The International Consolidated Airlines Group (LSE: IAG) share price has been a top FTSE 100 riser this year. The airline’s spearheaded a broad market rally that has pushed the index to a new four-year high.

I’m encouraged to see the stock make a positive start to 2023. After all, the past three years have been thoroughly miserable for longstanding investors following the huge share price crash that resulted from the pandemic’s crippling effects on the aviation industry.

So, what’s the next destination for IAG shares and would I buy? Here’s my take.

International travel recovery

At 140p, the IAG share price seems anchored well below its pre-pandemic highs above 400p. However, there are signs a recovery’s beginning to take hold in international travel as passengers return to the skies. This could boost the stock’s upside potential in 2023 and beyond.

Airline stocks are still reeling from the damage Covid-19 caused. Although they’ve fallen 14% over 12 months, IAG shares have fared better than FTSE 250 low-cost carriers easyJet and Wizz Air. These stocks are down 42% and 50%, respectively, compared to a year ago.

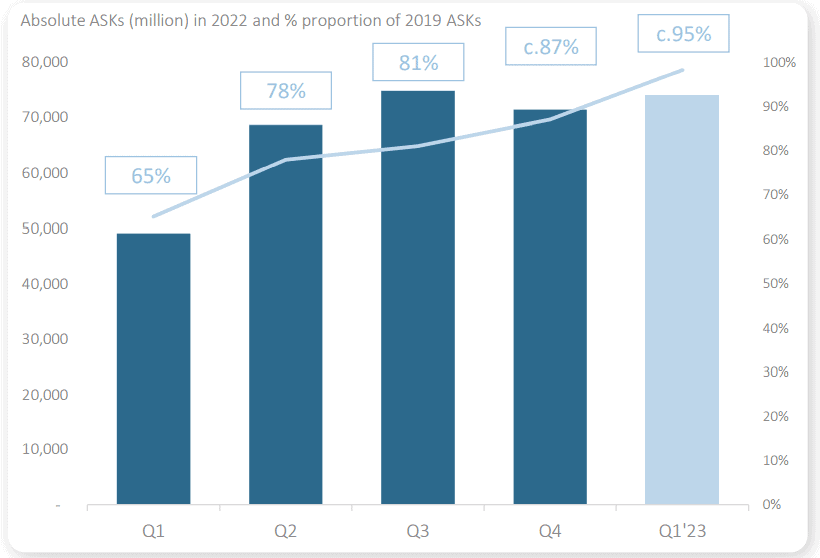

The British Airways parent company expects a near-full recovery to take shape at the beginning of this year. Capacity in Q1 2023 is anticipated to reach 95% of pre-Covid levels.

Chief executive Luis Gallego recently highlighted that leisure demand was “particularly healthy”, with leisure revenue already making a recovery to 2019 levels. Business travel is catching up too, but is making slower progress.

The broad picture’s a largely positive one. Governments around the world are re-assessing their public health strategies. The most onerous quarantine and testing measures are now in the rear view mirror in many parts of the globe.

Risks

However, the recovery remains patchy. For instance, the Asia-Pacific region continues to lag the rest of the world. Indeed, many countries recently rushed to reimpose restrictions on Chinese travellers in an attempt to limit the spread of new viral variants after China abandoned its zero-Covid policy in advance of the Lunar New Year period.

In addition, the cost-of-living crisis could also keep the IAG share price grounded this year. As sky-high inflation eats away at household budgets, cost-conscious consumers may forget about exotic long-haul destinations in favour of alternatives closer to home. Much of IAG’s success will depend on the macroeconomic backdrop in the run up to the crucial summer period.

What’s more, the airline’s also grappling with an €11bn net debt burden. With interest rates due to rise further, the cost of servicing this debt is likely to rise this year. This could eat into the firm’s profit margins just as it embarks on a tentative recovery.

Would I buy IAG shares?

I think the outlook for IAG’s share price is improving. I can find an increasing number of reasons to be bullish as the travel industry continues to return to strength.

However, there are considerable risks facing the company and I’m not ready to buy shares just yet. Currently, I believe there are better investment options for my spare cash to be found in other UK equities. Nonetheless, I’ll closely monitor developments affecting the airline as the year progresses.