Tesla (NASDAQ: TSLA) stock has had a terrible year so far in 2022. Its share price is down 60% this year, and the stock has lost more than 15% of its value this month. As its market cap falls under half a trillion dollars for the first time in years, its charts could indicate a once-in-a-lifetime bargain.

A Musk sell?

Having hit an all-time-high last year, the Tesla share price has fallen like a stone for several reasons. The first is its status as a growth stock. These types of stocks tend to fall in high interest rate environments as consumer spending decreases, which hurts future cash flows. The second would be Elon Musk selling a sizeable chunk of his shares to support his purchase of Twitter, which has sunk investor confidence.

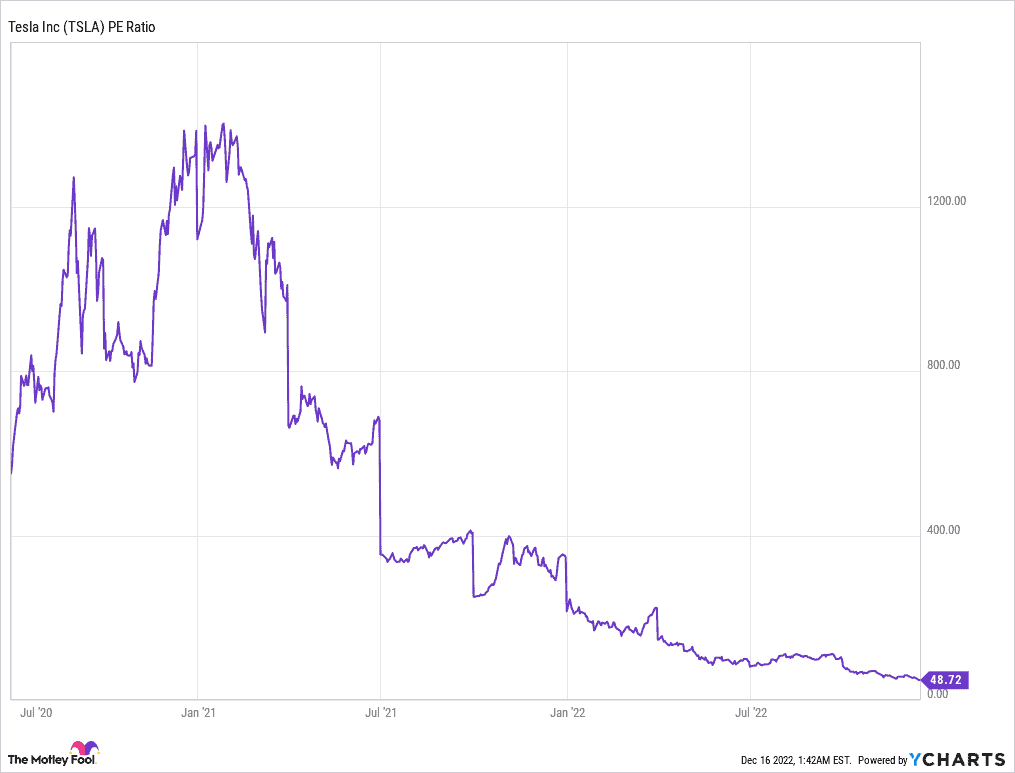

This has led to the stock hitting a low not seen since 2020. But what’s even more eye-popping is its current price-to-earnings (P/E) ratio, which is 49. Although this is still higher than the S&P 500‘s average of 21, Tesla stock has never traded at such a cheap valuation.

