Shares in British Telecom (LSE:BT.A) have started the year on the front foot. The stock is up by more than 10% and could see further gains in early February when it reports its Q3 numbers. Even so, it doesn’t necessarily make it a buy for my portfolio.

Dialling up the positivity

Having held up strongly against a market downturn in the first half of 2022, BT shares took a dive in the second half as higher costs hurt its bottom line. Nonetheless, a reversal could be on the cards as a number of investment banks turn bullish on the stock.

The likes of Citi, Goldman Sachs, and Jefferies recently upgraded their ratings to ‘buy’ with an average price target of £1.67. This presents a 30% upside from its current share price, and there are a couple of reasons behind this renewed optimism.

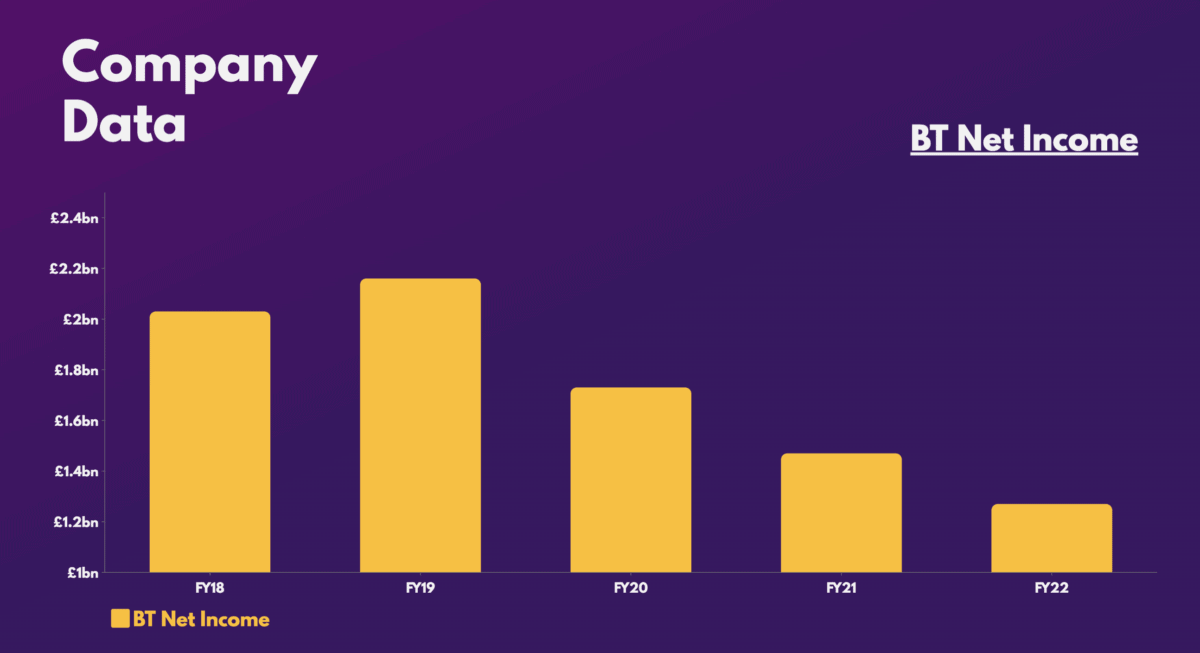

The first would be a rise in its wholesale prices for internet service providers (ISPs) to use its fibre optic cables. The second would be the above-inflation price hike (18.3%) for its broadband customers. These moves should help the company’s margins, and see its net income start to recover after three consecutive years of falls.

