At the moment, Microsoft (NASDAQ:MSFT) stock is changing hands for around $221 per share. That price is 36% below the stock’s November 2021 all-time high price of $343. Is this an opportunity for me to invest in Microsoft?

Looking at the performance of Microsoft stock, which is right around a 52-week low, I might assume that something has gone wrong with the underlying business. But that is not the case.

Microsoft is growing more profitable

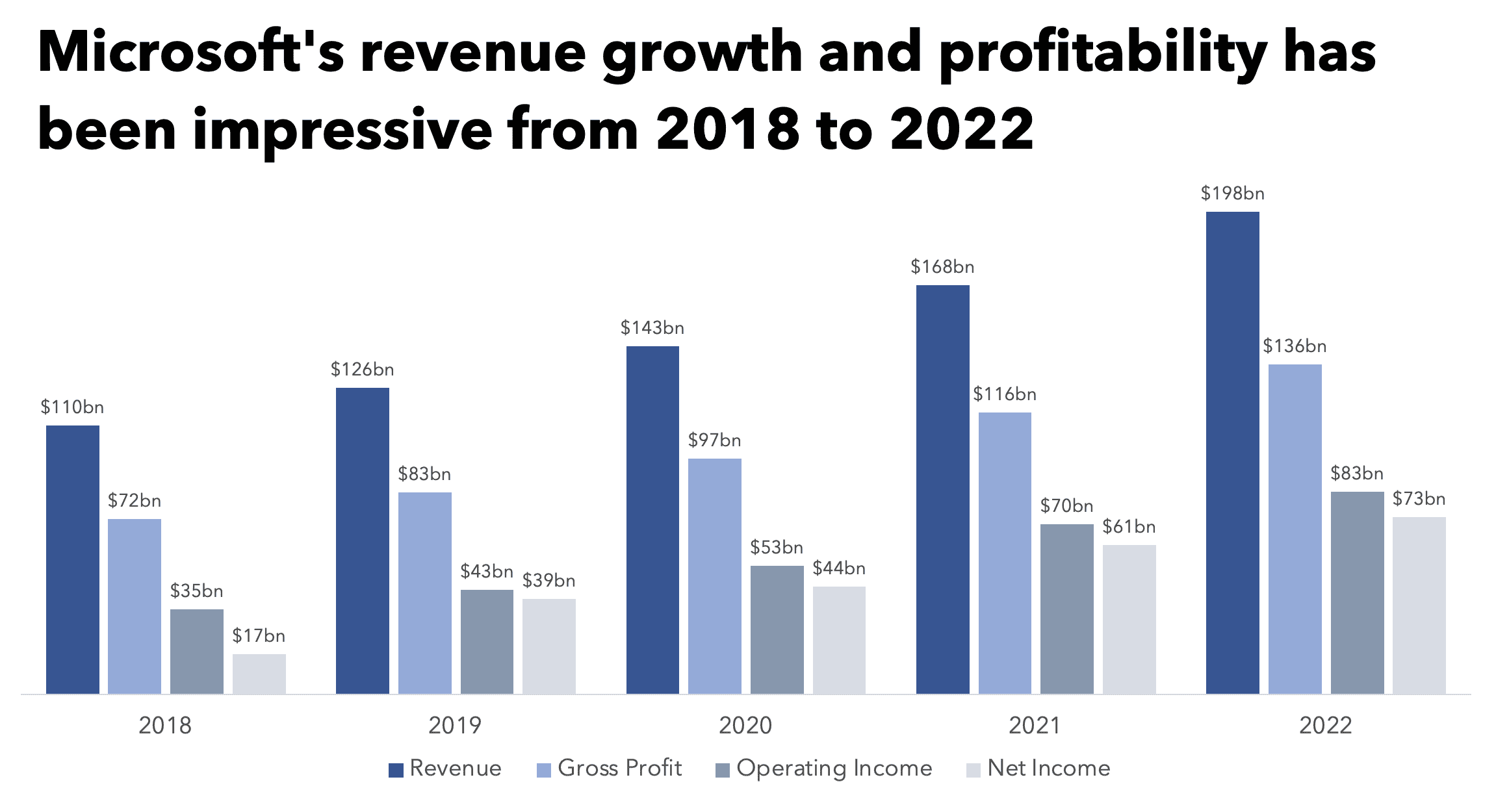

Microsoft’s revenue increased from $110bn in 2018 to $198bn in 2022. It grew by 16% on average each year. At the same time, gross margins improved from 65% to 68%. Operating margins at Microsoft were 32% in 2018, and in 2022, they hit 42%. The most impressive performance was in net income margins, which increased from 15% to 37% between 2018 and 2022. It’s worth pointing out that Microsoft’s fiscal year ends in June, so these year-end 2022 numbers are four months old.

