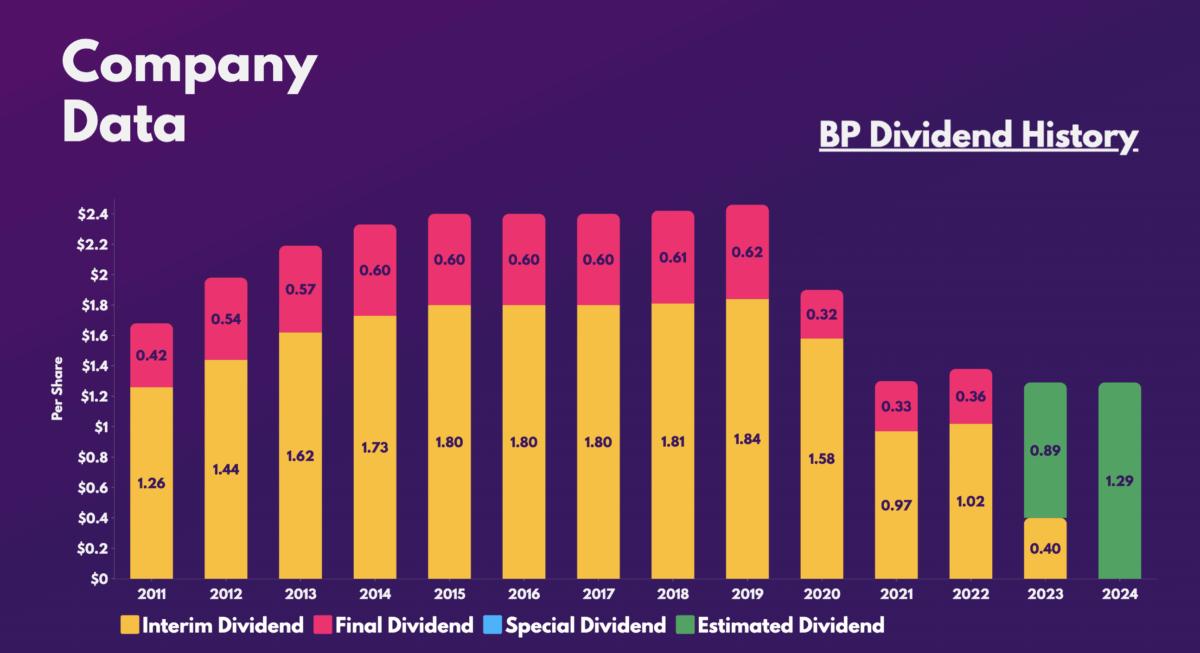

Although BP’s results missed analysts’ expectations, record profits were jubilant enough to spark a rally in the stock. Annual profits doubled to $27.6bn from $12.8bn. As a result, BP pledged an increase in dividends and a further $2.75bn in share buybacks.

| Metrics | Q4 2022 | Q3 2022 | Growth |

|---|---|---|---|

| Total revenues and other income | $70.36bn | $57.81bn | 22% |

| Diluted earnings per share (EPS) | $3.50 | -$0.69 | 607% |

Additionally, the board upgraded the company’s medium-to-long-term guidance. The oil giant is now anticipating EBITDA of $46bn to $49bn (from $38bn) in 2025, and $51bn to $56bn (from $39bn to $46bn) in 2030. Nonetheless, this is based on the assumption that oil continues to trade at a minimum of $70 per barrel.

Fuelling strong prices

That said, critics say that it’s overly optimistic to project oil prices to remain elevated for such a prolonged period. After all, oil was averaging around $55 per barrel before the pandemic, hence why BP shares were stagnant for the most part over the last decade. Even so, I can see oil prices remaining high for the foreseeable future for several reasons.

For one, the lack of storage infrastructure for renewables remains a challenge for it becoming a primary source of energy. Secondly, sanctions on Russia aren’t expected to be lifted anytime soon. Moreover, OPEC doesn’t seem inclined to ramp up production volumes either, keeping prices elevated. And with BP pledging an additional $8bn in capital expenditure to expand its oil and gas operations, it seems pretty evident that fossil fuels are here to stay, at least until 2030.

These all act as tailwinds for BP shares to continue their strong price action, which will be further boosted by larger profits and bigger dividends.

