Tech stocks like Microsoft (NASDAQ:MSFT) have declined by huge margins this year. With its share price down more than 25% this year, the stock could be trading on a discount today. So, here’s what the charts say.

Softening numbers?

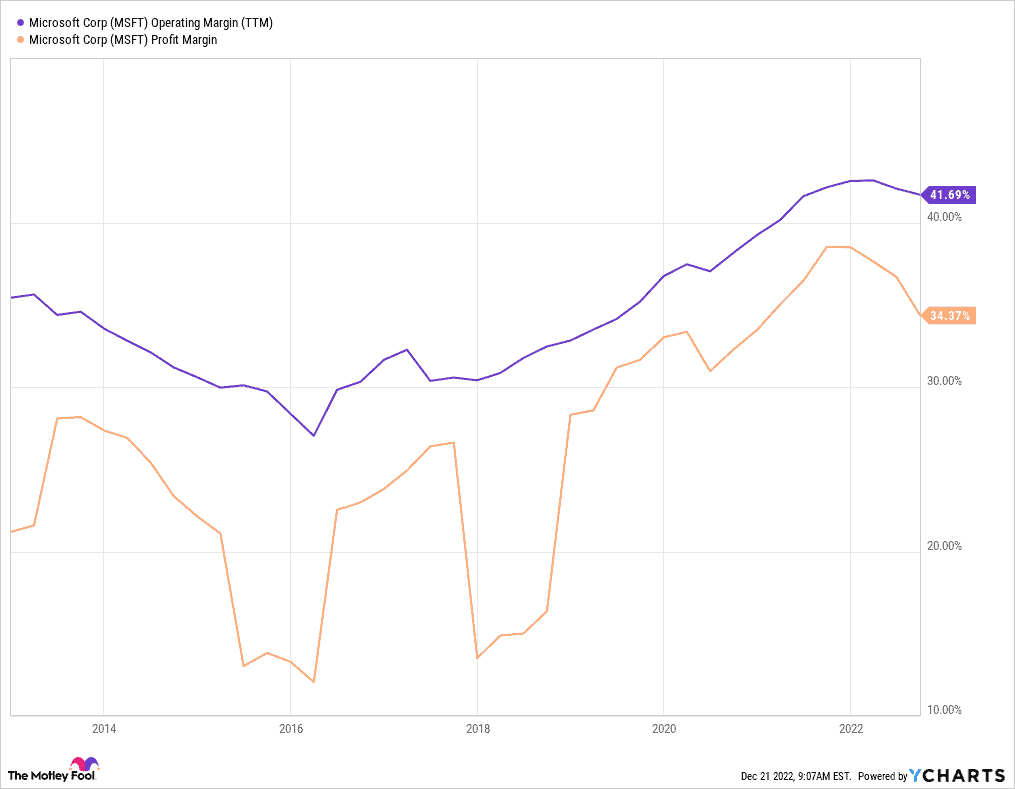

Having hit an all-time high of $343 during the pandemic, Microsoft stock has since dropped to $242. Fears of a recession have dented demand for its products and services. Nonetheless, it’s worth noting that its operating and profit margins have held up relatively well.

What impresses me most is its ability to keep its operating margins above 40%, despite higher costs associated with energy and labour this year. Although margins have dipped against 2021 levels, it’s commendable that they’ve remained above their pre-pandemic levels. This is always the first signs of a good investment for me — strong margins.

