The drop in Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) stock has been a blessing in disguise for me. Its decade-low price-to-earnings (P/E) ratio has allowed me to dollar-cost average and snatch up cheap shares.

Here’s why I’m planning to buy more before the company reports its earnings in early February.

Toothless 2022

Alphabet stock has been known for its strong and steady growth over the past decade. However, 2022 bucked this trend and sent the shares sliding 40%. Although this performance not as bad as other constituents of the FAANG group like Meta and Netflix, it’s worth noting that the conglomerate missed earnings estimates for three consecutive quarters last year. Whether it’ll complete a home run of misses next week remains to be seen.

A combination of sky-high inflation, rising interest rates, and the Russia-Ukraine conflict have put pressure on businesses to cut costs. And during economic downturns, advertising is normally the first to go. Hence, it’s no surprise to have seen Alphabet’s top and bottom lines suffer.

Additionally, other avenues of revenue were hit badly. TikTok continued to grab market share from YouTube while the platform’s Shorts feature was cannibalising its own advertising revenue. This led to a decline in revenue in YouTube’s Q3 numbers.

Pair the above with increased labour costs, higher head count, and the group’s Other Bets segment losing more money, and it’s easy to understand why investor sentiment turned sour.

Spelling out the numbers

Consequently, analysts spent 2022 downgrading their earnings estimates for the stock. The consensus for Alphabet’s Q4 numbers doesn’t paint a pretty picture. Aside from the growing Cloud platform, Google’s business divisions are forecast to see miniature growth and even declines.

| Metrics | Q4 2022 (Consensus) | Q4 2021 | Projected growth |

|---|---|---|---|

| Total revenue | $76.65bn | $75.33bn | 1.6% |

| Earnings per share (EPS) | $1.21 | $1.53 | -21.6% |

| Search revenue | $43.3bn | $43.3bn | 0% |

| YouTube revenue | $8.20bn | $8.63bn | -5.0% |

| Google Cloud revenue | $7.40bn | $5.54bn | 33.6% |

Nonetheless, there’s a silver lining amid all the doom and gloom — that’s that stocks tend to bottom before earnings estimates do. Since analysts are projecting EPS to hit a bottom in Q2 this year, the bottom for Alphabet stock could be here. After all, its share price is already up 15% from its bottom in November.

Furthermore, there are several indications that the tech giant could end up beating analyst estimates this time round. For one, slower recruitment in Q4 should ease the downward pressure on its bottom line. Secondly, the development of Shorts monetisation could bring advertising dollars back to YouTube. Most importantly, I’d argue, is that bearishness on the stock has been overdone, and any upside surprises to the firm’s top and bottom lines could see the Alphabet share price pop next Thursday.

A safer bet to wait?

All that being said, there’s no guarantee that my predictions will come true. Alphabet stock could very well end up heading back down. However, I’m not interested in timing the market. I’m invested for the long term and will continue to dollar-cost average if the stock declines. This is especially the case when its forward valuation multiples are at decade-lows.

| Metrics | Valuation multiples | Industry average |

|---|---|---|

| Forward price-to-earnings (P/E) ratio | 18.6 | 28.9 |

| Forward price-to-sales (P/S) ratio | 4.1 | 4.6 |

| Forward enterprise value-to-EBITDA | 9.8 | 12.8 |

| Price-to-earnings growth (PEG) ratio | 1.1 | 2.5 |

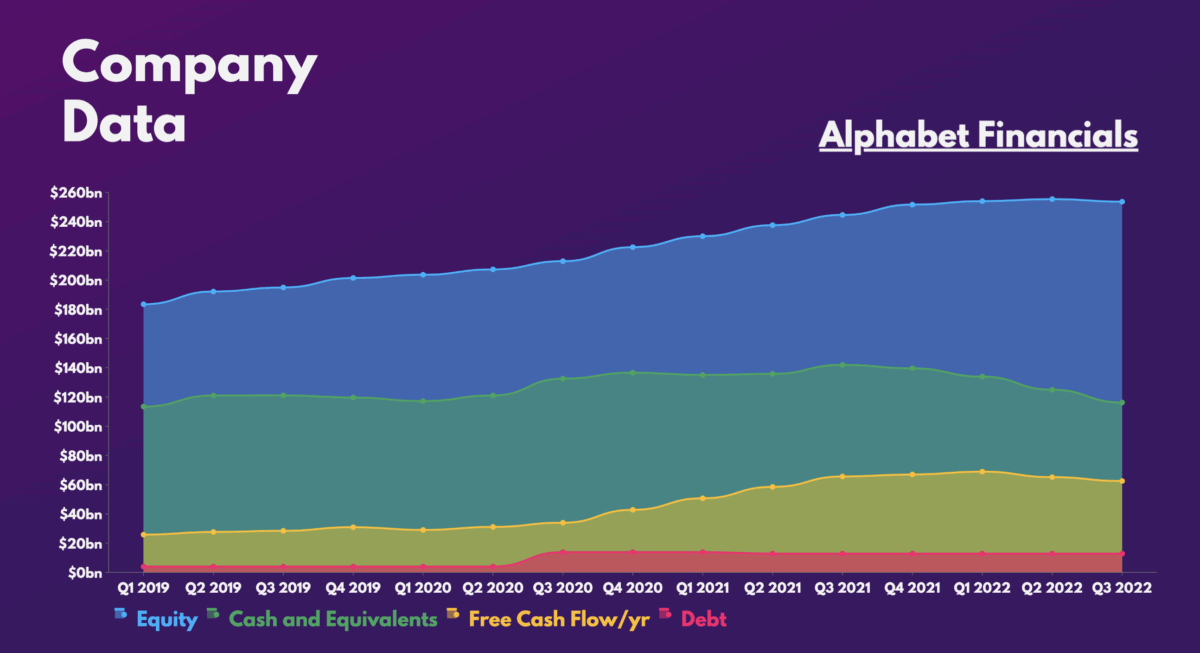

What’s more, Alphabet’s balance sheet is immaculate, which means that I don’t have to worry about getting my position diluted or seeing its earnings potential hindered by debt repayments. And with the likes of Jefferies, Cowen, Goldman Sachs, and many more advocating a strong buy with an average price target of $126, I see no reason not to continue increasing my stake in Alphabet.