Driving growth

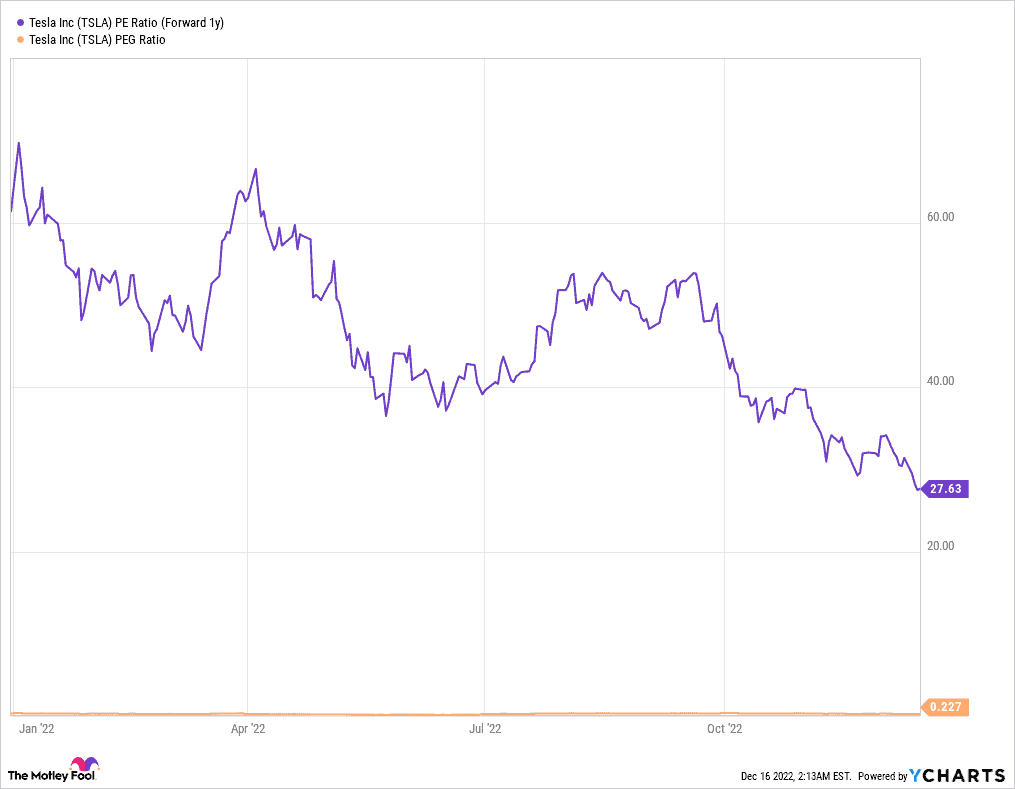

That being said, it’s worth noting that the P/E ratio is a lagging indicator. A more accurate way to value Tesla would be to look at its forward P/E. This takes its forecast future earnings into consideration. With a forward P/E of 28, it’s still more expensive than the S&P. However, the stock’s forward price-to-earnings (PEG) ratio stands at 0.3. This shows that buying Tesla stock now could be a bargain given its earnings growth potential.

To complement these multiples, the firm’s long-term order book isn’t shrinking either. In fact, it’s growing. Although analysts will be quick to point to shorter wait times and production slowing, this is down to the manufacturer upgrading its production lines. Additionally, inventory levels remain relatively low which shows that management is managing its production levels and margins effectively.

