The news is full of stories of Inflation, rate rises, strikes, and failing companies blighting the UK economy. I have seen the UK described as a basket case, and by extension the UK stock market. Now, whether the UK economy is doomed or not is irrelevant to the point I want to make. That is a stock market or market index is not necessarily the same thing as its country’s economy. That is particularly true of the FTSE 100 index, which I am still happy to keep investing in.

FTSE 100 near its all-time high

The FTSE 100 hit 7,877.45 points on 19 June 2019. As it stands that is its record high. Right now, the index is just below that, at 7,764 points, but it has been close this week. Flirting with all-time highs suggests that the index, and by extension the companies whose stocks make it up, are doing okay. How can that be if the UK economy is apparently in the doldrums? Well, about three-quarters of the revenues of FTSE 100 companies come from outside the UK.

There are variations across the 100 or so among companies in the index. AstraZeneca gets about a tenth of its revenues in the UK. NatWest on the other hand gets about 95% of its revenue on these shores. A lot of FTSE 100 companies report in sterling. Therefore, exchange rate movements will affect their foreign earnings and thus their share prices. And an awful UK economy is definitely not a good thing for the FTSE 100, but on the whole, in terms of revenue generation, its fortunes should depend more on what’s going on in the rest of the world, rather than what’s happening in the UK.

Underperforming index

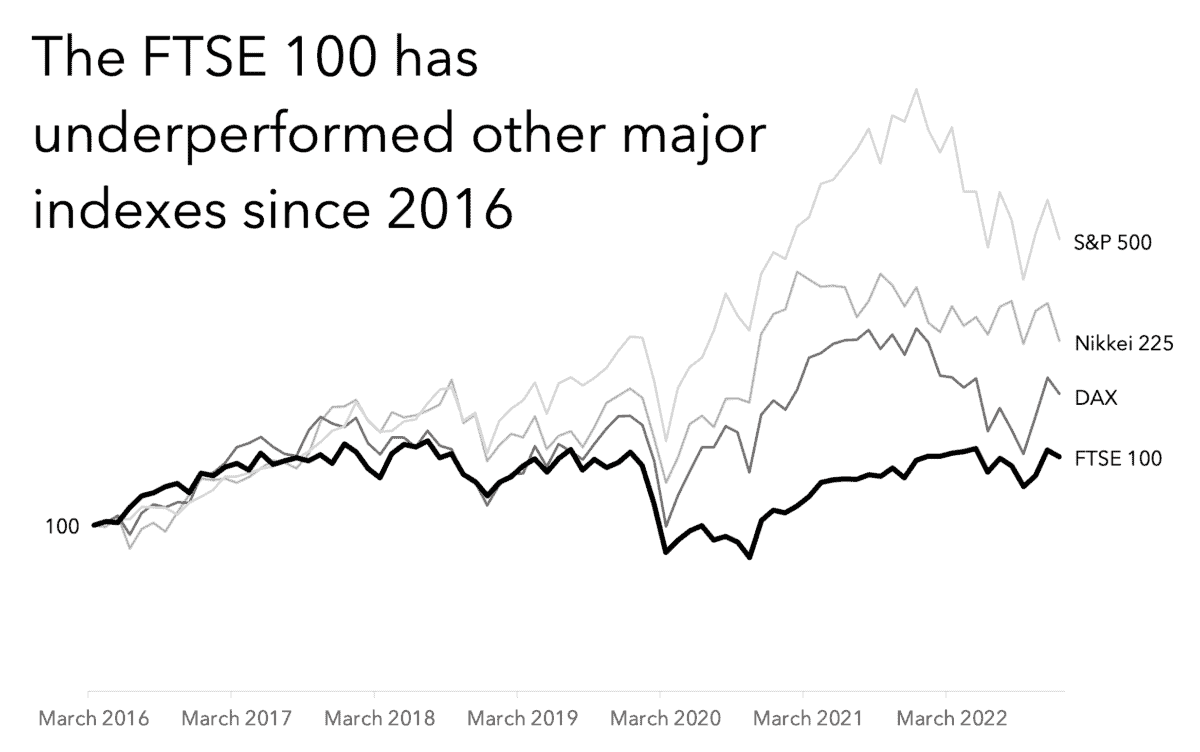

Since March 2016, the FTSE 100 has underperformed the US S&P 500, the German Dax, and the Japanese Nikkei 225. The performance lag was especially pronounced in the boom after the coronavirus global market crash in early 2020. Now, one interpretation of the underperformance is that the UK economy, particularly the effect of Brexit, has been holding the index back. But, looking more closely, it seems that the FTSE 100 held up fairly well while other indexes started to slide in late 2021 and into 2022.

