I’m searching for the best dividend stocks to buy on a budget. Here are two on my shopping list today.

Home comforts

I believe real estate investment trusts (or REITs) are great ways to build long-term passive income.

They must pay dividends on a minimum of 90% of their annual profits, according to regulations.

The regular rental incomes they receive give them the ammunition to pay out reliable dividends, too. This is critical for those seeking a dependable second income.

The PRS REIT (LSE: PRSR) is one such share I’m considering buying as residential rents soar. The property stock builds and rents out family homes across the UK. And it is expanding its portfolio to make the most of strong market conditions.

The business is looking to build its portfolio from 4,786 homes as of June to 5,600.

Revenues at PRS rocketed 58% in the 12 months to June, a result that drove pre-tax profit 163% higher.

I’m expecting the company’s profits to continue soaring as Britain’s shortage of rental homes worsens. A massive 227,000 new rental homes are needed each year to meet demand, says consultancy Capital Economics.

I’m concerned about the impact of rising construction costs on the REIT’s profits. But I believe that the potential rewards of owning this property share overwhelmingly outweigh this risk.

Today PRS carries a decent 4.8% forward dividend yield. It also trades on a corresponding price-to-earnings growth (PEG) ratio of 0.5. Stocks with readings below 1 are considered undervalued.

9.4% dividend yield!

I’m also considering buying Glencore (LSE: GLEN) shares to boost my long-term dividend income.

The FTSE 100 mining stock faces extreme near-term uncertainty as the global economy cools. The prices of the raw materials it produces and trades might sink if demand slumps.

Pleasingly, however, the projected dividend for 2022 is well covered by anticipated earnings. So even if Glencore earns less than brokers expect there’s a wide margin of safety for investors.

Dividend coverage sits at 2.9 times for this year. A figure of above 2 times is the target for share pickers.

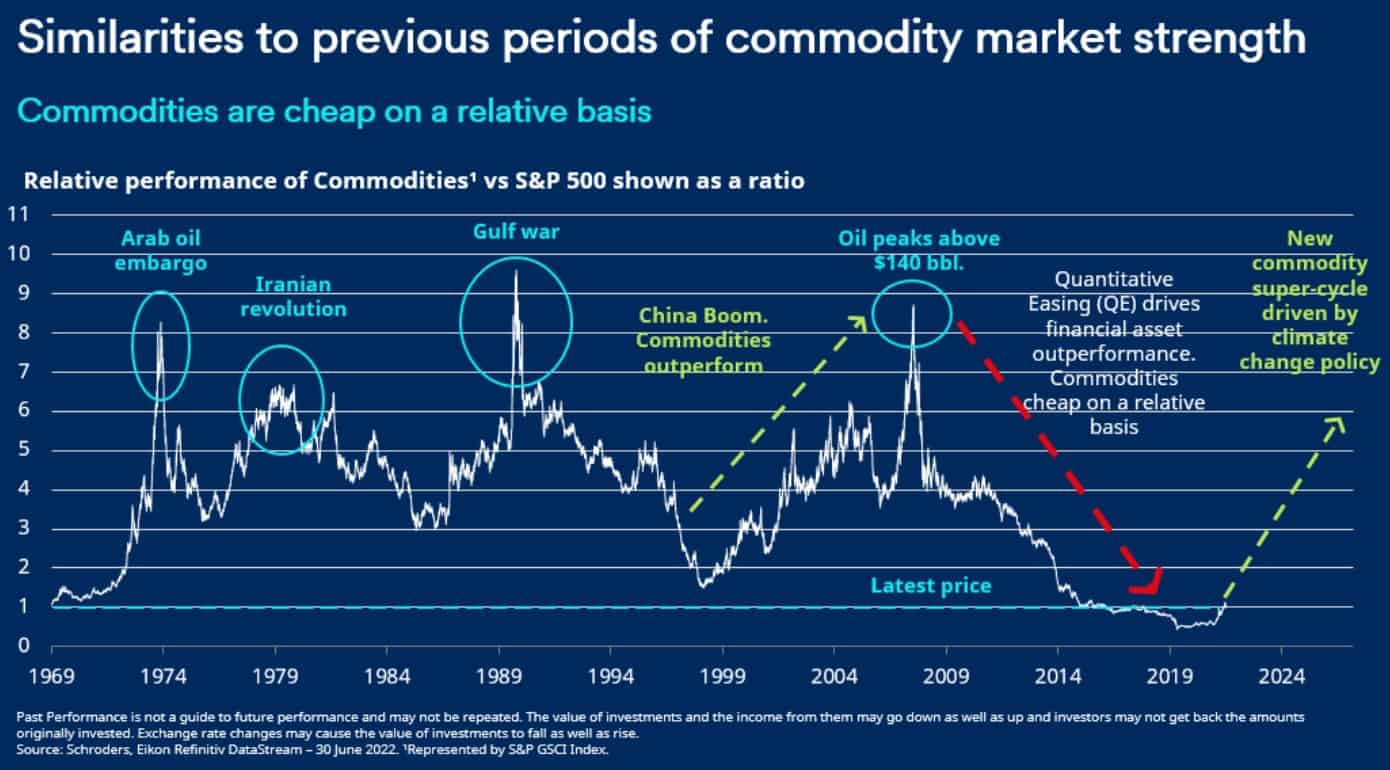

As a long-term investor, I’m more interested in what dividends Glencore will provide beyond 2022. And it’s my opinion that the future is bright as the next ‘commodities supercycle’ drives profits.

Physical consumption of raw materials looks set to soar on the back of trends like rising urbanisation in emerging markets and huge global investment in green technologies.

A decline in the US dollar is also expected to boost commodity demand. This will essentially make it cheaper to buy dollar-denominated assets. There’s also the fact that commodities look dirt-cheap right now.

Glencore’s current share price carries a 9.4% dividend yield. It also trades on a price-to-earnings (P/E) ratio of just 3.7 times.

This all-round value makes it — like the PRS REIT — a top stock to boost passive income.