Rigorous financials

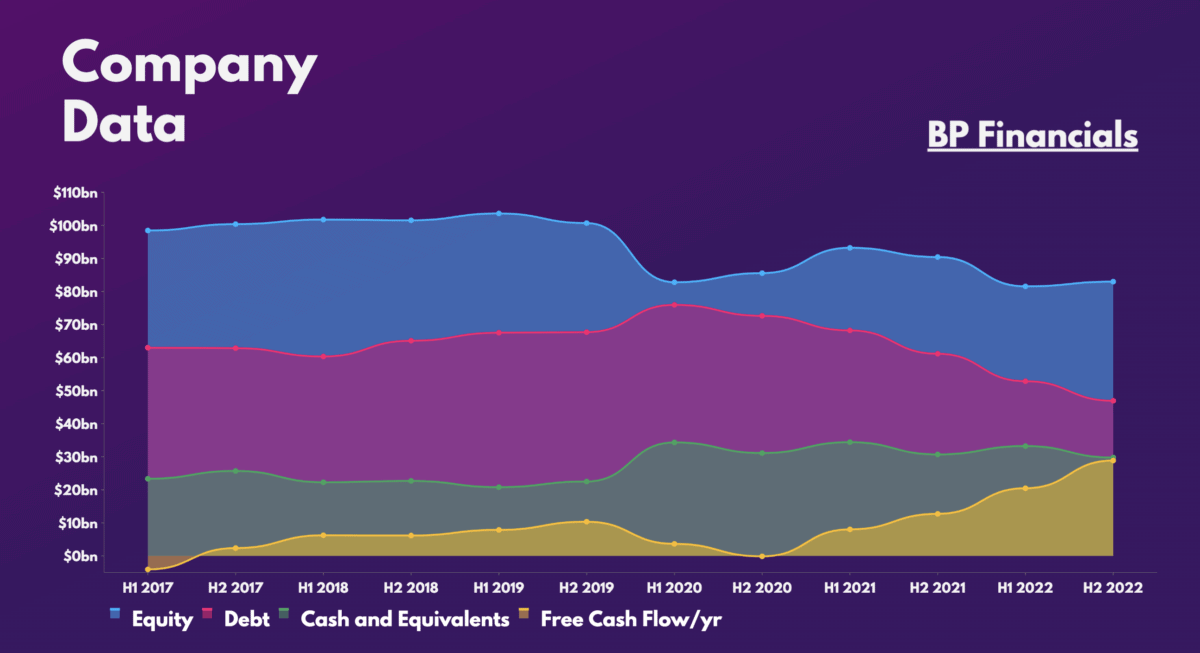

Are BP shares a buy for me then? Well, the company has excellent shareholder returns and a strong balance sheet, paired with declining levels of debt. These metrics are always positive signs of a good investment.

Having said that, there are risks associated with investing in oil. For instance, any softening of tensions between the West and Russia could send prices lower. Hence, it’s no surprise to see Jefferies being skeptical of the firm’s EBITDA estimates. The investment bank isn’t bullish on oil prices staying above $70 per barrel over the medium term.

Nevertheless, the overwhelming consensus remains positive, especially given the tailwinds associated with China’s reopening, a shallow global recession, and a stubborn OPEC. As such, Goldman Sachs forecasts oil prices to top $100 per barrel by the end of the year. This sentiment is shared by Barclays and RBC too, as they rate BP shares a ‘buy’ with an average price target of £8.25. This presents a 45% upside from current levels, which makes sense given the stock’s rather cheap valuation multiples.

| Metrics | BP | Industry average |

|---|---|---|

| Price-to-book (P/B) ratio | 1.8 | 0.9 |

| Price-to-sales (P/S) ratio | 0.5 | 1.1 |

| Forward price-to-sales (FP/S) ratio | 0.5 | 1.2 |

| Forward price-to-earnings (FP/E) ratio | 6.6 | 8.6 |

With all that in mind, I think BP shares are certainly a lucrative investment. However, investing in them also leaves my money in the fate of several government entities in an extremely volatile geopolitical environment. For those reasons, I’d rather invest in other stocks with brighter long-term prospects and a higher margin of safety and certainty.