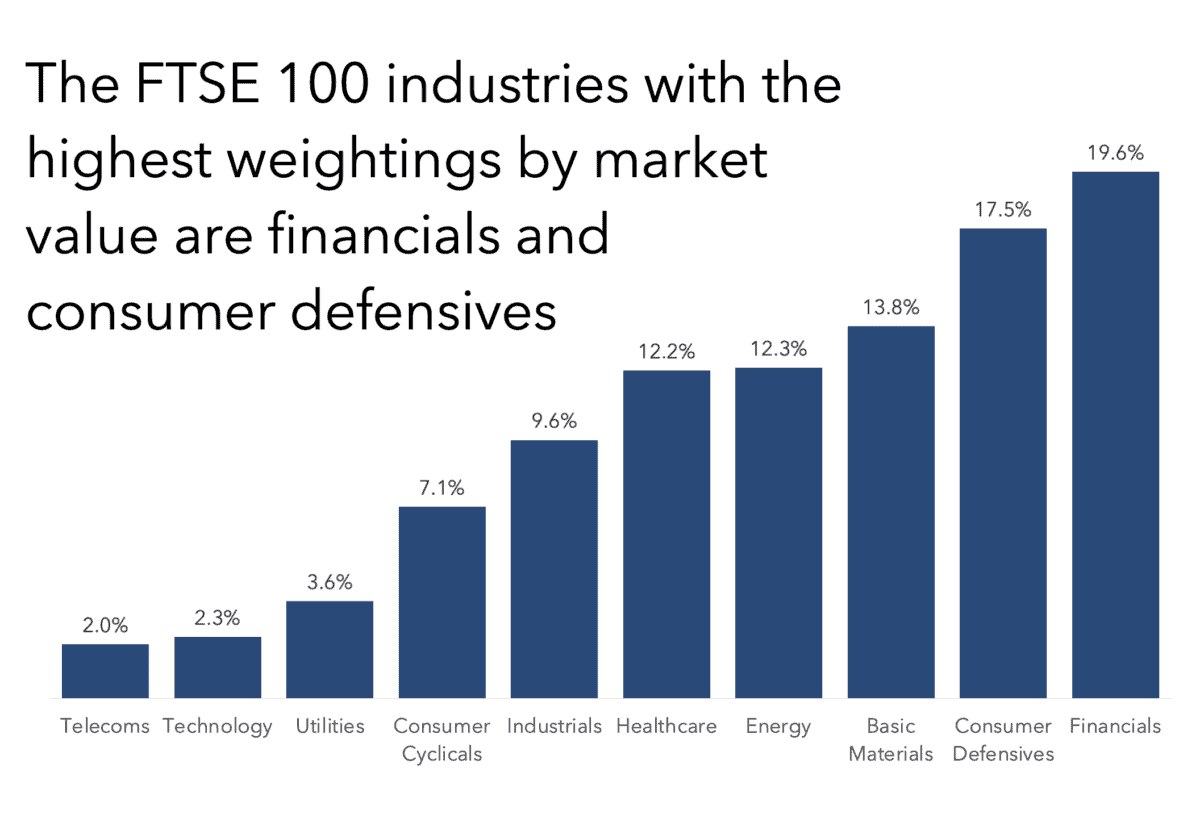

I think that has got a lot to do with the makeup of the index. It is important to know what you are buying. The FTSE 100 is heavily weighted towards the financial, consumer defensive, and basic materials (mining) industries and is a value-orientated index. It is short on growth stocks and technology names in particular.

Being light on growth has been a benefit of late. But that will probably not always be the case. So while I am happy to keep investing in the FTSE 100, in the form of individual stock picks in my Stocks and Shares ISA, and through a tracker in my SIPP, I do recognise its strengths and weaknesses. Investing in it does give me exposure to the global economy, but mainly in a few, what might be called old-world industries. That’s not enough diversification for my stock portfolio, so I am happy to look outside the index as well.