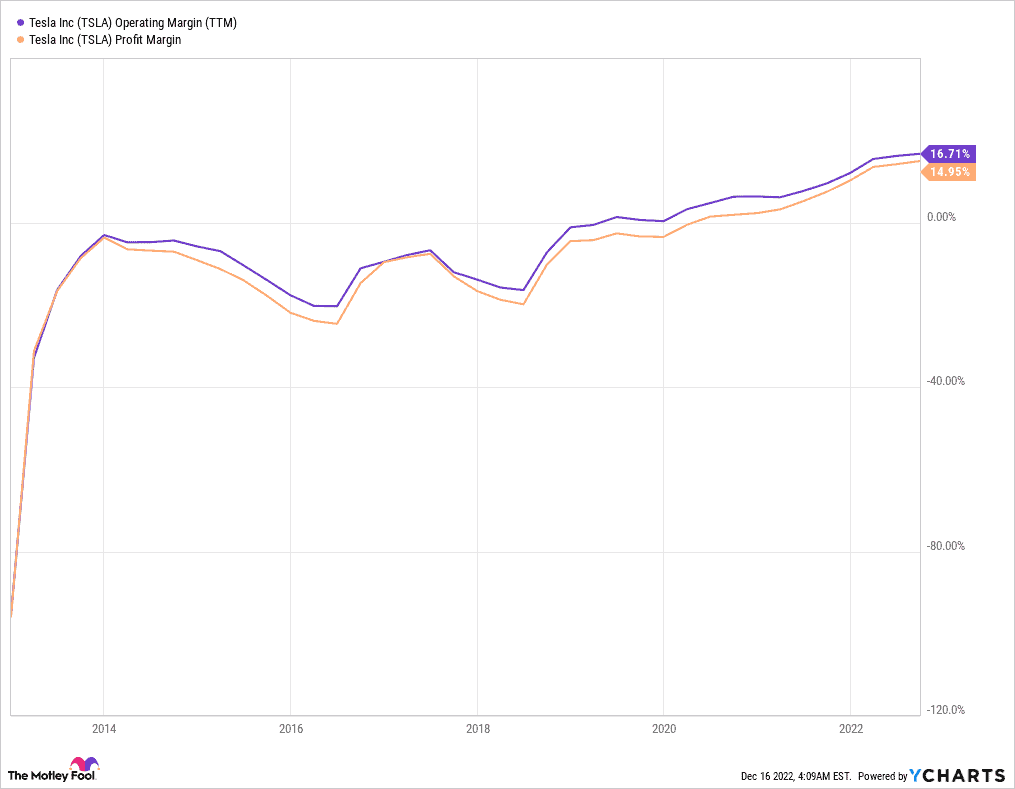

Not to forget, Tesla also has future innovations in the pipeline. These include its new truck products and humanoid robots, which could allow the group’s bottom line to see monumental improvements in the coming years. After all, it currently has operating and profit margins of approximately 15%, and they’ve been growing sharply over the past decade.

