Scottish Mortgage Investment Trust (LSE:SMT) buys stakes in what it describes as “the world’s most exciting growth companies“. Indeed, the Scottish Mortgage share price growth has rewarded long-term shareholders with handsome returns.

Despite recent falls, the shares rose 421% over the past decade — double the 207% increase in its benchmark, the FTSE All World Index.

Four themes categorise the majority of stocks owned by Baillie Gifford’s flagship FTSE 100 trust. Let’s explore them.

A digitalised world

One theme is digital transformation.

Semiconductor outfit ASML exemplifies the trust’s concentration in this area. The Dutch company is Scottish Mortgage’s second-largest position at 6.7% of the portfolio.

In addition, Argentinean e-commerce giant MercadoLibre is the eighth-largest holding at 3.1%. MercadoLibre provides an online marketplace and financial services. It’s essentially Latin America’s Amazon.

After making substantial profits from trimming its Amazon stake in 2020, the trust’s track record is impressive. I’m confident the fund managers can identify new opportunities in the ongoing digital revolution.

Decarbonisation

Another theme is renewable energy.

Swedish lithium-ion battery maker Northvolt is the fifth-largest position at 3.6%. It’s a private company, so I can’t buy the shares on a stock exchange, but Scottish Mortgage offers me indirect exposure.

Tesla needs no introduction. It’s the seventh-largest holding at 3.2%. The company operates in a potentially massive market with ever-increasing government incentives to boost electric vehicle adoption.

PwC believes the annual global rate of decarbonisation needs to increase to achieve a net zero economy. The 15.2% rate required is 11 times faster than the worldwide average over the past 20 years, which demonstrates this sector’s significant growth potential, in my view.

Technology meets healthcare

Scottish Mortgage is also focused on the fusion of technology and healthcare.

Moderna is a household name thanks to its Covid-19 vaccine. It’s the trust’s largest position at 10.6%. It develops mRNA technology to target huge public health challenges.

Perhaps a less familiar name is DNA-sequencing business Illumina. The California-based company is the third-largest holding, at 4.1%.

There’s no doubt the pandemic accelerated technological developments in healthcare. Offering the potential to develop a vaccine for cancer, flu, or HIV, I feel the sky’s the limit for mRNA technology demand.

However, breakthroughs are difficult to predict with certainty. Scottish Mortgage is taking a big bet on Moderna shares — only time will tell how wise that strategy is.

And beyond…

The last theme includes the final frontier — space — among other things.

Space Exploration Technologies is another private company that Scottish Mortgage owns. Elon Musk’s venture is the fourth-largest position at 3.6%. From satellite launches to its Starlink internet access service, SpaceX operates at the cutting edge of the cosmic economy.

Space offers potentially vast opportunities as well as uncertainty. There’s a danger investors can be overly optimistic about technological advances.

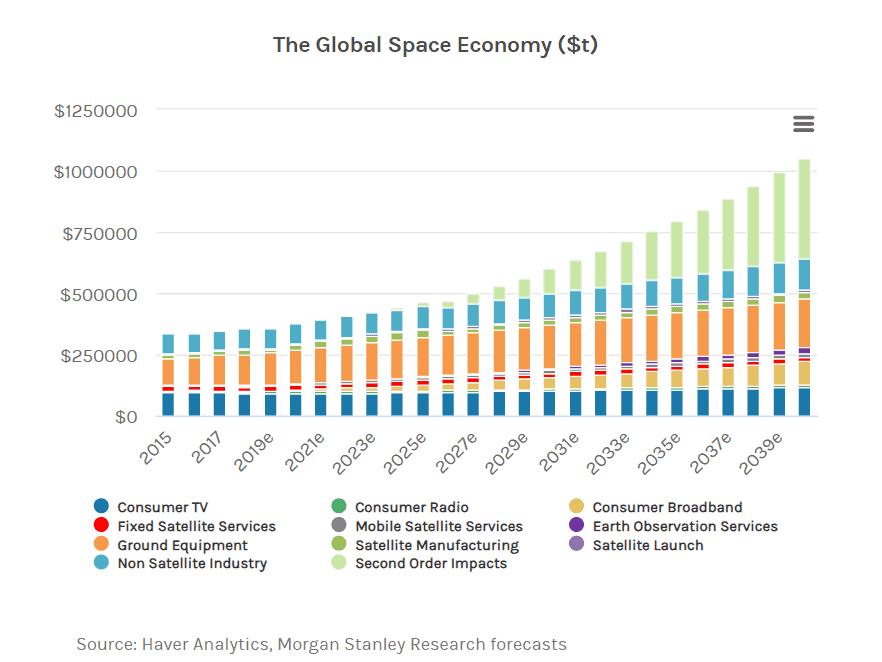

Nonetheless, it’s reassuring that Morgan Stanley analysts share Scottish Mortgage’s outlook, predicting the global space economy could double to over $1trn by 2040.

I’m holding my Scottish Mortgage shares

Owning speculative growth stocks carries risks for the stock, of course. The shares are particularly sensitive to market sentiment, and there’s always a concern the fund managers could make bad picks.

However, I like the exposure Scottish Mortgage offers to innovative global companies. I’m comfortable with my current shareholding and I’ll be looking for dip-buying opportunities in 2023.