Vodafone (LSE: VOD) shares boast a market-leading dividend yield just under 8.4%. With huge shareholder distributions on offer, I’m eyeing up the telecoms titan for my portfolio this year.

Let’s explore how I could earn over £1,200 per year in passive income by investing in the FTSE 100 company.

A top dividend stock

The Vodafone share price is currently 92p. Over 12 months the stock’s fallen 23%, pushing the dividend yield well above the Footsie average.

Today, 300 shares would cost me £276. Let’s imagine I continued buying this number of shares every week over the course of a year. In total, I’d pay £14,352 for 15,600 shares.

I’d be able to buy all the shares via a Stocks and Shares ISA, as the total sum fits within my £20k annual limit. This is handy as any income received within the ISA wrapper wouldn’t be subject to dividend taxes.

At the current dividend yield, my shareholding would produce an annual passive income stream of £1,202.70 — a touch above £100 each month.

I could then reinvest the dividends into more Vodafone shares. This would allow me to benefit from a compounding effect over the long term.

Reasons to be bullish

After trailing the FTSE 100’s return for years, the latest financial results offer some glimmers of hope.

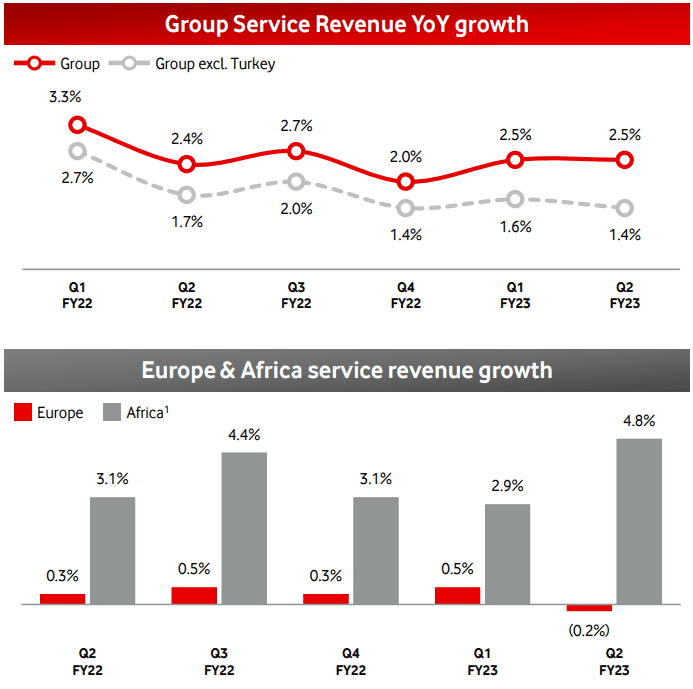

For the first half-year of FY23 Vodafone reported a 2% revenue uptick to €22.9bn, buoyed by service revenue growth and increasing equipment sales. Operating profit also rose by 12% to €2.9bn.

Much of the progress was driven by its success in Africa. The firm’s established itself as a leading technology provider in the continent by connecting over 170m Africans to a range of mobile and lifestyle services.

In addition, the business is contemplating merging its UK operations with Three UK. This deal would make the combined outfit Britain’s second-largest mobile network operator. With 27m customers, it would be second only to Virgin Media O2’s 32m.

The proposed merger would equip the company with the necessary scale to accelerate its full 5G rollout and expand its broadband connectivity. If it materialises, I think the tie-up could produce positive momentum for the share price.

Risks

However, there are significant headwinds to growth too. In contrast to Africa, Vodafone has flatlined in Europe. This is largely thanks to a 1.1% service revenue decline in its largest market, Germany.

In addition, the company’s debt levels make for uncomfortable reading. With €67.5bn in long-term debt, the debt-to-equity ratio stands at about 116%. This has forced Vodafone to pursue aggressive cost-cutting measures to save $1.1bn by 2026, including its biggest round of layoffs in five years.

What’s more, the company’s currently lacking clear direction and leadership. Under pressure due to a 40% collapse in the share price under his tenure, former CEO Nick Read stepped down on 31 December. CFO Margherita Della Valle is tasked with steadying the ship as interim CEO.

My passive income portfolio

While not without risks, I think better days could lie ahead for Vodafone if it can reduce its debt and streamline its business.

If I had some spare cash, I’d invest in the shares to target a regular passive income stream.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.