Cineworld (LSE: CINE) shares have been on a rollercoaster ride this year. From losing 85% of their value in a matter of days, to a 200% spike, this is a stock that has piqued my interest. With rumours of a takeover from one of its rivals circulating, I’m wondering whether it’s worth buying some shares.

Horror show

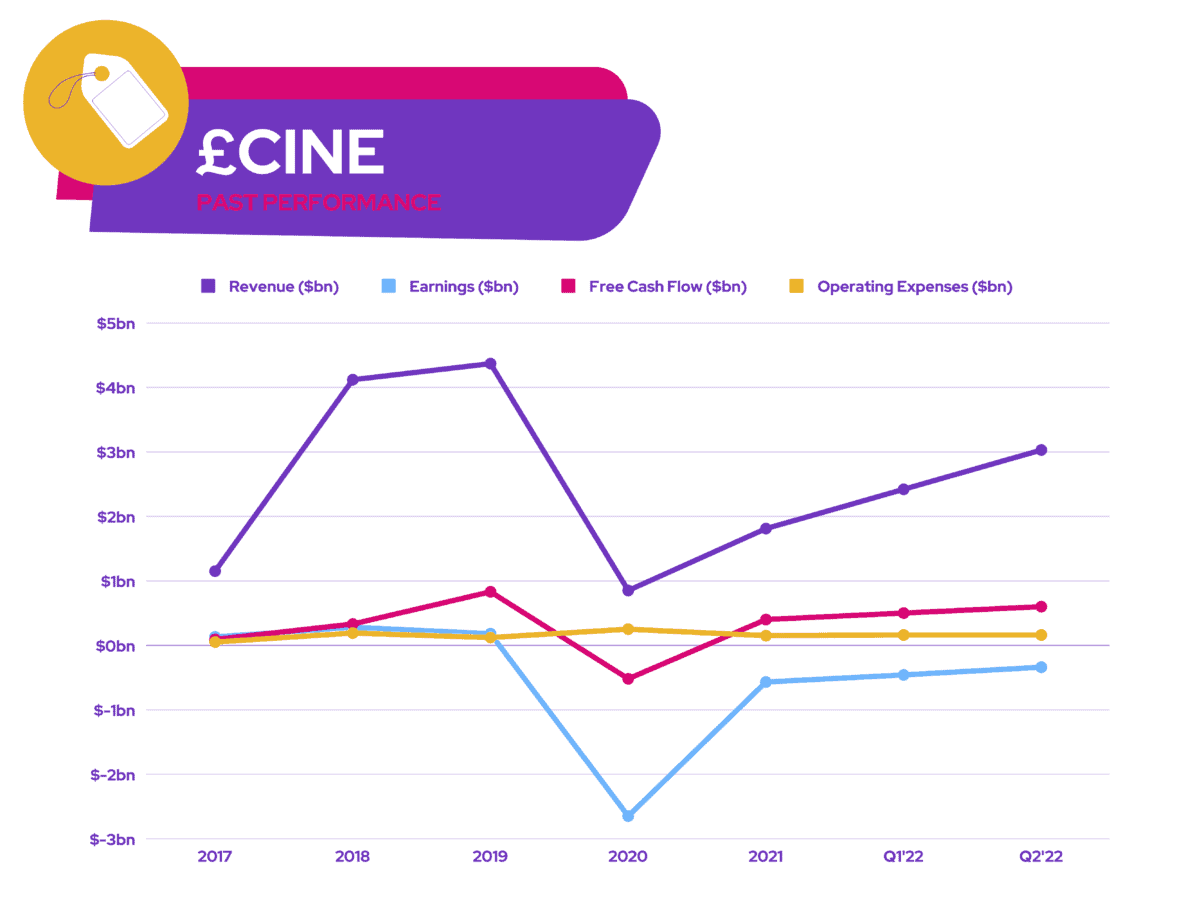

The cinema group filed for bankruptcy protection not too long ago. The big problem began when the pandemic hit, which caused the closure of cinemas. Consequently, its stock caved in from a lack of customers and an already torrid balance sheet. The shares went into free fall and are now a heart-wrenching 99% from their pre-pandemic high.

After the bankruptcy protection filing, the chain managed to come to a settlement with its landlords and lenders, which gave it leeway to borrow $150m and make a $1bn debt repayment.

Even so, it’s still in a precarious position with plenty of lawsuits and debtors on its tail. As part of its bankruptcy settlement, Cineworld also agreed to explore a potential sale, and allow its creditors to have a say in its business plans.

Not a pretty Vue

As a result, the UK’s third largest cinema, Vue has been rumoured to be mulling a takeover. The potential suitor currently trails behind Odeon and Cineworld with 91 venues and 870 screens. Therefore, a bid for Cineworld could be seen as an effort to consolidate the industry and expand its market share.

Nonetheless, not everyone at Vue will be on board with such a move. The company itself just went through a £1bn restructuring programme, and is exploring the possibility of going public in a couple of years’ time. Acquiring Cineworld would eat up more of its cash reserves, and may hinder its own prospects more than boost them.

A blockbuster move?

So, do I think Cineworld shares are worth me buying today? Well, given its shambolic collapse, there are plenty of reasons to steer clear.

But there’s the prospect of Vue swooping in and buying the group for a share premium. Depending on the size of the bid, shareholders could potentially see double or even triple-digit increases from its current share price.

On the flip side though, it’s hard to say whether a takeover bid will come through, and whether it would be competitive enough to push Cineworld’s share price up substantially. Not to mention, management said it intends to emerge from its current bankruptcy intact while maximising value for moviegoers and all other stakeholders. As such, it has no plans to approve a takeover.

Cineworld has not initiated, and does not intend to initiate, an individual auction for any of its US, UK, or rest of world businesses on an individual basis.

Cineworld

Ultimately, buying Cineworld stock on takeover rumours from Vue or any competitor would be a risky move, in my opinion. I believe Vue’s possible takeover ambitions are counter-productive, given its own financial woes. And of course, Cineworld has so many issues of its own. That’s why I see investing in Cineworld shares as a huge risk and one I’m not willing to take.