At the end of each month, I make time to review the market and pick the dividend yield heroes that will power my portfolio.

Once a month is enough to carry out a review. It stops me obsessing over minor price changes each day. Instead, I concentrate on long-term trends that are the key to a great investment strategy.

Here are my top picks for February.

Building growth

A fluctuating share price has generated some startling dividend yield figures at Persimmon (LSE: PSN), most recently more than 16%, but I am taking a realistic approach in choosing the housebuilder as an investment.

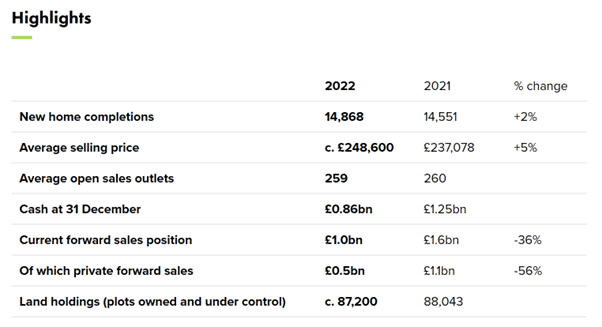

A trading update on 2022 performance said new home completions were up 5% year on year, and average selling price increased 5%.

Group Chief Executive David Finch said that the year had seen a strong performance, despite “headwinds”. These include supply constraints and a more challenging sales environment, with rising interest, mortgage rates, inflation and weaker consumer confidence.

These are short-term issues that will weigh on forward sales, but he is confident that long-term demand for new homes remains strong.

I tend to agree, not least because there is a national housing stock shortage of more than one million homes. More homes are needed, and I think this will continue to drive demand in the long term.

Furthermore, I think worries about future economic challenges are already reflected in the share price. Currently, it sits at around £14 — far below the lows reached during the pandemic.

There is a risk the share price could fall further as the housing market cools during 2023. Also, in the global economic crisis back in 2008, dividend yields collapsed to almost nothing.

However, I believe there are significant long-term gains to be had in both the share price and yield. If dividend returns are around 4-8%, based on the current share price, then I will be happy.

Digging for diamonds

Back in October last year, The Motley Fool’s Royston Wild picked Anglo American (LSE: AAL) shares as a great value stock that he was interested in after their price slumped.

He chose well, as an investment at the time would have leapt 30% by now. I think there is still more good news to come, particularly in terms of its strong dividend yield of more than 5%.

There is a risk, because pre-Covid dividend returns were much lower. If I look at the 2018 yield as a share of today’s share price, it would be 2%.

However, I think there are some key factors that will drive its growth, with a wide-ranging mining portfolio covering in-demand commodities, including platinum and diamonds (Anglo American owns 85% of De Beers Group, the global diamond company). It is also involved in crop nutrients.

A key to growth will be the Quellaveco copper mine in Peru, one of the largest undeveloped copper deposits in the world. As production ramps up, it is expected to increase global production by 10%. This in turn should drive profits and future dividends.