Rolls-Royce (LSE: RR) shares last saw the £1 mark in late February. Nonetheless, the group continues to innovate its offerings outside of its core business area. So, could new ventures and innovations help lift the Rolls-Royce share price back up to higher levels?

Tailwinds not dissipating

Rolls-Royce earns the bulk of its income from its Civil Aerospace division. Therefore, it’s expected to continue benefiting from the rebound in travel demand. Longer flying hours for airlines and private jets should greatly benefit the company’s top line.

The likes of Delta, United Airlines, and American Airlines have reported no slowdown in long-haul international travel thus far, and IAG is expected to report the same when it unveils its Q3 results later this week.

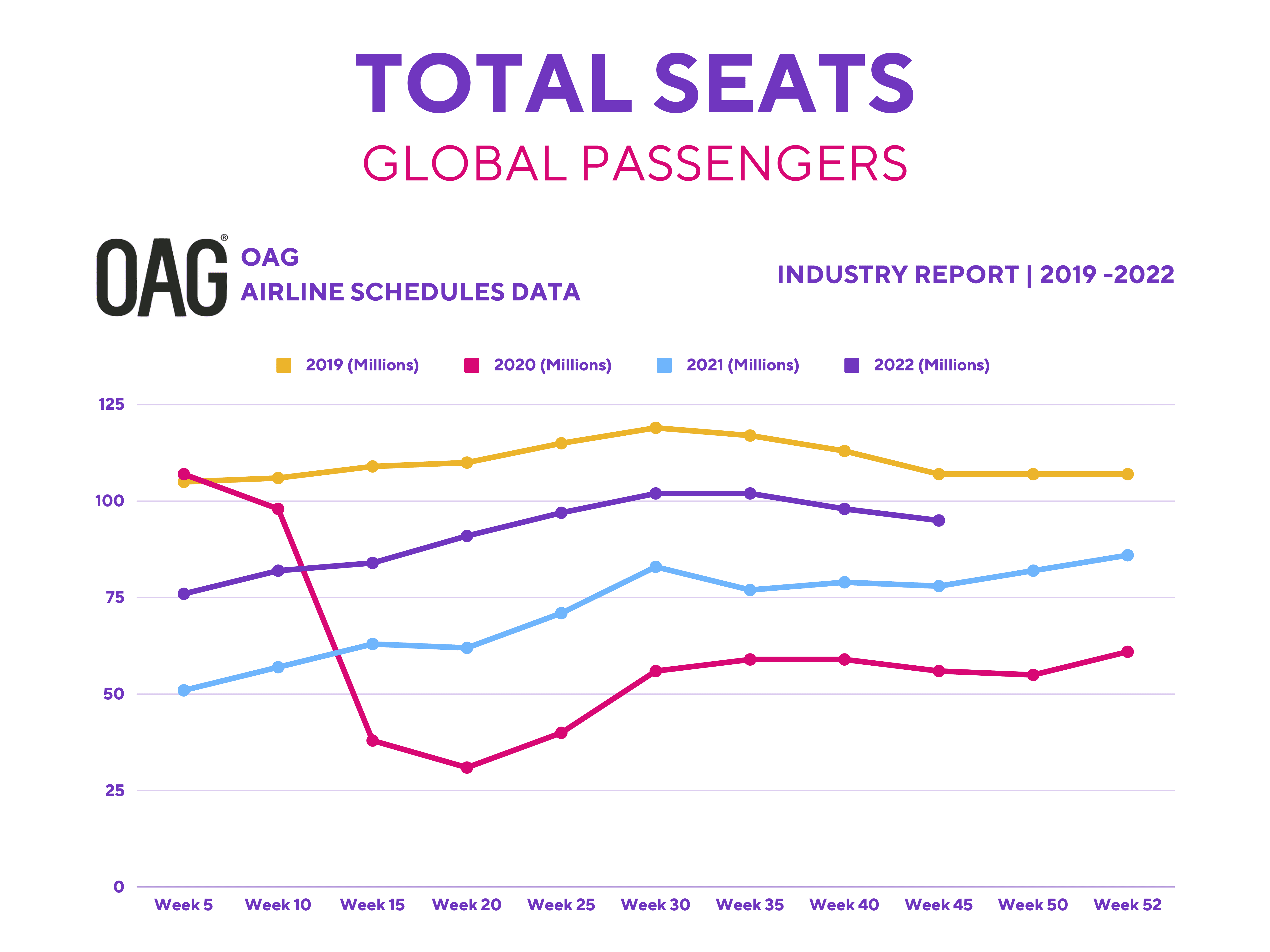

As such, it’s a bit of a head-scratcher to see the Rolls-Royce share price drop down to 70p from £1. This is especially the case when considering passenger seat numbers. These have increased by approximately 15% since the end of February. Thus, I’m expecting Rolls-Royce’s top line to continue recovering when it reports its Q3 results next month.

Energised for innovation

Nevertheless, it’s the firm’s Power Systems division that excites me. In its half-year results, the branch saw an impressive 20% growth year on year. Building on this, I believe that there are a number of key breakthroughs that could spark a fundamental improvement to Rolls-Royce’s earnings potential.

The biggest would be its ambitious plans to build Small Modular Reactors (SMR). Given the importance surrounding energy independence in light of the Russia-Ukraine conflict, these nuclear SMRs could be groundbreaking and bag massive profits, if successful.