Tesla is electrifying returns

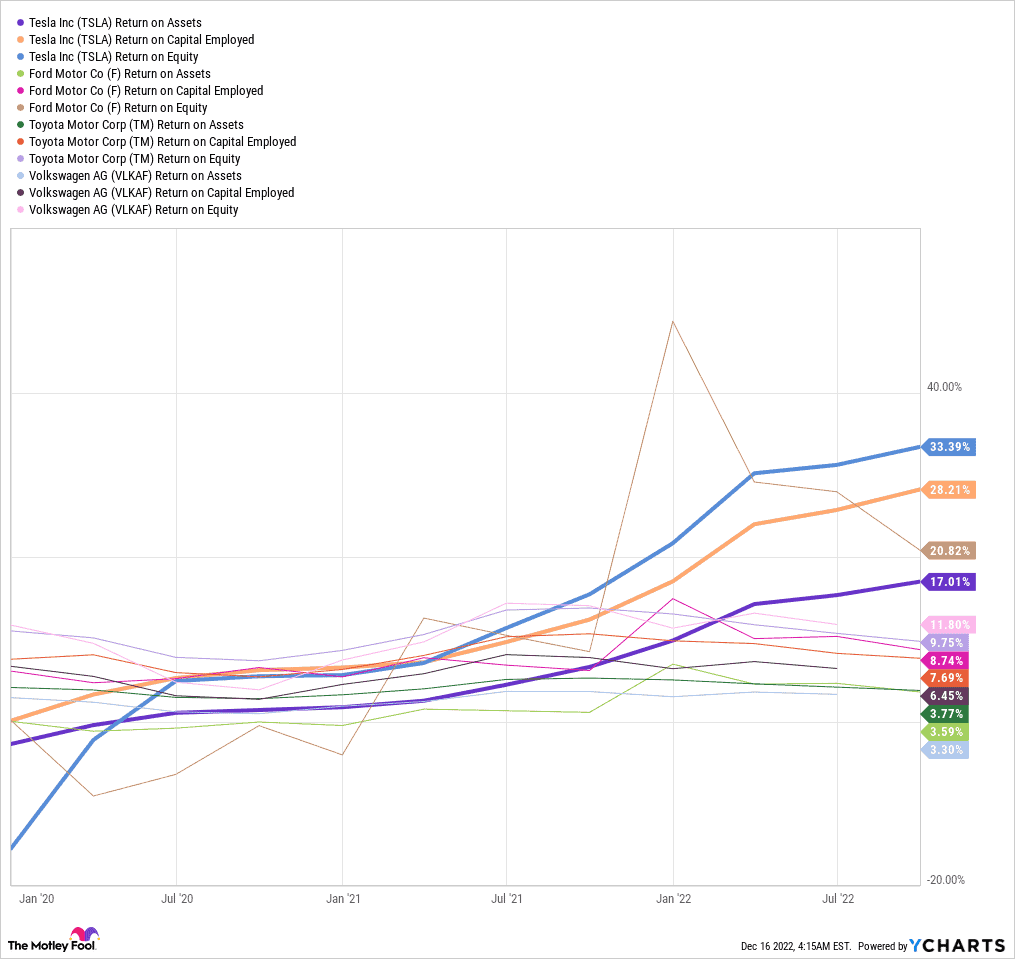

Tesla also has had an excellent track record of producing large returns for shareholders. Moreover, this has increased over the years. Looking at the company’s return on assets, equity, and capital employed, there’s clearly a distinction to be made. In fact, Elon Musk’s company outperforms many of its car peers by massive margins.

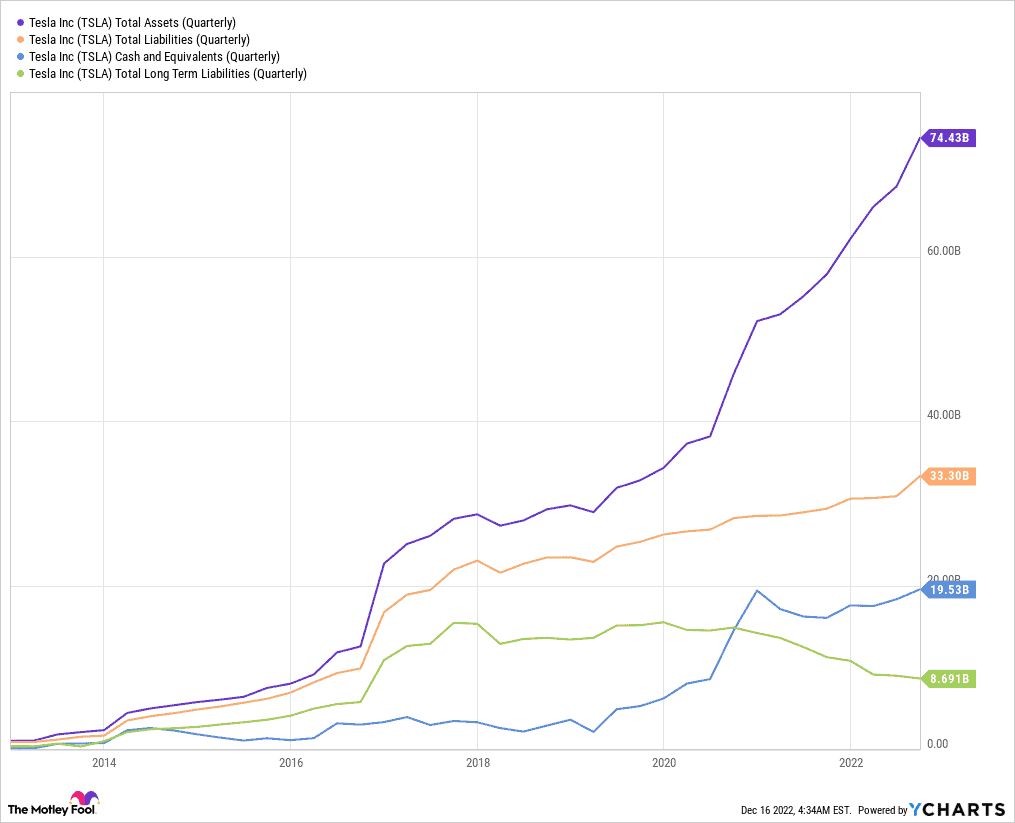

Pair this with its immaculate balance sheet and the stock looks even more attractive. With very little debt, the auto manufacturer has more than sufficient capital to weather a global recession.

What’s more, the conglomerate is continuing to grow its market share in the car market, which goes to show how well it’s doing despite the tough economic environment. In a world that’s becoming increasingly electric, Tesla is well positioned to capitalise.

Analysts rate the stock a ‘moderate buy’ with an average price target of $294. I’ll be looking to buy more of its shares when I’ve got more spare cash on hand.