I own shares in Scottish Mortgage Investment Trust (LSE: SMT). Although I entered my position more recently than two years ago, I’ve watched in dismay as my Scottish Mortgage shares have plummeted since I bought them.

The loss would have been worse if I’d bought my shareholding two years ago. However, I invested knowing this is a high risk/reward fund. Plus, as a long-term investor, I’m more concerned about my performance over a decade rather than shorter-term volatility.

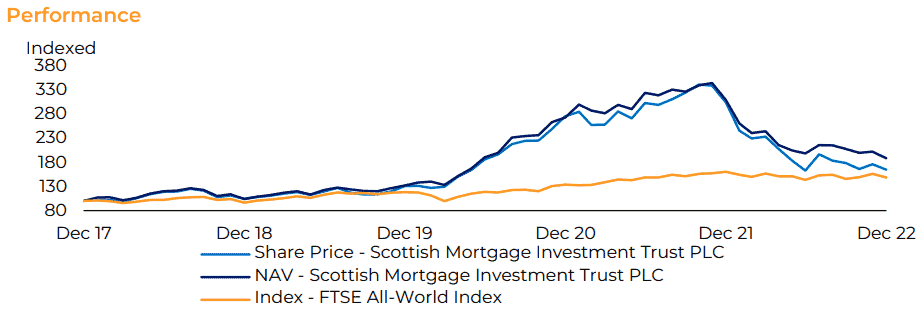

So let’s explore the return I’d have made from a £1,000 investment in January 2021, and why I think the shares look cheap after a substantial haircut.

Two-year return

Two years ago, the FTSE 100 investment trust was soaring as the net asset value (NAV) of its growth stock portfolio rocketed.

The Scottish Mortgage share price was trading at 1,229p, boosted by economic stimulus measures in response to Covid lockdowns.

Today, the stock’s changing hands for 770p. That’s a 37% decline over 24 months.

In 2021, I could have bought 81 shares with a £1k lump sum, leaving £4.51 as spare change. Those shares would currently be worth £623.70.

As a growth stock orientated fund, Scottish Mortgage isn’t renowned for its dividends. Nonetheless, I’d have received a handful of small dividend payments over that time period totalling £5.80.

Therefore, my grand total today would be £634.01, including shareholder distributions and the spare cash.

Growth stock investing

Baillie Gifford’s flagship investment trust has a clear purpose. To quote co-manager Tom Slater, it’s the pursuit of “long-run capital appreciation by investing in the world’s most promising growth companies over long periods of time and embracing the volatility that goes with that.”

Looking at a longer-term time horizon, the fund’s been successful in delivering strong returns. Over a five-year period, Scottish Mortgage shares outperform the FTSE All-World Index that the company uses as a benchmark.

So why are the shares so volatile? To answer this, it helps to examine the stocks it holds. For example, the fund’s largest position is mRNA biotech pioneer Moderna at 10.6% of the Scottish Mortgage portfolio.

Moderna stock attracted excitement from traders during the pandemic due to the development of its effective vaccine against Covid-19. Scottish Mortgage timed its entry point to coincide with the FDA’s emergency use approval in December 2020.

Talking about Moderna as simply a Covid vaccine provider is akin to pigeonholing Amazon as just a bookshop in the early 2000s.

Scottish Mortgage Investment Trust

Moderna’s share price has since waned as investors have turned elsewhere, looking to defensive investments and inflation hedges. However, with a diverse pipeline to combat cardiovascular disease, cancer, infectious diseases and autoimmune diseases, Scottish Mortgage backs the company to deliver big returns in the coming years.

I’d buy more today

Scottish Mortgage shares carry significant risks. I expect there will be more volatility to come, given the nature of the company’s portfolio.

Nonetheless, I trust the fund’s leadership to identify promising growth stocks of the future. I’d take the opportunity to bring the average price of my shareholding down by investing more today while the shares trade at an 8.3% discount to the portfolio’s NAV.