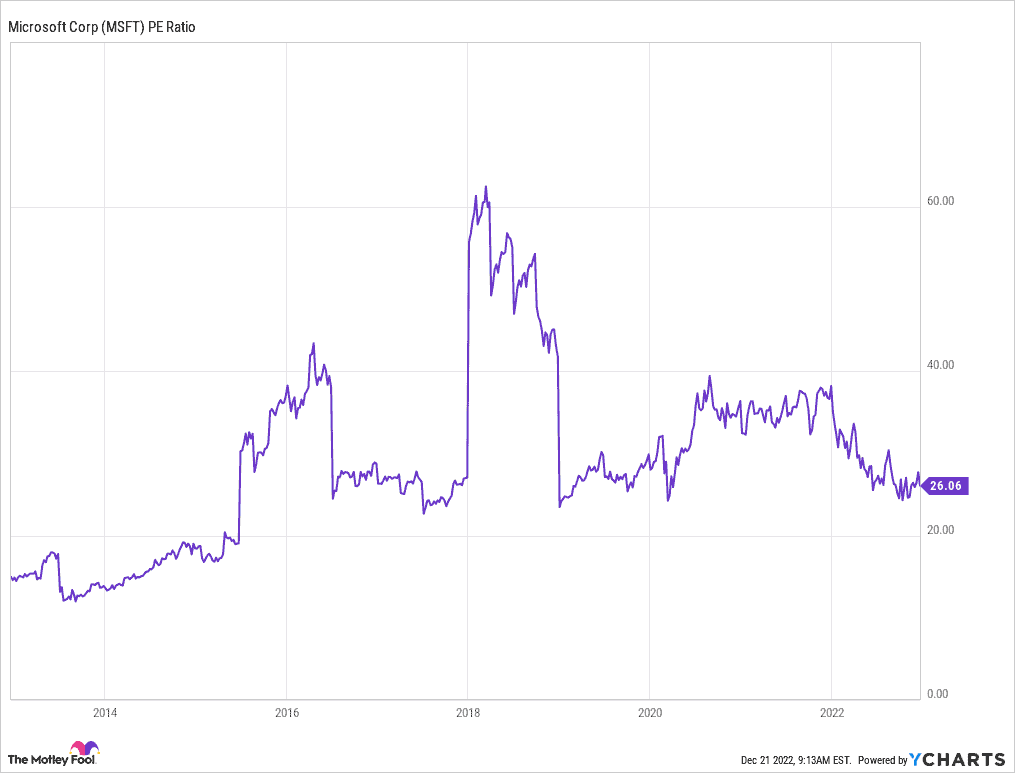

But is Microsoft stock fairly priced? Well, its shares currently trade at a price-to-earnings (P/E) ratio of 26. This is more than the S&P 500‘s average P/E of 21, which could indicate that the stock lies on the pricier side.

