We encourage a buy-and-hold approach to the stock market here at the Fool UK. It’s not simple to find quality companies with excellent prospects and buy them at an attractive price, but when such an opportunity presents itself, I’ll take it. I’ll hold stocks for years, even decades, assuming their fundamentals don’t change for the worse.

Volatility brings opportunities. It tends to rise when the markets are heading down more often than when they’re heading up. Declining markets tend to be volatile so, it’s at these times when I should be on the lookout for bargains.

But such times usually mean existing holdings are taking a hit. It’s hard not to react when a stock’s price is being dragged down by sour market sentiment even if, operationally, the company behind the stock seems to be doing okay. There’s are tensions linked to a buy-and-hold approach. Bargains are more likely to be found in volatile markets. But existing portfolios, constructed presumably of previously purchased bargains, will suffer during volatile times. Not selling the things that are probably declining in value but instead buying more of the same type of thing takes discipline and courage.

Is the stock market volatile right now?

Is today’s stock market volatile? Of course, it is — what a silly question! It’s all over the news. But, rather than letting the media narrative guide me, I prefer to do my own research.

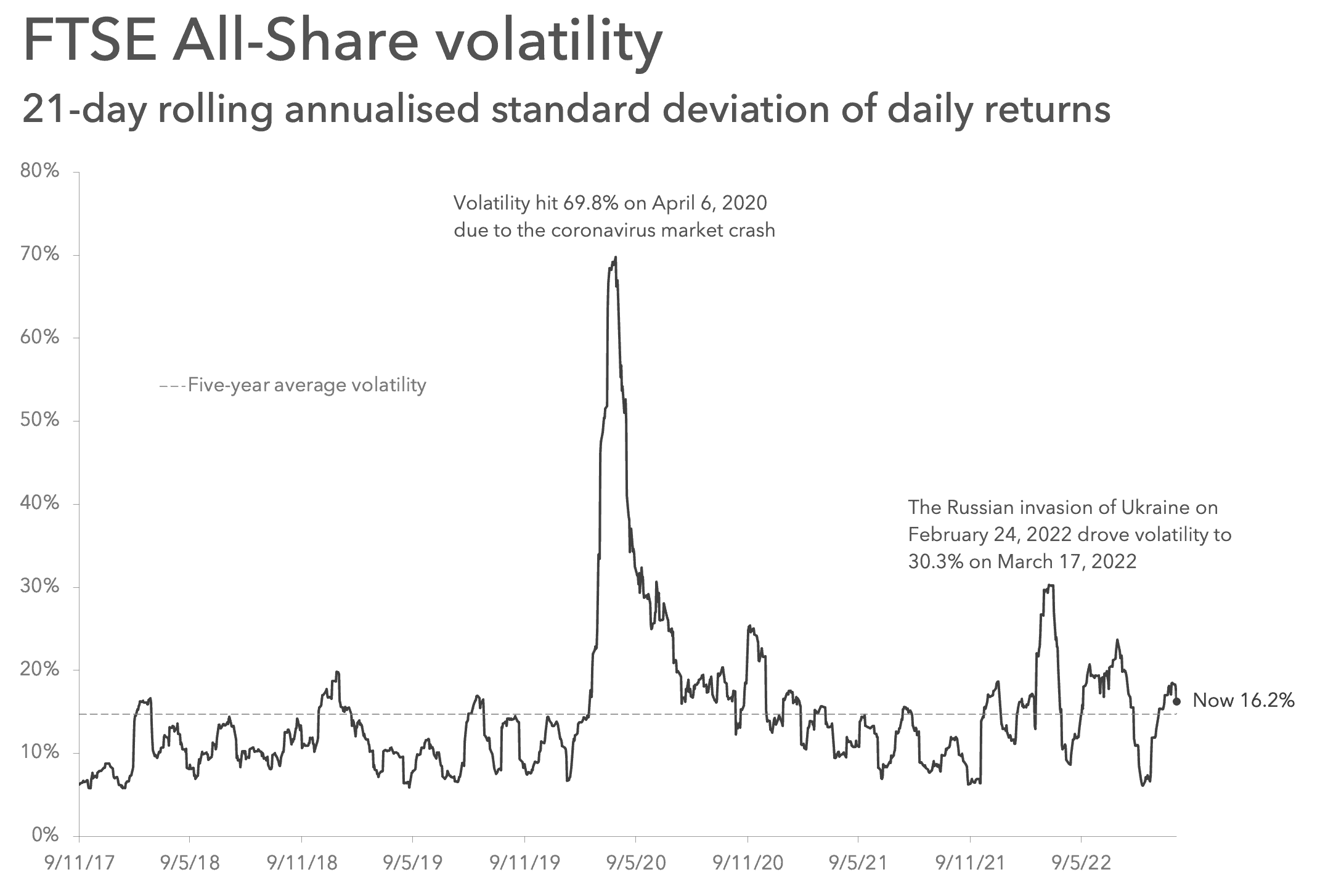

On a 21-day annualised basis, the volatility of the FTSE All-Share is 16.2% right now. The average for the last five years is 14.1%. So, the FTSE All-Share is just about showing above-average turbulence at the moment. And volatility has increased from a recent low point.

The ups and downs of the market have been above average for much of 2022. The stock market was relatively calm in 2021. This contrast makes today’s situation seem extreme. However, it’s worth pointing out that volatility right now is nowhere near the 69.8% seen during the coronavirus market crash in 2020.

What I’m doing

Refusing to be guided by the news cycle is one step to dealing with times like these. As the exercise above demonstrates, an investor might be led to believe that right now, the stock market is more turbulent than ever. It’s not. But there can be no denying that 2022 has been disappointing. So, what do I do in such times?

I stick rather than twist. I don’t rush to sell shares in companies that I think will do well in the long term, even if their prices are sliding. Most market participants are bad at timing markets. Look at the disclaimer on any trading platform — it will say that most retail traders lose money.

Since I have no reason to believe I can successfully ‘time’ markets, I invest consistently in what I believe are quality companies with funds I don’t need for three-to-five years when volatility is both high and low. For example, I’ve recently added to my positions in GSK and Vistry. I buy at high and low prices over time, which should average out over the long term. And if I buy quality stocks and build a diversified portfolio, the return on my investment over time should be good.