Additionally, Rolls-Royce recently shared a number of interesting developments. The British firm has been successfully implementing its MTU engines and technologies for its naval clients. Moreover, it’s developing a line of sustainable fuels for aircraft and yachts. Consequently, Rolls-Royce signed an agreement with easyJet to pioneer the development of hydrogen combustion engine technology.

Sky’s not the limit for now

With all that in mind, will I be buying Rolls-Royce shares for its potential? Well, the conglomerate is leading the charge in the clean energy space with its radical innovations. Admittedly, these do excite me as I believe the upside potential for the stock could be incalculable, if successful.

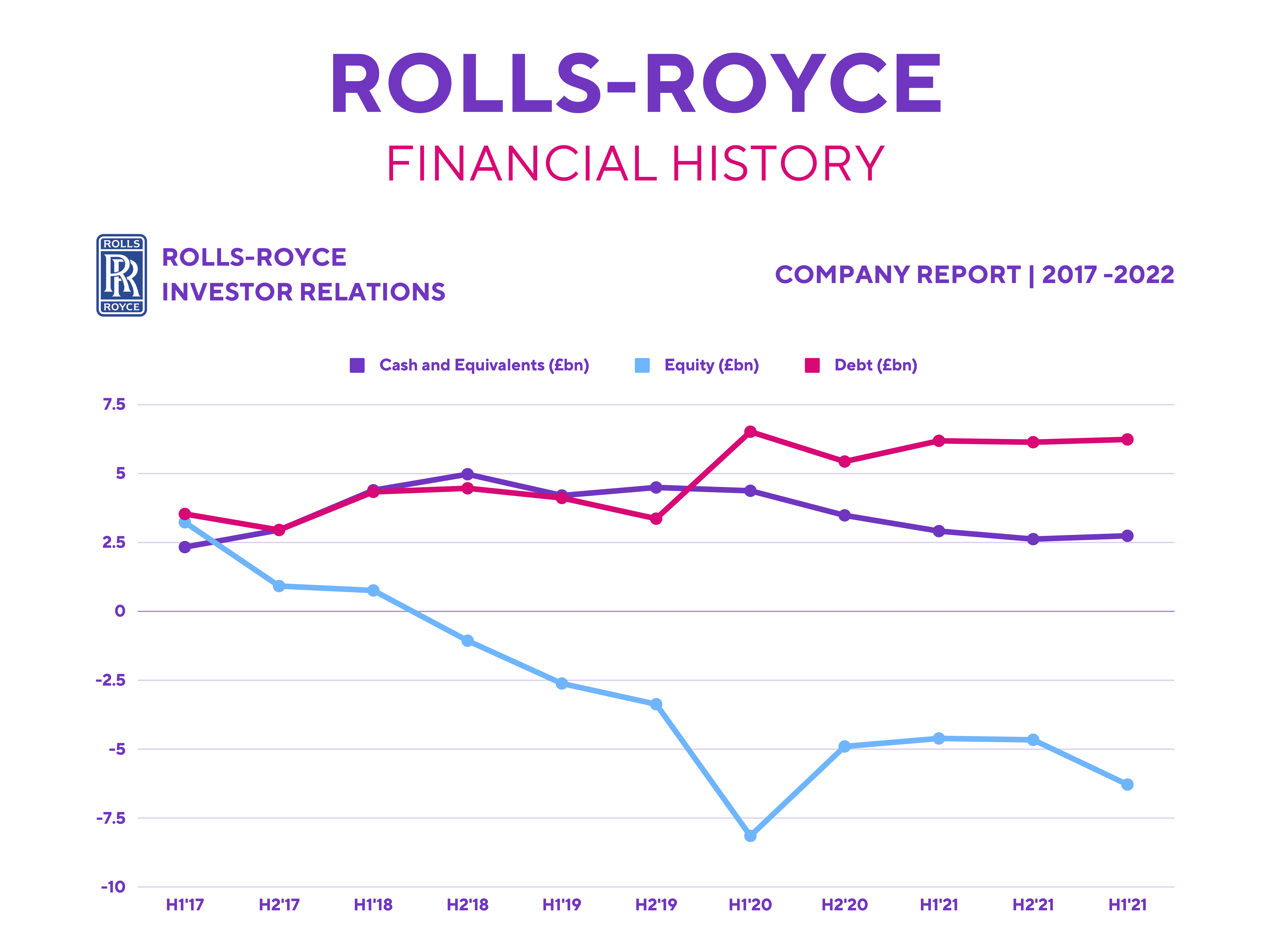

But even so, I still can’t turn a blind eye to the state of its balance sheet. With negative shareholders’ equity and a staggering pile of debt, Rolls-Royce is going to struggle to fund all of its promising ventures if its financials don’t improve drastically.

The recent sale of ITP Aero worth €1.8bn should help shore up its finances slightly. However, management will still have to hope that free cash flow continues to improve at a steady pace, or risks missing its debt repayments in the near future.

Having said all that, as much as I’m a big fan of the manufacturer’s visions, I won’t be investing in Rolls-Royce shares today due to the state of its finances. Not to mention, brokers from JP Morgan and Deutsche have an average price target of 75p for the stock, which doesn’t present much upside from the stock’s current price.