Lining up the numbers

For its latest quarter though, the firm is expecting to report a decline in revenue. Sky-high inflation continues to clamp down on consumer spending. On the flip side however, analysts are forecasting a 3% increase in the group’s EBITDA as cost controls start to take effect.

| Metrics | Q3 2023 (Consensus) | Q3 2022 | Projected growth |

|---|---|---|---|

| Group revenue | £5.24bn | £5.37bn | -2.5% |

| EBITDA | £2.02bn | £1.96bn | 3.0% |

Even though BT’s top line is forecast to decrease, an improvement to its bottom line is certainly a plus. Provided the telecoms giant can surpass estimates, I can see further boosts to its share price. That being said, there are caveats to take into consideration. A change to its profit outlook and dividend guidance could change the share price’s trajectory as well.

| Metrics | FY23 (Consensus) | FY22 | Projected growth |

|---|---|---|---|

| Group revenue | £20.53bn | £20.85bn | -1.5% |

| EBITDA | £7.91bn | £7.58bn | 4.4% |

| Basic earnings per share (EPS) | 17.6p | 12.9p | 36.4% |

| Dividend per share | 7.74p | 7.70p | 0.5% |

A buy signal?

Do I think BT shares are worth a buy before its Q3 trading update then? Well, there are certainly a number of tailwinds that make a positive case. Pair this with its cheap valuation multiples and it’s certainly enticing.

| Metrics | Valuation multiples | Industry average |

|---|---|---|

| Price-to-earnings (P/E) ratio | 7.5 | 17.2 |

| Price-to-sales (P/S) ratio | 0.6 | 1.2 |

| Price-to-book (P/B) ratio | 0.9 | 1.7 |

| Price-to-earnings growth (PEG) ratio | 0.8 | 4.1 |

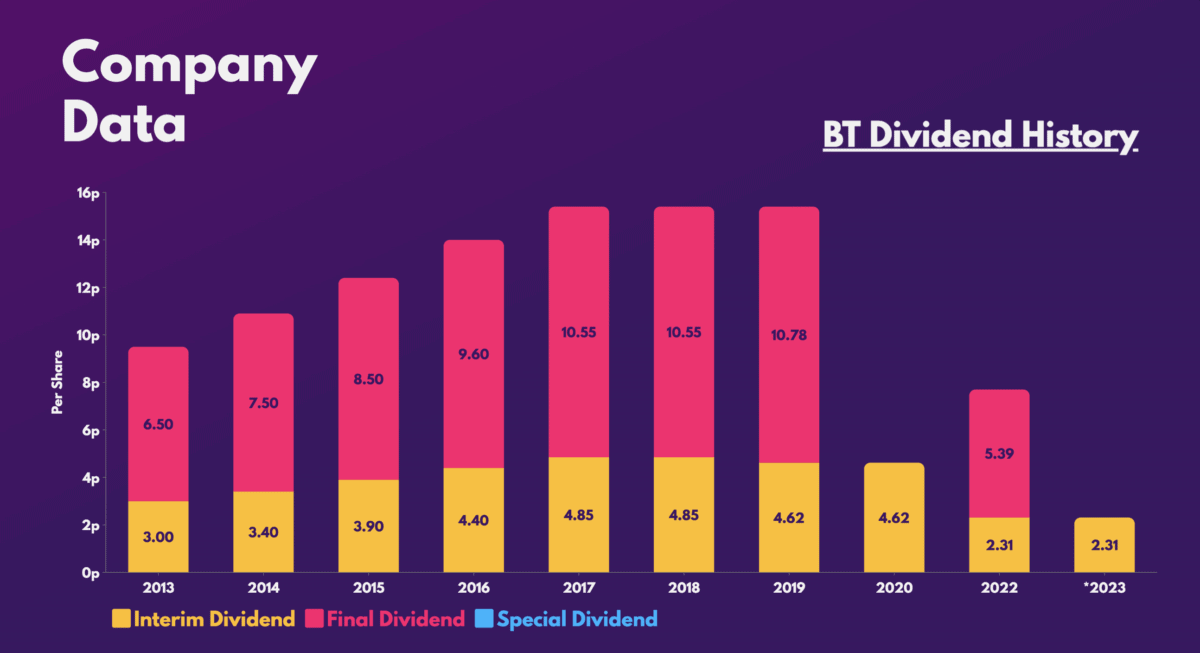

Moreover, its strong history of high and growing dividends should pique the interest of investors searching for passive income. After all, it’s got an excellent dividend cover of 2.6 times.

