Shares in UK housebuilders have had a rough time this year. Taylor Wimpey (LSE: TW) shares have been no exception, with its stock down more than 40%. Nonetheless, a decline in its share price has presented an attractive dividend yield of 9%, which could mean a buying opportunity for my portfolio.

Interest declines

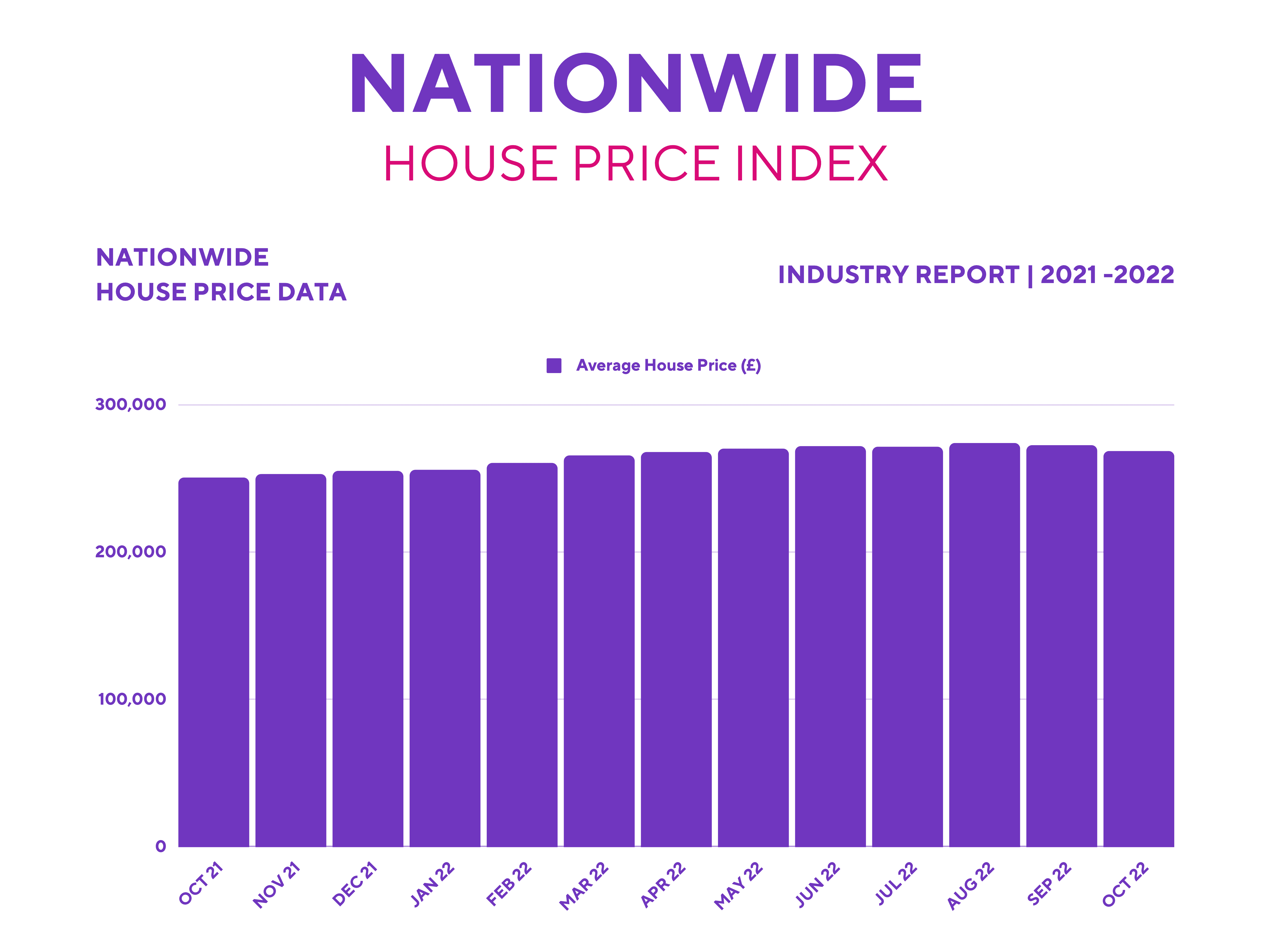

Interest in houses has substantially declined this year. This can be attributed to the rise in the average mortgage rate, which has hit 5.42% this month, a 13-year high. Consequently, house prices have stalled, causing the Taylor Wimpey share price to drop. Investors are wary that the company’s top and bottom lines will be severely impacted from a possible housing market crash, which could impact its dividend payouts too.

However, these fears were rebuffed by management in its latest trading update, at least for now. The board even reaffirmed its outlook for the year of delivering an operating profit of approximately £920m and 14,000 homes.

Having said that, the builder still saw an increase in cancellations this quarter, along with a lower sales rate and smaller order book.

| Housebuilders/Metrics | Taylor Wimpey | Persimmon | Barratt | Bellway |

|---|---|---|---|---|

| Cancellation rate | 24% | 28% | 8% | 14% |

| Net sales rate per outlet | 0.51 | 0.60 | 0.55 | 0.55 |

| Order book change | -10% | -67% | -5% | -1% |

Thin walls

Taylor Wimpey hasn’t seen as much deterioration in customer demand as Persimmon, but the rate is higher than at Barratt and Bellway. These two are yet to report their results and since their last updates, a lot has happened. So, cancellation rates may have ticked up for them as well.

Nevertheless, it’s worth noting that Taylor Wimpey has a wide regional exposure to the UK housing market. As such, it may not provide the developer with much protection if the housing market collapses unlike, say, Berkeley that’s more insulated due to its exposure to the south, where house prices are more resilient.

| Regions | Percentage of land plots |

|---|---|

| Central & South West | 27.1% |

| Scotland, North East, North Yorkshire | 22.9% |

| Midlands & Wales | 20.8% |

| London & South East | 17.3% |

| North West & Yorkshire | 11.9% |

Insulated dividend?

That being the case, can Taylor Wimpey still afford to pay its share of dividends? Well, in contrast to Persimmon, the company is yet to rebase its dividend. With an operating margin of 20% and a healthy debt-to-equity ratio of 2%, CFO Chris Carney assured investors on its earnings call that the firm’s dividend is sufficiently covered by its assets, even in an unfavourable market.

Be that as it may, Lloyds, the UK’s biggest mortgage provider, is expecting house prices to fall by around 8% by 2023. This could detrimentally impact Taylor Wimpey’s cash flow, and as a consequence, its dividend. Yet Barclays and HSBC aren’t as pessimistic. They’re forecasting house prices to grow slightly. Given the two contrary signals, it can make investing in Taylor Wimpey shares uncertain.

But I think the worst case scenario for the housebuilder has already been priced in. Its shares are currently trading at a forward price-to-earnings (P/E) ratio of 5, which is below its long-term average of 10. Therefore, buying its stock now presents limited downside risks and could allow me to secure a high dividend payout in the near term, while potentially capitalising on a housing market rebound in the long term. After all, Deutsche recently reiterated its ‘buy’ rating for the stock with a price target of £1.15. For those reasons, I’ll be looking to open a position soon.