A blizzard of regulation

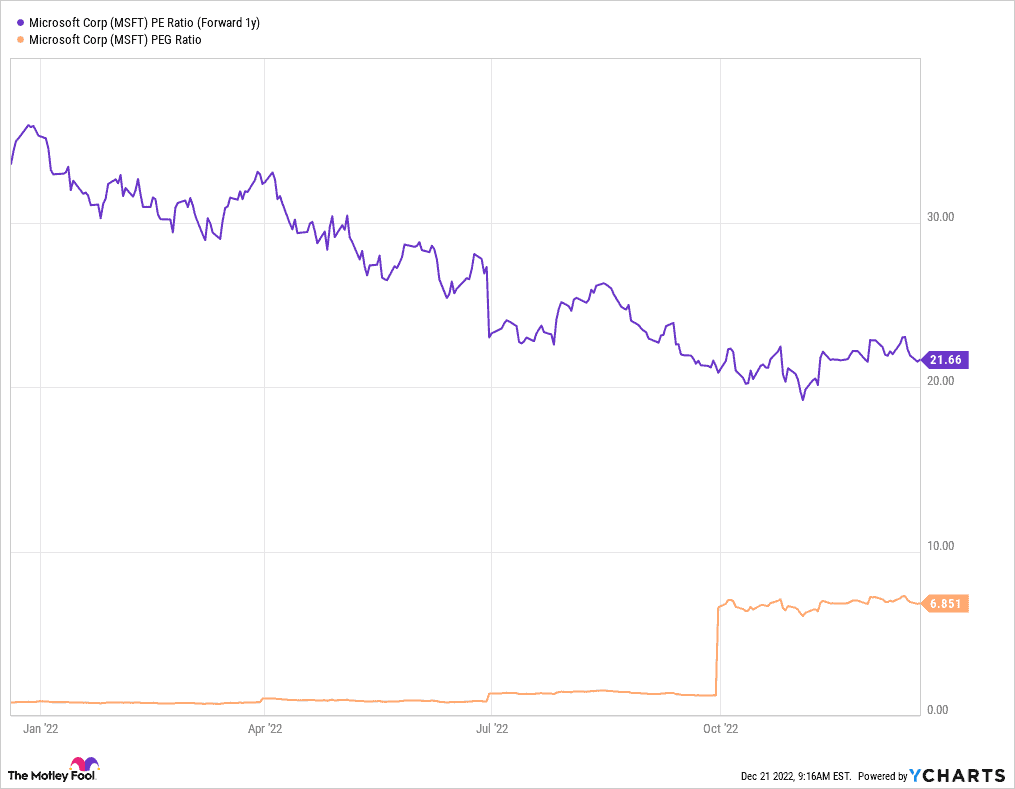

It’s worth noting, however, that the P/E ratio is a lagging indicator. A more accurate way to value Microsoft would be to look at its forward P/E. This takes its forecast future earnings into consideration. With a forward P/E of 21, it can be said that I’m paying a fair value for future earnings growth within a year. On the flip side though, the tech stock’s forward price-to-earnings (PEG) ratio stands at a whopping 6.9; way above the ‘acceptable’ threshold of 1.

The bulk of the conglomerate’s growth has been coming from its cloud offerings, especially in recent times. This is expected to continue growing along with its hopeful acquisition of Activision Blizzard, which should help its top and bottom line grow over the long term. However, the move has come to a bit of a halt in recent weeks as authorities question whether the merger would break anti-competition laws.

Window of opportunity?

