Pharmaceuticals stocks are usually highly popular when times get tough. Yet the GSK (LSE: GSK) share price has tumbled 30% during 2022.

This slump has caught my attention, as a long-term value investor. Severe share price volatility this year makes the company look like a top-value stock to buy.

Today GSK shares trade on a forward price-to-earnings growth (PEG) ratio of 0.5. Any reading below one shows that a stock is undervalued.

On top of this, the dividend yield here sits at 4.2% and 4.1% for 2022 and 2023, respectively. Both figures beat the 3.7% FTSE 100 average.

Testing trials

Demand for essential medicines remains broadly impervious to broader economic conditions. This is why City analysts think GSK’s earnings will rise 19% this year and 9% in 2023.

But buying pharmaceutical shares is still plagued with risk. Developing drugs is a complex business that can result in huge, unexpected costs, and can cost a fortune in lost revenues if product launches are delayed.

What’s more, even when a product leaves the lab bench, major problems can emerge. Just this week GSK withdrew US approval for its Blenrep blood cancer battler following a disappointing trial in which it failed to display “progression-free survival” for patients.

News of the trial failure sank GSK’s share price earlier this month.

3 reasons I’d buy GSK shares

But failures like this are (at least to date) overwhelmingly offset by the successes. This is why GSK is one of the world’s 10 largest drugmakers by sales.

Encouragingly for investors, GSK has a packed product pipeline too, which could supercharge profits over the coming decade if testing goes as planned.

The company had 65 vaccines and medicines at various stages of development as of September. Many of these are in fast-growing therapy areas like oncology and infectious disease as well.

Investors don’t have to wait for GSK to report ripping revenues growth, either.

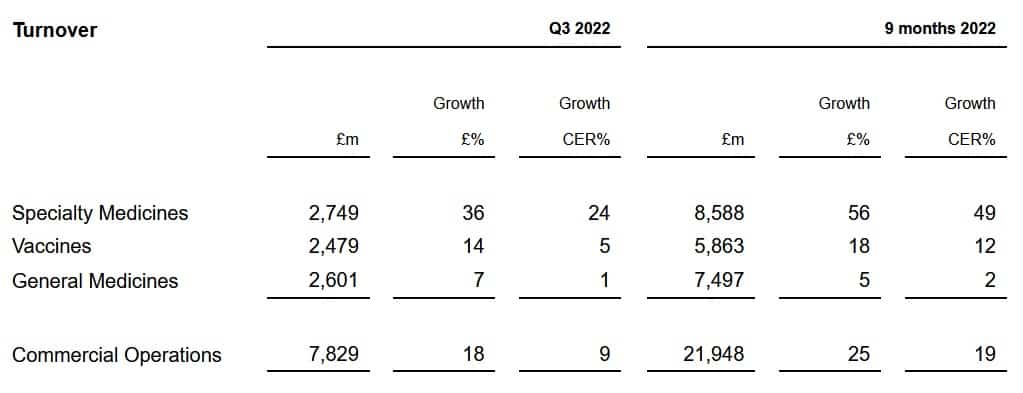

This month the company reported that third-quarter sales leapt 18% between July and September, to £7.8bn. This was thanks to record sales of its Shingrix shingles vaccine. In fact the business hiked its full-year forecasts following its sunny third quarter.

Positive sales momentum and a strong pipeline are two great reasons to buy GSK shares in my book. So is the company’s improving balance sheet.

It recorded strong free cash flow of £723m in quarter three and net debt dropped £3.7bn year on year (to £18.4bn). This gives the business more room to invest for growth as well as to pay good dividends to its shareholders.

The verdict

As I say, GSK’s share price has fallen heavily in 2022. The divestment of its Haleon consumer healthcare division earlier this year has weighed on investor appetite. So have worries over lawsuits related to its Zantac heartburn treatment in the US.

I see this as an excellent dip-buying opportunity. On balance the drugs company looks good to deliver strong profits growth over the next decade at least. And so I expect its share price to soar from current levels.