Even at nearly half a century old — Microsoft was founded in 1976 — this company is growing faster than most. It is still making improvements to its operating efficiency and return on equity. Why has its share price taken such a battering over the last year if its results over the previous five years look good?

The Big Five tech stocks

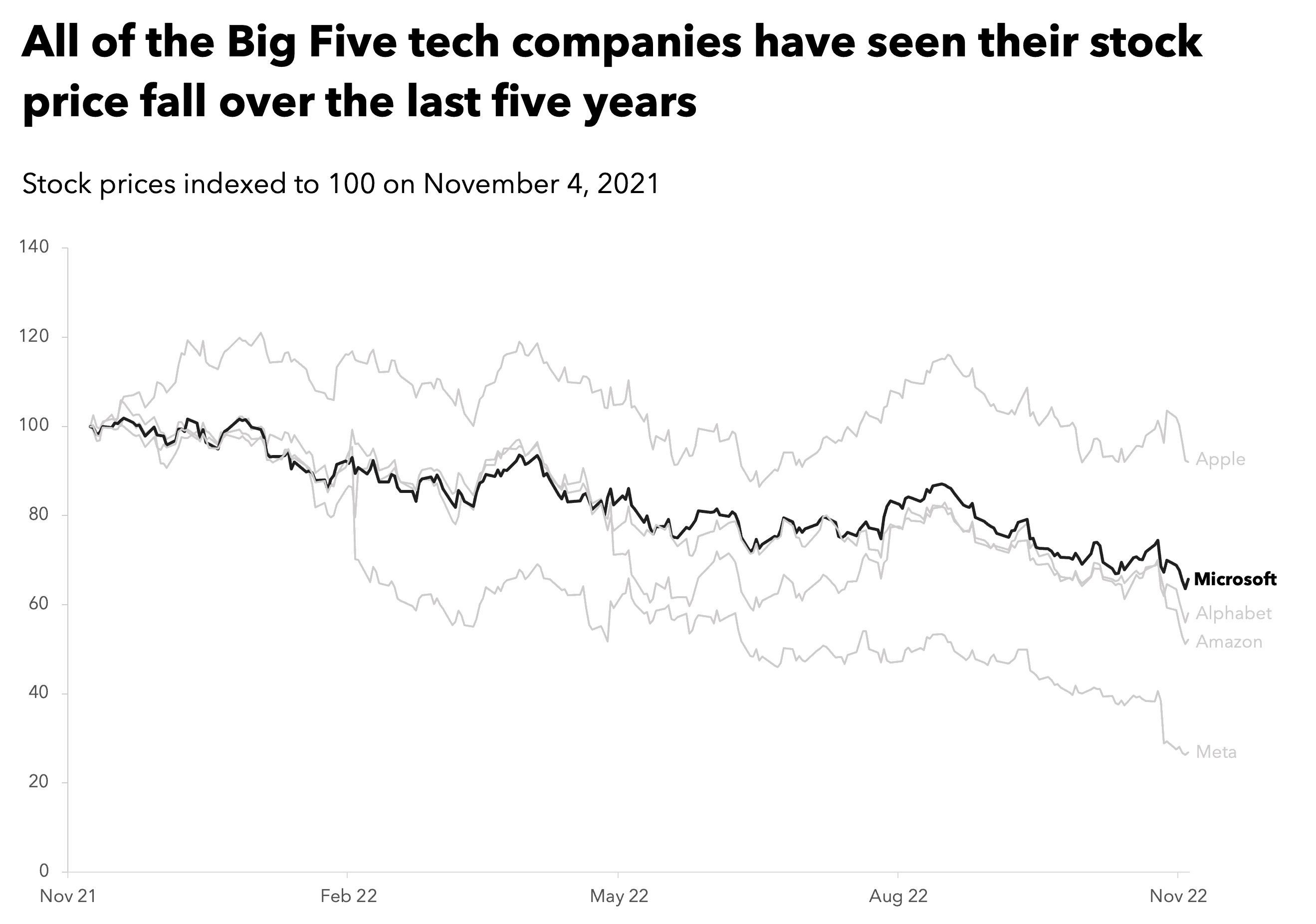

Microsoft is one of the “Big Five” information technology companies alongside Amazon, Apple, Facebook owner Meta, and Alphabet, Google’s parent company. During the post-pandemic bull run, all five stocks rapidly hit all-time highs. Over the last year, all five have started to give back some of those gains as the shift to online working started to reverse, interest rates began rising, and inflation kicked in.

It’s probably the case that the Microsoft stock price got driven beyond what its five-year performance could justify. So, some price decline could be expected as the tech stocks’ exuberance abated. But, looking at Microsoft’s quarterly results suggests that it’s not just the market dragging it down.

Should I buy Microsoft stock?

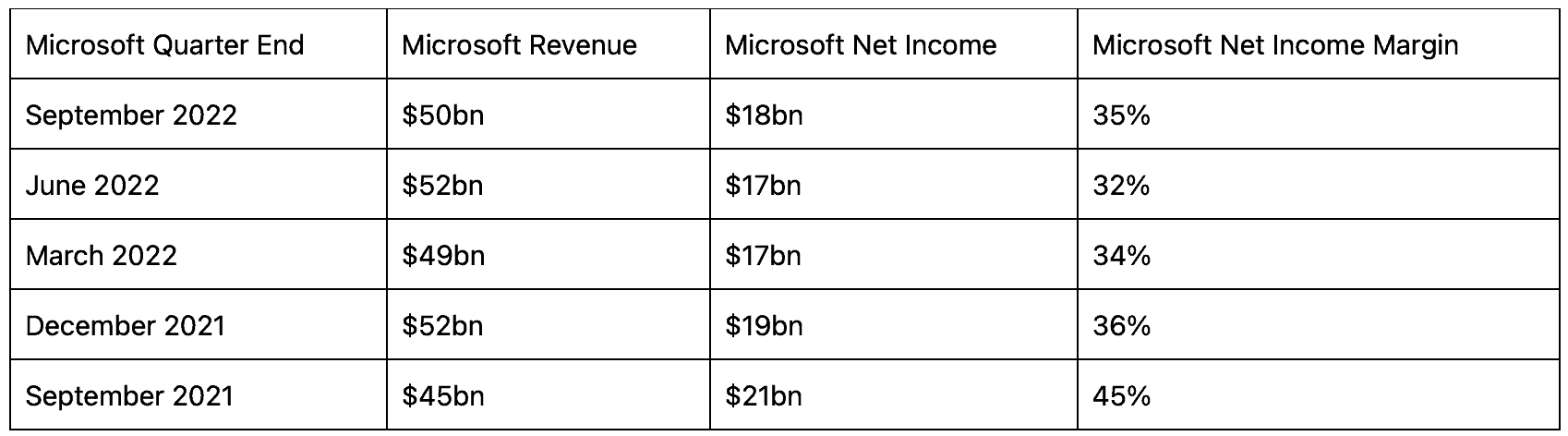

Microsoft’s revenue for the latest quarter (September 2022, Q1 2023) was around $5bn higher year on year. That bodes well for full-year revenue. But, the company has warned that revenue growth in its cloud computing division — its main growth engine — is slowing.

Furthermore, quarterly net income margins have been shrinking. That might be partly explained by data centres becoming more costly to run as energy gets more expensive.

I am not surprised by the slowing cloud computing revenues if the base for comparison is a work-from-home lockdown world, nor by the shrinking margins. And in the long term, I think Microsoft looks like a solid bet. It is established in cloud computing, and Its Xbox ecosystem exposes it to the growing video games industry.

Its suite of productivity software, including Excel and Word, is the de facto choice for businesses and consumers worldwide given their PCs probably run on Windows. Microsoft does has a big weakness in mobile phones, which are dominated by Apple and Google’s operating systems, although its apps are available on all operating systems.

In the short term, I think Microsoft is adjusting to the post-pandemic world. I will not invest in Microsoft stock in my Stocks and Shares ISA, but I do want to watch this stock and see how things develop.