Shares in Royal Mail owner IDS (LSE: IDS) have experienced an eye-watering decline this year, losing more than half their value. Nonetheless, this has propped up its dividend yield to a lucrative 7.1%. But here’s why even that could be in trouble.

Set on strikes

IDS’s latest half-year results didn’t paint a pretty picture. Both its top and bottom lines saw substantial declines with its Royal Mail business reporting a 200% drop in operating income. Therefore, the board now expects the FTSE 250 firm to be loss-making until approximately FY25.

IDS may even consider spinning off its GLS arm. The international branch was one the few silver linings in the company’s report as it saw revenue growth and brought in positive cash flow. In fact, GLS may very well have to do the heavy lifting for the foreseeable future.

| Metrics | Revenue | Operating income | Cash flow |

|---|---|---|---|

| Royal Mail | £3.65bn | -£219m | -£274m |

| GLS | £2.20bn | £162m | £131m |

To make matters worse, further strikes from workers are now expected go ahead during the festive season. This isn’t good news as Royal Mail enters its busiest period of the year. Management had initially offered a 9% pay rise over two years, but this was rebuffed by the Communication Workers Union (CWU). Given that the two parties are still a long way apart in finding a resolution, further strikes are to be expected. This would impact the conglomerate’s top and bottom lines substantially and present IDS shares with a strong headwind.

Crumbling cash flow

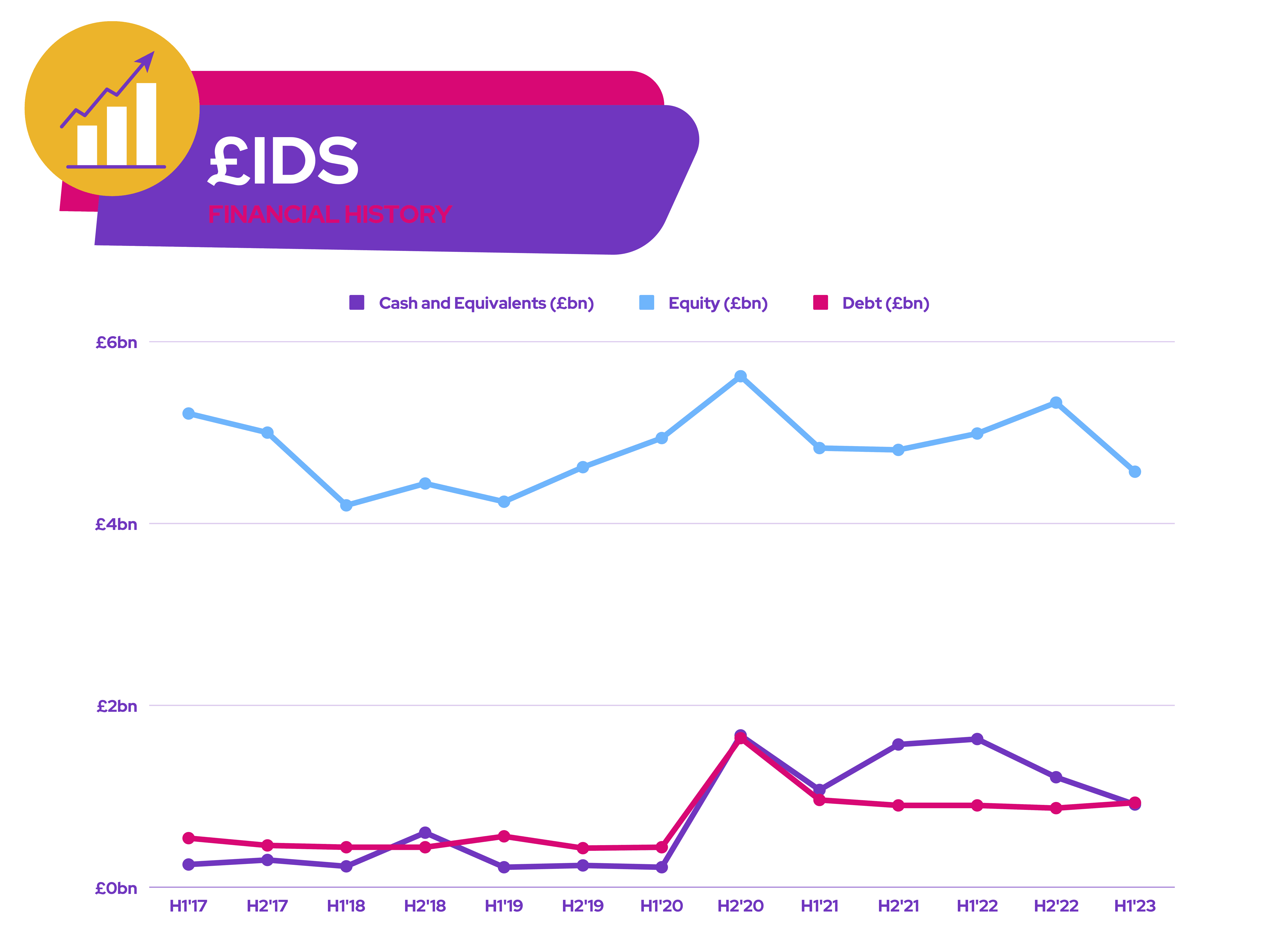

In ‘sunset’ industries where profits aren’t growing, it’s normal to see companies offer mega dividends to keep investors on board. However, this is a privilege that IDS can’t afford as it’s expecting its free cash flow to continue declining substantially.

| Metrics | H1 2023 | H1 2022 | Change |

|---|---|---|---|

| Free cash flow | -£195m | £260m | -175% |

| Net debt | -£1.47bn | -£0.54bn | -172% |

Although the current state of its balance sheet still looks reasonably healthy, it doesn’t have enough cash to cover its trailing dividend yield of 7.1%. Consequently, any dividend payouts will quickly turn its balance sheet into ruins, as its dividend cover currently stands at -2x. Moreover, the company is going to have to address its increasing debt pile.

Are IDS shares cheap?

There’s a case to be made that the stock is cheap, however. For instance, its price-to-earnings (P/E) ratio of 9 remains below the FTSE 100‘s average of 12. Plus, its price-to-book (P/B) ratio stands at 0.5. Nevertheless, these metrics should be taken with a pinch of salt. That’s because profits are expected to fall, which will most likely see the company’s book value decrease and P/E ratio drop into negative territory.

So, will I buy its stock? Well, with its debt set to increase, the cost of servicing that debt could also rise and would put further pressure on its bottom line. Furthermore, the volatility surrounding its delivery operations, along with the double-digit decline in parcel volumes, mean that its shares could experience further downside in the short term.

On the flip side, Berenberg has a ‘buy’ rating with a price target of £3.70, which could indicate upside potential from these levels. Even so, I’m more likely to agree with Liberum analyst Gerald Khoo. The broker has a ‘sell’ rating on the stock, citing that he remains “sceptical about management’s ability to successfully execute restructuring and reap the associated benefits”. As such, I’m not planning to buy IDS shares for my portfolio any time soon.