I believe investing in a Stocks and Shares ISA is the best way to create long-term wealth. It’s why I use any spare cash I have at the end of the month to buy UK and US shares in one of these tax-efficient wrappers.

I also have a Cash ISA. I use this to hold any money I’ll need for a big purchase, or to save money for a rainy day. But I don’t use this account to try and build wealth for when I retire.

Doing so could end up costing me a fortune in lost returns. And research from a leading financial services consultancy shows why.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

The path of poor returns

New data from Barnett Waddingham shows that Cash ISAs produced an average 0.63% rate of return in the 2020/2021 tax year.

This is a pretty dreadful return, in my opinion. Yet millions of people are using these low-paying accounts to save outside of their pensions (25% of Britons, according to the survey).

Putting money in a low-interest account is particularly dangerous right now too. Mark Futcher, head of defined contribution (DC) pensions at Barnett Waddingham, said that while cash accounts might feel safe, high inflation means “[your money] could be falling in ‘real terms’ by as much as 8% or 9%.”

The power of shares

Barnett Waddingham’s research actually suggests that a Stocks and Shares ISA could be a better way to create money for retirement.

Investing in shares is riskier than parking money in a savings account. Stock markets can go down as well as up, and a poor investment decision cause someone to lose some or all of their money.

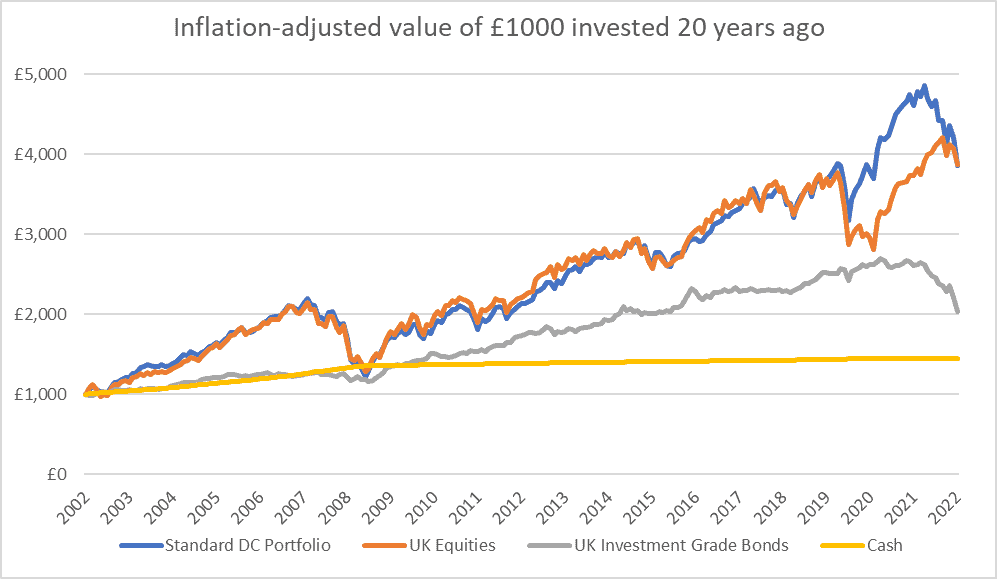

But history shows that stock investing is one of the most effective ways for Britons to build wealth. As Futcher notes: “UK equities have consistently outperformed cash over the last 20 years.”

He also adds that “equities are less ‘risky’ in the long term than the short term.” In effect, investors who buy and hold shares for several years or more can sidestep the volatility that often causes losses.

Life-changing wealth

History shows us that investing in UK shares creates an average annual return of 8%. That’s much better than what the best-paying Cash ISA currently pays (2.25% from Leeds Building Society, according to Moneysupermarket.com). And that sort of wealth can have a big impact on long-term wealth.

Someone who saved £300 a month in this Cash ISA for 30 years would have £151,903 to show by the end of it. That’s not bad and it’s also guaranteed. But that’s three times less than the £407,820 that the average UK share investor would likely have made over the same period.

Barnett Waddingham added that just 17% of people currently use a Stocks and Shares ISA. This suggests millions of people could be missing out on life-changing wealth. I don’t plan to be one of these.