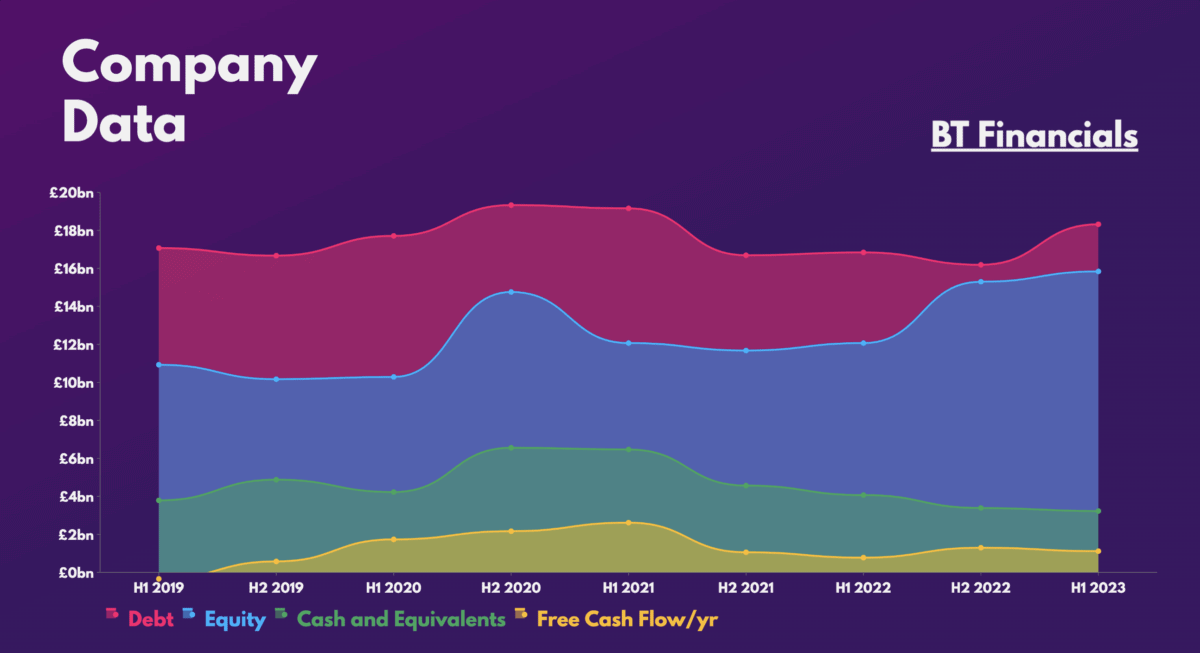

Nevertheless, these catalysts shouldn’t detract from the various issues the conglomerate faces, and its terrible balance sheet is a big one. Price increases could serve its bottom line well. However, regulators are looking into them and could veto those increases to protect ISPs and customers. It’s worth noting that its new wholesale prices are yet to be approved by Ofgem.

Although most of its debt isn’t due soon, repayments are undoubtedly going to hinder future earnings and dividend expansion. This is evident in the latest analyst estimates, which predict a drop in EPS and dividends through to FY25.

| Consensus metrics | FY23 | FY24 | FY25 |

|---|---|---|---|

| Group revenue | £20.53bn | £20.82bn | £21.01bn |

| EBITDA | £7.91bn | £8.05bn | £8.19bn |

| Basic earnings per share (EPS) | 17.6p | 16.7p | 17.3p |

| Dividend per share | 7.74p | 7.79p | 7.63p |

So, given that I invest for the long term, I don’t see BT shares as a good investment despite its short-term tailwinds. Thus, I won’t be buying the stock today.