Tesla (NASDAQ: TSLA) stock is down 54% over the past year. After shedding more than $700bn in market valuation during 2022, the electric vehicle (EV) manufacturer appeared to be in the middle of a deflating bubble alongside a number of US growth stocks.

However, the rebound in the Tesla share price that started this year has accelerated in recent days, with a 34% gain since the beginning of January. Yesterday, the business revealed record fourth-quarter results for 2022 even as its margins shrank.

So, what do the results mean for the company? Here’s my take.

Q4 earnings

Tesla reported $24.32bn in revenue for Q4 2022, which represents a 37% year-on-year increase. This narrowly beat the consensus forecast of $24.16bn and it’s the highest ever figure for the business.

The company’s profit figures were even more impressive. With earnings of $1.19 per share, this number is well above the $1.13 per share that analysts expected.

However, the automotive gross margin of 25.9% doesn’t look quite as pretty. This is the lowest figure Tesla’s reported in the past five quarters. Free cash flow also took a hit, declining 49% to $1.4bn.

It’s a mixed picture. The company performed exceptionally well on key headline figures, which explains the positive market reaction after-hours. However, the gross margin erosion suggests to me there’s some weakness below the surface.

Risks and Rewards

CEO Elon Musk was assertive on an investors conference call yesterday, claiming 2022 was Tesla’s “best year ever on every level“. The controversial billionaire’s leadership remains a defining feature of the company, but shareholder concern has grown due to his somewhat wayward focus.

After expressing an acquisition interest in Twitter in April 2022, Musk finally completed the $44bn deal in October. Since then, he’s been distracted with new responsibilities at the social media platform. I’d like to see a renewed interest from Musk in his EV business to ensure the company can reach its full potential.

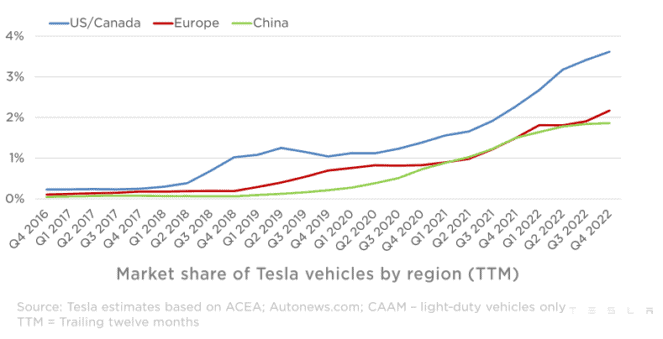

Tesla has also announced substantial price cuts, sending shockwaves across the industry. For example, the Model Y’s starting price has been trimmed from $65,990 to $52,990. In addition, US consumers can benefit from a $7,500 federal EV tax credit on their purchase. This should help the company in its efforts to continue capturing market share.

That being said, the business faces increased competition from US rivals such as Ford that continue to expand into the EV space. Overseas competition is also intensifying. For example, Japanese vehicle manufacturer Honda recently announced plans to launch a new EV division in April. It expects stateside production will begin in 2026.

Should I buy Tesla stock?

Even after a massive haircut, Tesla still looks a little pricey to me with a price-to-earnings (P/E) ratio of 44.5. Nonetheless, it’s the industry leader in the EV sector. It has a huge head start on competitors in terms of technology and production capacity.

I already have indirect exposure to the stock via my holdings in Scottish Mortgage Investment Trust, so I’d only add a small position to my portfolio at this stage. But, the Q4 results were positive overall and I think the shares could climb higher from here. I might buy.