ITV (LSE: ITV) shares dipped into penny stock territory in March 2022 and they have yet to recover above £1. With the shares at nearly 86p today, what would my return have been if I’d invested in the FTSE 250 company a year ago?

Let’s crunch the numbers and explore my take on the outlook for the business today.

One-year return

One year ago, the ITV share price stood at 114.80p. Despite staging an impressive rebound from its September lows, the stock is still down 25% from February 2022.

I haven’t invested in the company before, but I find it’s always useful to use past performance as an investment guide — even if it doesn’t guarantee future returns.

If I’d deployed a £1,000 lump sum into the stock 52 weeks ago, I would have been able to buy 871 shares, with 9p left as spare change.

As I write, my shareholding would be valued at £748.19. Thanks to a healthy dividend yield, I could also add £43.55 in passive income to my total return.

Therefore, I’d be left with £791.83 from my original £1k investment today. That’s a disappointing outcome. But does that mean ITV shares could be a bargain buy today?

The outlook for the ITV share price

I think the coming year could prove better for the media business than the previous one. Using the price-to-earnings ratio as a valuation metric, the stock looks reasonably cheap at a 7.33 multiple.

Perhaps the most exciting development for the company is its new ITVX free streaming service. Aided by December’s FIFA World Cup, ITV’s streaming hours increased by 55% year on year. ITVX also allows viewers to watch popular shows such as Love Island and Coronation Street.

The platform offers the broadcaster multiple revenue streams. CEO Carolyn McCall claims the new service has “landed really well” with advertisers. Viewers can also choose to remove adverts via a subscription service priced at £5.99 per month, which includes Britbox bundles too.

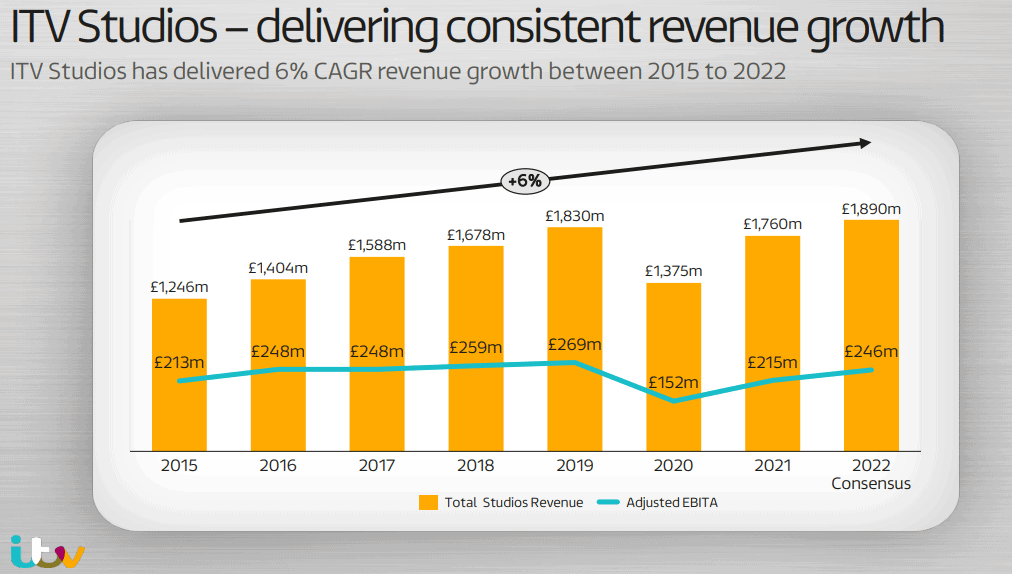

In addition, the business is showing budding signs of a rebound in other divisions. Despite a big dip in revenue during the pandemic, ITV Studios — the company’s television production and international distribution arm — is tipped to deliver record revenue for FY 2022.

There are reports that a Hollywood producer and French production company are contemplating taking strategic interests in ITV Studios, which was valued at over £2.5bn by analysts last year. This could translate into positive momentum for the share price if a deal is reached.

Admittedly, the business faces risks from potential reductions in advertising expenditure, particularly if the UK economy falls into recession this year in line with the recent IMF forecast. That being said, I think the stock looks oversold currently after a tricky couple of years.

Would I buy?

I’m optimistic about the future for the ITV share price. Although the trailing 12-month return isn’t pretty, the stock looks like a value investment proposition to me today.

Ultimately, if all goes well, the company could return to the FTSE 100. In this scenario, additional capital inflows from passive investors might help lift the shares.

With some spare cash, I’d invest in ITV today.