Telco companies tend to hold up better than many during economic downturns. However, BT (LSE: BT.A) shares weren’t so fortunate last year, dropping more than 30%. So, here are two catalysts I think could bring some back buzz to the stock this year.

1. Efficient cost-cutting

BT is focusing on reducing its costs and improving efficiency. Its plans include cutting £3bn of costs over the next three years and merging its Enterprise and Global divisions. This kind of aggressive cost control has the potential to increase its margins, which should in turn give BT shares a boost. The company could end up using the cash saved from these measures for several purposes.

For one, it could reinvest it into its growing its Openreach division. This would help to accelerate revenue growth and fend off increasingly tough competition. After all, the likes of Vodafone, Sky, and Liberty Media are all hot on BT’s heels to capture as much market share as possible as 5G rolls out and more households adopt fibre internet.

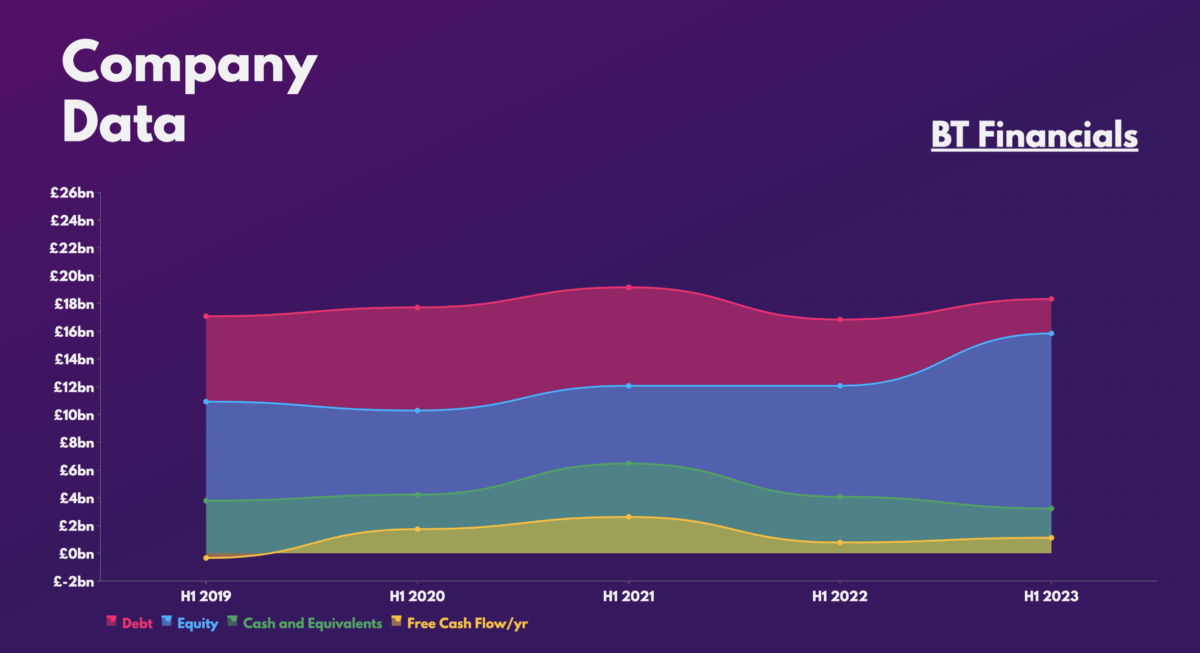

Second, it could start paying off its mountain of debt that’s worth £18.3bn. With a debt-to-equity ratio of 115.6%, the FTSE 100 firm’s balance sheet isn’t in the best state. And improving its financials could attract investors such as myself.

The other purpose would be to use the spare cash to pay bigger dividends and/or buy back shares. With a dividend yield of 6.5%, BT shares currently have healthy dividend cover of 2.6 times. This is good news if I invest for passive income as it guarantees a margin of safety. An improvement to its operations could see its dividend cover widen too, which would give management room for an increment in dividend payments. If so, I can see the stock gaining popularity quickly.

2. Regulatory approvals

Another catalyst for this year would be getting through several regulatory hurdles. Provided the conglomerate can overcome these, I’m expecting the stock to consolidate at a higher level.

The first and most important one would be approval surrounding Openreach’s new prices for competitors to use its fibre cables. Provided they’re approved, I can see BT shares benefiting, given that Openreach is its fastest-growing division.

Additionally, the firm is still under scrutiny for mid-contract price increases, which is frowned on by Ofgem. The regulator is reviewing whether its increases were sufficiently transparent. And if found guilty, BT could end up with a hefty fine that would impact its bottom line. The group’s plans to increase the prices on most if its customers’ contracts by 3.9% plus the current inflation rate in April doesn’t help its optics either.

With all that in mind, I’m not so keen on becoming an investor in BT just yet. While its dividend yield certainly looks lucrative given its potential as a passive income stock, there’s no guarantee that it can stay at such levels over the next few years. This is especially the case if the business has to pay hefty fines and/or absorb losses around Openreach customers. As such, I’ll want to see an improvement to its balance sheet and regulatory landscape before investing.