Investing in property could be a good idea in these turbulent times. I’ve chosen to do so by buying UK real estate stocks in my Stocks and Shares ISA.

The dependable rental incomes such shares receive provide excellent earnings visibility during good times and bad. This gives them the financial clout and the confidence to pay big dividends year after year.

Property companies are also able to effectively raise rents to offset rising cost pressures. With domestic inflation sitting around 40-year highs this benefit is worth its weight in gold.

My 2023 plans

In 2022 I added care home operator Target Healthcare REIT to my ISA. Rapidly-ageing Western populations means this is a fast-growing market. And under real estate investment trust (REIT) rules, this business has to pay 90% of annual profits out by way of dividends.

I also own Tritax Big Box REIT and US share GXO Logistics in my portfolio. I’m expecting demand for their warehouses and distribution assets to soar as e-commerce steadily expands.

In 2023, I’m looking to buy more dividend-paying property stocks too. Further stock market volatility is possible as the global economy veers towards recession. So making decent returns through share price gains might be unlikely.

I’m looking to boost my dividend income to get around this and build wealth. And in particular, I’m seeking to build my exposure to the residential property market.

Going residential

| Company | 2023 Dividend Yield |

| Residential Secure Income | 5.7% |

| The PRS REIT | 4.5% |

REIT shares The PRS REIT and Residential Secure Income are two dividend stocks on my radar today. The residential property market is especially robust during good times and bad. This provides me with protection in what promises to be another tough year the economy.

What’s more, right now, rents are soaring across most parts of the country, boosting profits (and thus dividends) at shares like those mentioned above.

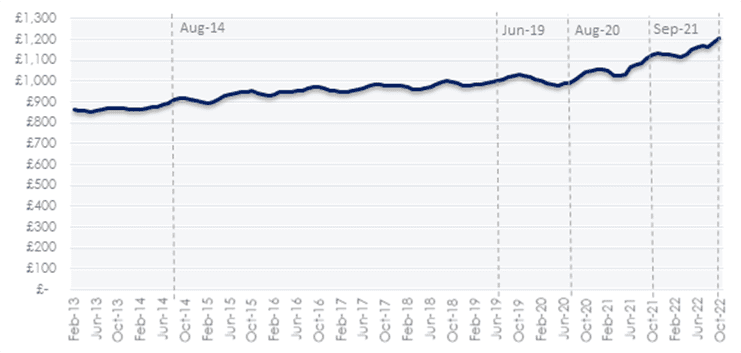

Average rents on newly-let homes have soared through £1,200 per month for the first time, according to Hamptons International. The estate agent says prices hit £1,204 in October, up a whopping 7.1% month on month.

Why not buy-to-let?

Investors in residential property stocks don’t have a say in which rental assets to own. This is unlike buy-to-let where there is total control. I can choose for example to buy a rental property in an area of particularly-high rental growth. And this can enhance my long-term returns.

However, I still believe buying residential property stocks is a better option that buy-to-let. Increased regulations, rising costs and higher tax has reduced buy-to-let returns here significantly in recent years. This is why the number of private landlords selling up has exploded, worsening the property supply shortage.

It’s my opinion that this shortage will continue too, driven by population growth and weak housebuilding rates. So I’ll be looking to buy shares like The PRS REIT in 2023 and to hold them for years. I think they’ll be a great source of long-term dividend income.