Surely the Card Factory (LSE: CARD) share price can only be heading down? It’s a bricks-and-mortar focused card retailer. Surely the days of taping a couple of pound coins inside a birthday card and popping it in a postbox are in decline?

To my surprise, greetings cards seem far from dead. According to entreptneur.com, millennials spend more on cards than any other generation, including baby boomers. Despite their reputation for being digital savvy, millennials are apt to turn to something a little more personal and tangible when the moment matters.

Millennials like cards

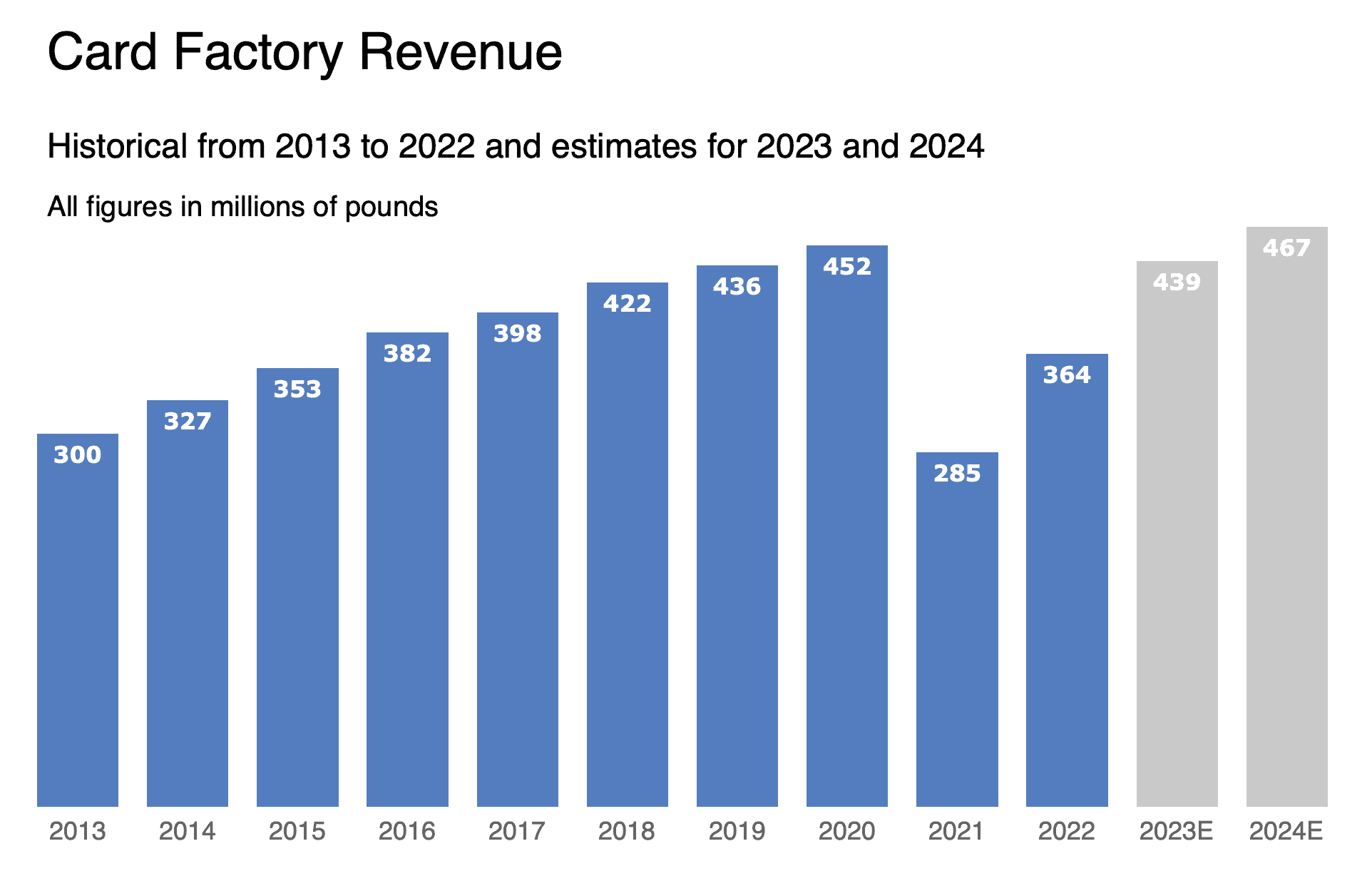

Card Factory’s revenue numbers are in keeping with a market that is in good health, with some obvious caveats. From 2013 to 2020, total sales rose from £300m to £452m. There was a lockdown-induced slump to £285m in 2021. But 2022 revenues hit £364m, and analysts forecast 2024 revenues at £464m, surpassing the pre-pandemic peak.

