Google’s parent company, Alphabet (NASDAQ: GOOGL) is synonymous with excellent returns. It’s been able to outperform the S&P 500 on almost every time horizon. So, how much would I have now if I’d invested £1,000 in Alphabet stock five years ago?

Alphabet Class A vs Class C Stock

Like many other companies, it possesses different types of stock. It makes both its Class A and Class C stocks available to trade on the public stock market. So, what distinguishes one from the other?

Well, the two stocks actually trade at separate price levels. However, they trade in tandem with each other and usually aren’t more than 1% apart. The main distinction though, is that Alphabet Class A stock holds voting rights and an ownership stake of the company, while Class C stock just gives shareholders the latter. It’s for that reason that I opted to purchase the conglomerate’s Class A stock.

Therefore, if I’d invested in Class A stock five years ago, I’d have a return of 94%. Meanwhile, I’d have a return of 99% if I’d invested in Class C stock. This is what it would translate to in real income, inclusive of exchange rates and excluding broker fees and capital gains tax.

| Stock/Metrics | Class A | Class C |

|---|---|---|

| Amount invested | £1,000 | £1,000 |

| Post-conversion to USD | $1,319.50 | $1,319.50 |

| Growth | 93.61% | 98.67% |

| 5-year return | $2554.68 | $2621.45 |

| Post-conversion to GBP | £2,304.32 | £2,364.55 |

As we can see, although the growth of Alphabet stock was approximately 95%, investing over five years ago would have more than doubled my investment. That’s because of the impact of a weak pound and strong dollar today. If we’re to compare this to the performance of the US’s three main indexes, Alphabet still outperforms by quite some margin.

| Index/Metrics | Dow Jones | S&P 500 | Nasdaq |

|---|---|---|---|

| Amount invested | £1,000 | £1,000 | £1,000 |

| Post-conversion to USD | $1,319.50 | $1,319.50 | $1,319.50 |

| Growth | 27.72% | 40.10% | 57.70% |

| 5-year return | $1,685.27 | $1,848.62 | $2,080.85 |

| Post-conversion to GBP | £1,520.11 | £1,667.46 | £1,876.93 |

Stay invested?

What about the future then? Well, given the sector the Nasdaq-listed company operates in, technology remains a key driver for the future of society. As such, I expect Alphabet stock to continue growing in the coming years.

The tech firm will be reporting its Q3 results later this month, which is a key event I’ll be paying close attention to. That being said, the stock has been performing rather poorly this year. This is due to bear market conditions as a result of high inflation and rising interest rates, sparking fears of a recession. Nonetheless, here are its earnings estimates going into its Q3 earnings release.

| Metrics | Amount (Q3 2021) | Earnings estimates (Q3 2022) |

|---|---|---|

| Total revenue | $65.12bn | $70.92bn |

| Diluted earnings per share (EPS) | $1.40 | $1.27 |

Stocking up

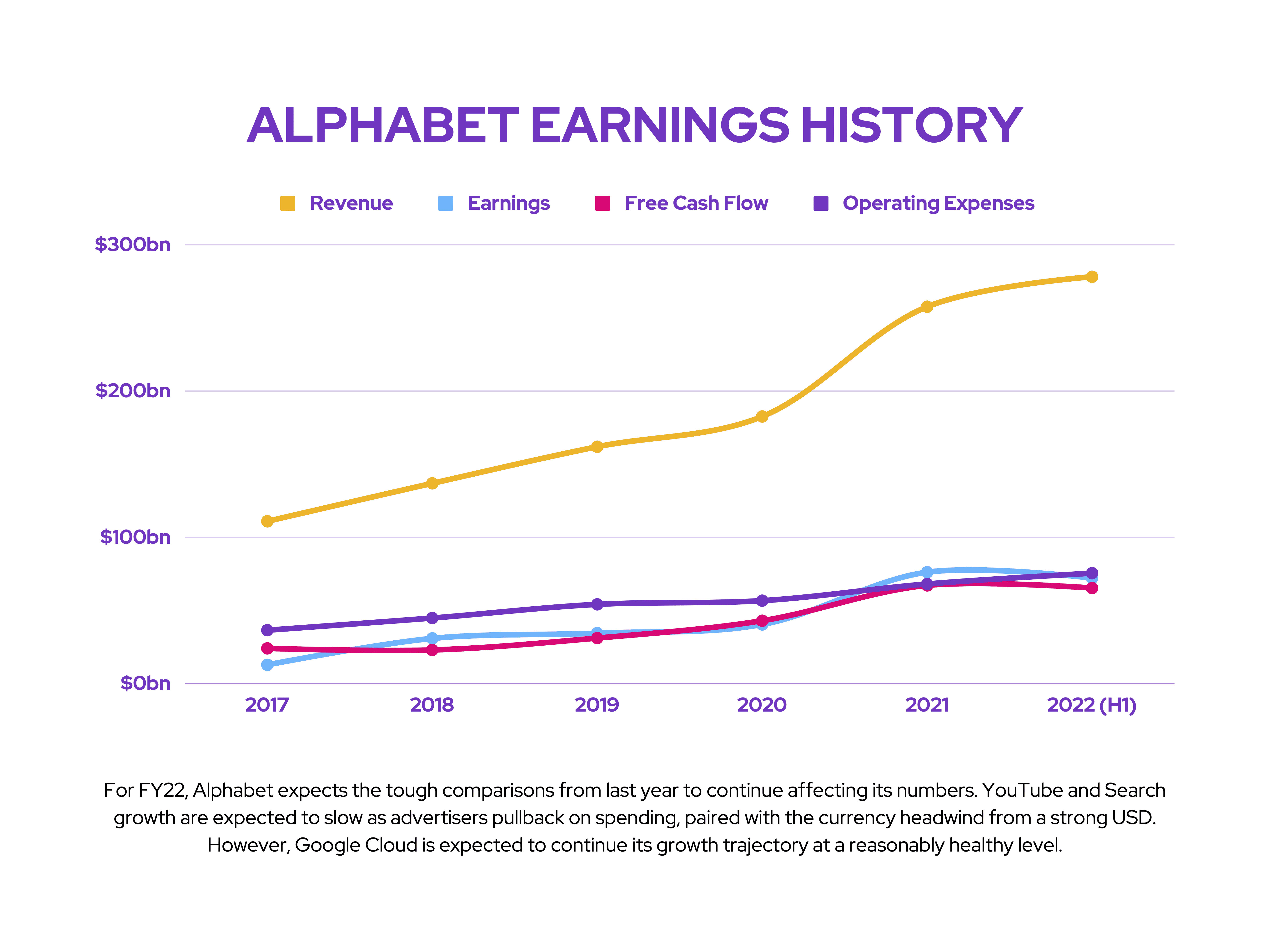

Having said that, will I continue to buy Alphabet stock? Well, for starters, the tech company has an immaculate balance sheet, with a stellar debt-to-equity ratio of 5%. Not to mention, the firm has an excellent history of growing its top and bottom lines, as well as maximising its return on equity (28.2% vs the wider industry’s 7%). Additionally, its healthy profit margin of 25.9% just goes to show that Alphabet is capable of churning out quality earnings, even in times of difficulty.

Although past performance is no indicator for future returns, the company has a lot going for it. Being the world’s go-to home for search and video, while having an arsenal of growth prospects in cloud, autonomous driving, and AI, Alphabet has attributes of both a defensive and growth stock. It’s for those reasons that I’ll be using the current bear market as an opportunity to hopefully continue growing my wealth by purchasing more Alphabet stock.