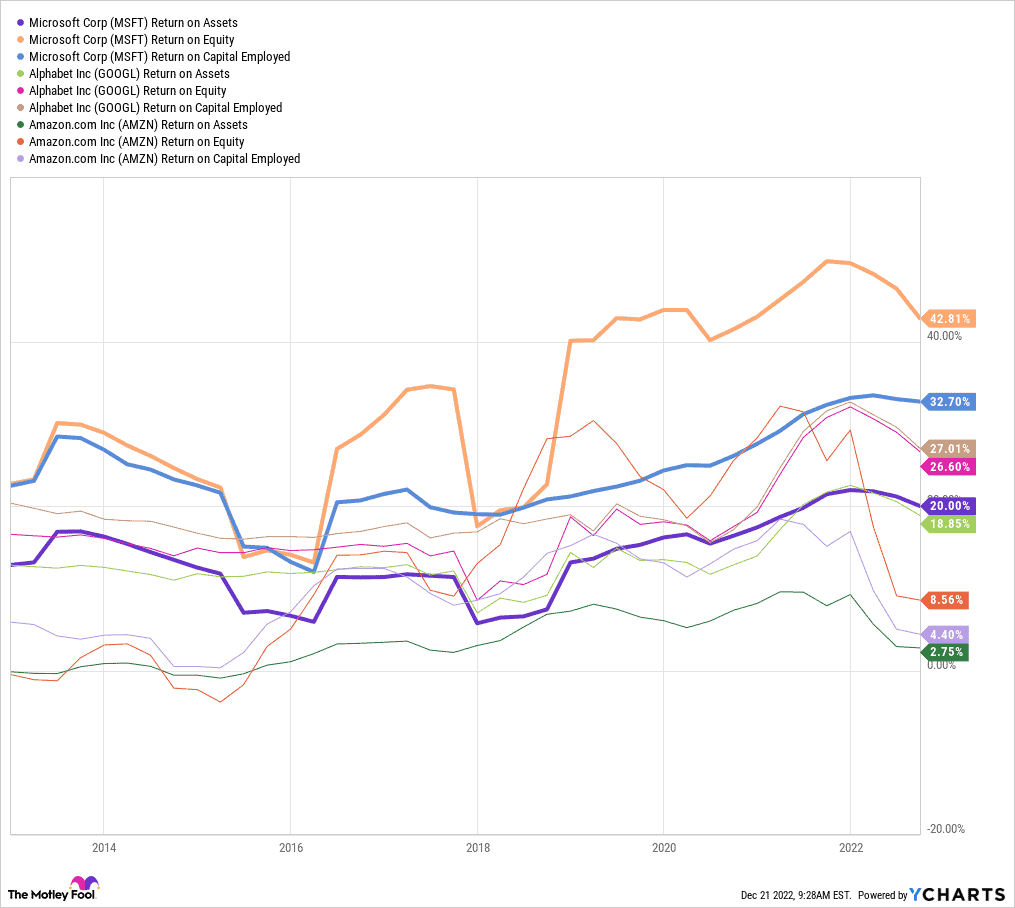

Having said that, Microsoft has a steady and excellent track record of producing large returns for shareholders. Moreover, this has increased over the years. Looking at the company’s return on assets, equity, and capital employed, there’s clearly a distinction to be made. In fact, the company outperforms many of its cloud peers by massive margins.

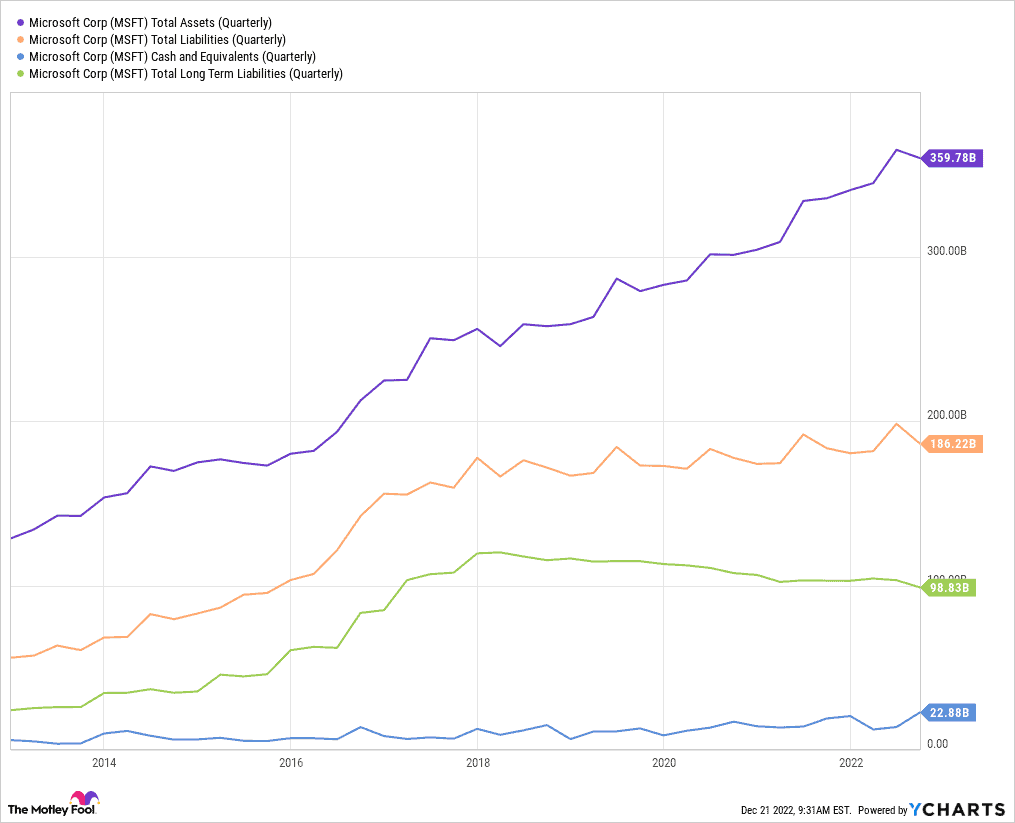

Pair this with its immaculate balance sheet and the stock looks even more attractive. With very little debt, the auto manufacturer has more than sufficient capital to weather a global recession.

What’s more, the group continues to grow its market share in the cloud space, which goes to show how well it’s doing despite the tough economic environment. Not to mention, in a world that’s becoming increasingly digital and with cloud computing expanding rapidly, Microsoft is well positioned to capitalise.

Overall, I think Microsoft stock is fairly valued at its current price. After all, analysts rate the stock a ‘strong buy’ with an average price target of $291. This would present me with roughly a 21% upside from current levels. But due to the red tape surrounding the acquisition of Activision, I’ll be holding off buying any shares until the landscape becomes clearer.