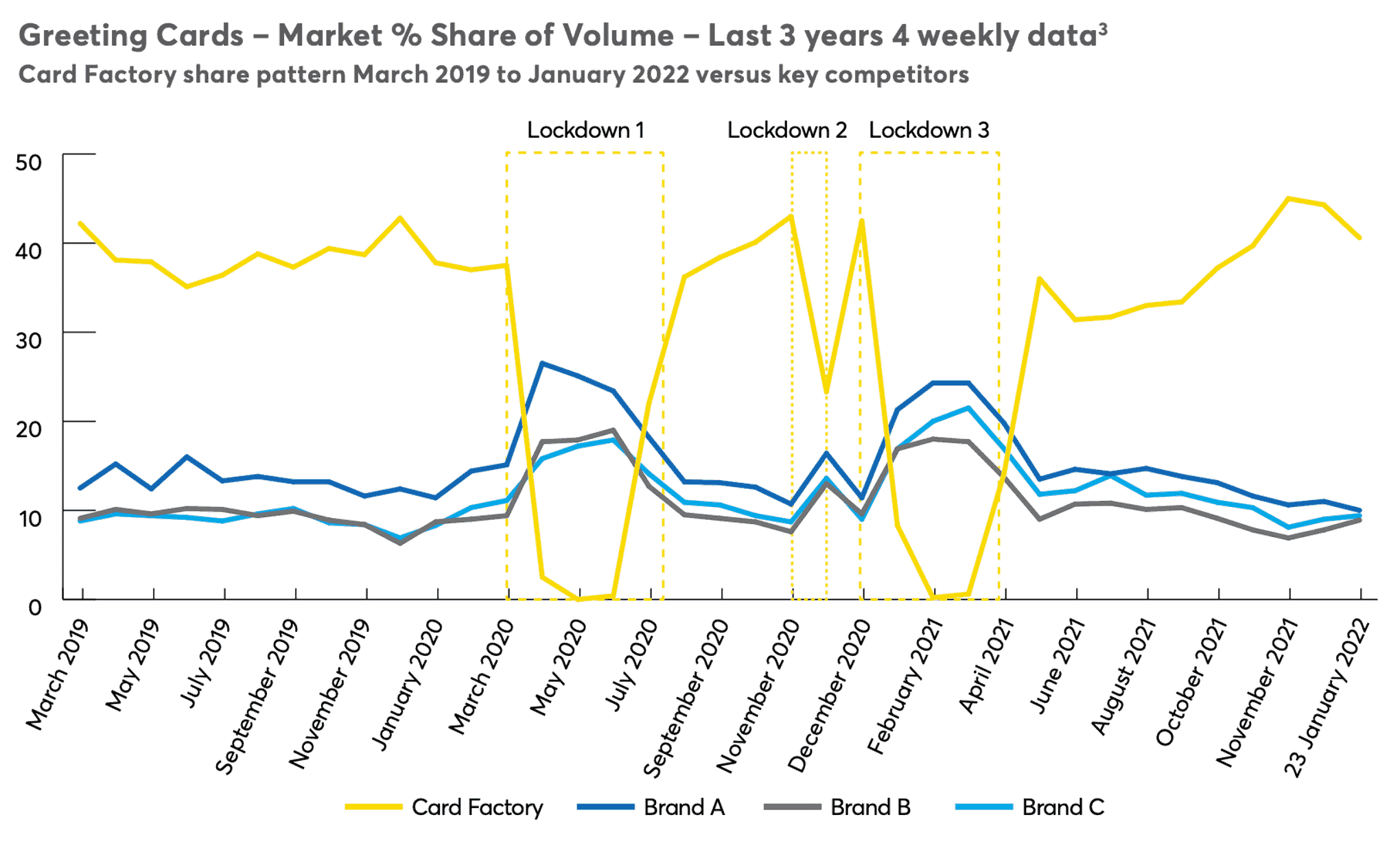

Card Factory’s volume share of the UK greetings card market hovered around 40% before the pandemic. The lockdowns meant Card Factory lost a chunk of volume market share. However, on each occasion, it bounced back. This pattern is evidence of a brick-and-mortar focus as online-focused competitors were able to scoop up market share when shoppers could not take to the streets.

The average price of a greeting card sold online is £2.50, compared to the £1.50 in a store. Perhaps that’s because online cards tend to be customised, which adds value. Card Factory does offer online orders and shipping on its website. It also has the online-only Getting Personal brand, which caters to the customised online greeting and gift card market. However, this is a small business, averaging about 3.5% of total revenues.

Card Factory management focuses on volume market share rather than value. That’s because it is a discount retailer. Its value-based market share of the greetings card market averaged 18% from 2013 to 2017.

Card Factory share price

So would I buy shares in Card Factory for my Stocks and Shares ISA? Well, I would not mind exposure to a market liked by a generation starting to enter its peak spending power. Aside from a few pandemic blips, it has maintained a healthy market share and grown its revenues. The company’s cash flow per share usually exceeds earnings per share (EPS). That’s usually a good sign, and it’s cheap, trading at a P/E ratio of 5.6.

But Card Factory is a discount retailer with limited traction online. This shows in its operating margins. They declined from 22% in 2017 to 16.3% in 2020. Then the pandemic hit, and they now sit around 11.6% over the last 12 months. I am concerned that Card Factory is involved in a price war. Yes, its revenues are growing, but its normalised (stripped of extraordinary or one-off items) EPS was 20.1p in 2017, yet analysts expect them to be 8.56p in 2024.

The Card Factory share price will likely follow earnings and operating efficiency trends more than revenue. So I won’t buy until I feel confident Card Factory is not in a discounted race to the bottom.