Shareholders of IAG (LSE: IAG) who bought its stock when it was below £1 must be happy, having gained more than 30%. It makes me wonder whether I should join their ranks. Yet the remarkable recovery also comes with a few caveats that I need to note. So, here are four key catalysts that could impact the IAG share price moving forward.

1. China

The company’s Achilles heel on its way to a full recovery seems to be Asia, more specifically China. Due to the ongoing zero-Covid policy, travel to and from the country has been limited. The recent uptick in cases and lockdowns haven’t helped sentiment.

Nevertheless, I feel the China situation has already been priced in to the current share price. The resumption of flights to Hong Kong and Japan should pull Asian travel figures up. But with China’s unwillingness to fully open its borders, Asia’s recovery is expected to take a while. Still, this is something to keep a close eye on given that a reversal in government policy could further boost the IAG share price.

| Passengers carried | Q3 2022 | Q3 2019 | Change vs 2019 |

|---|---|---|---|

| Domestic (UK & Spain) | 7.71m | 8.07m | -4.4% |

| Europe | 15.97m | 19.00m | -15.9% |

| North America | 3.14m | 3.57m | -11.9% |

| Latin America & Caribbean | 1.37m | 1.69m | -18.7% |

| Africa & Middle East | 1.26m | 1.59m | -20.4% |

| Asia & Pacific | 0.08m | 0.66m | -88.4% |

2. Jet fuel

The FTSE 100 firm is decently hedged in fuel for the rest of the year, at 68%. Despite that, it still remains vulnerable going into next year with only approximately 47% of its fuel costs hedged so far. This could hurt its improving bottom line.

Therefore, recent drops in crude oil have certainly been welcome. Having said that, the disparity between crude and jet fuel still remains large, with prices still remaining at elevated levels. This is because higher diesel margins disincentivise refiners to produce more jet fuel. As such, more downward pressure on oil prices could benefit IAG’s earnings estimates and give a boost to its stock price.

3. Heathrow

While the rebound in travel demand continues to remain strong, customer numbers are still lagging pre-pandemic levels by 12%. Yet CEO Luis Gallego expects passenger capacity to hit 95% of 2019 levels by Q1.

However, IAG’s recovery is still at the mercy of its main hub, Heathrow Airport. Having had a tumultuous time with passenger caps over the summer due to staffing issues, Europe’s biggest airport has since lifted the cap. Even so, a reversal on this could negatively impact IAG and is something to keep note of.

4. Guidance

Most important, however, is whether the British Airways owner can beat its guidance going into the festive season. In its Q3 earnings report, the board gave a very positive outlook for the quarter and year ahead. If IAG manages to beat the forecast in Q4, it could further elevate its stock from current levels.

| Metrics | FY22 outlook |

|---|---|

| Pre-exceptional operating profit | €1.1bn |

| Operating cash flow | “Significantly positive” |

| Total capacity | 78% of 2019 levels |

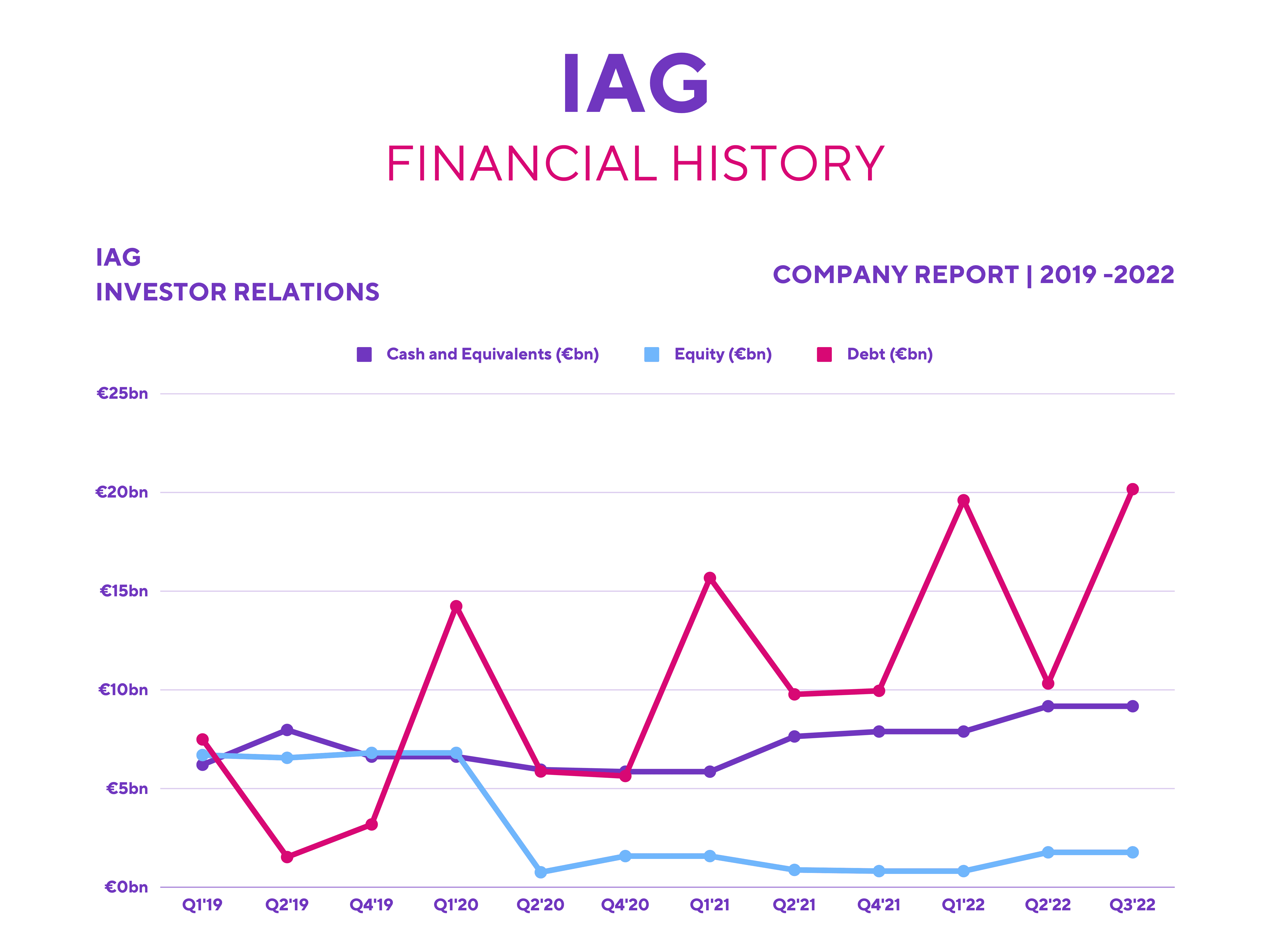

So, are IAG shares investable for me? Well, hindsight says yes given the impressive gains it’s made since its one-year lows. However, I place great store by companies’ balance sheets, and IAG’s isn’t looking particularly great with its high debt.

Additionally, I believe that the upside potential for IAG remains restricted for the medium term as macroeconomic conditions continue to worsen. This is presumably why a number of brokers from Deutsche, JP Morgan, and Berenberg still rate the stock a ‘hold’. For that reason, I’ll be putting IAG shares on my watchlist for the time being, and may invest when there’s more clarity with better financials.