Credit Suisse (NYSE: CS) stock has plummeted by more than 50% this year and has hit an all-time low. Rumours of a potential collapse have been making headline news. As such, investors are worried whether this will lead to a global financial crisis. So, here’s everything that’s happening to Credit Suisse and whether fears of a collapse might be wide of the mark.

A Lehmann restructuring

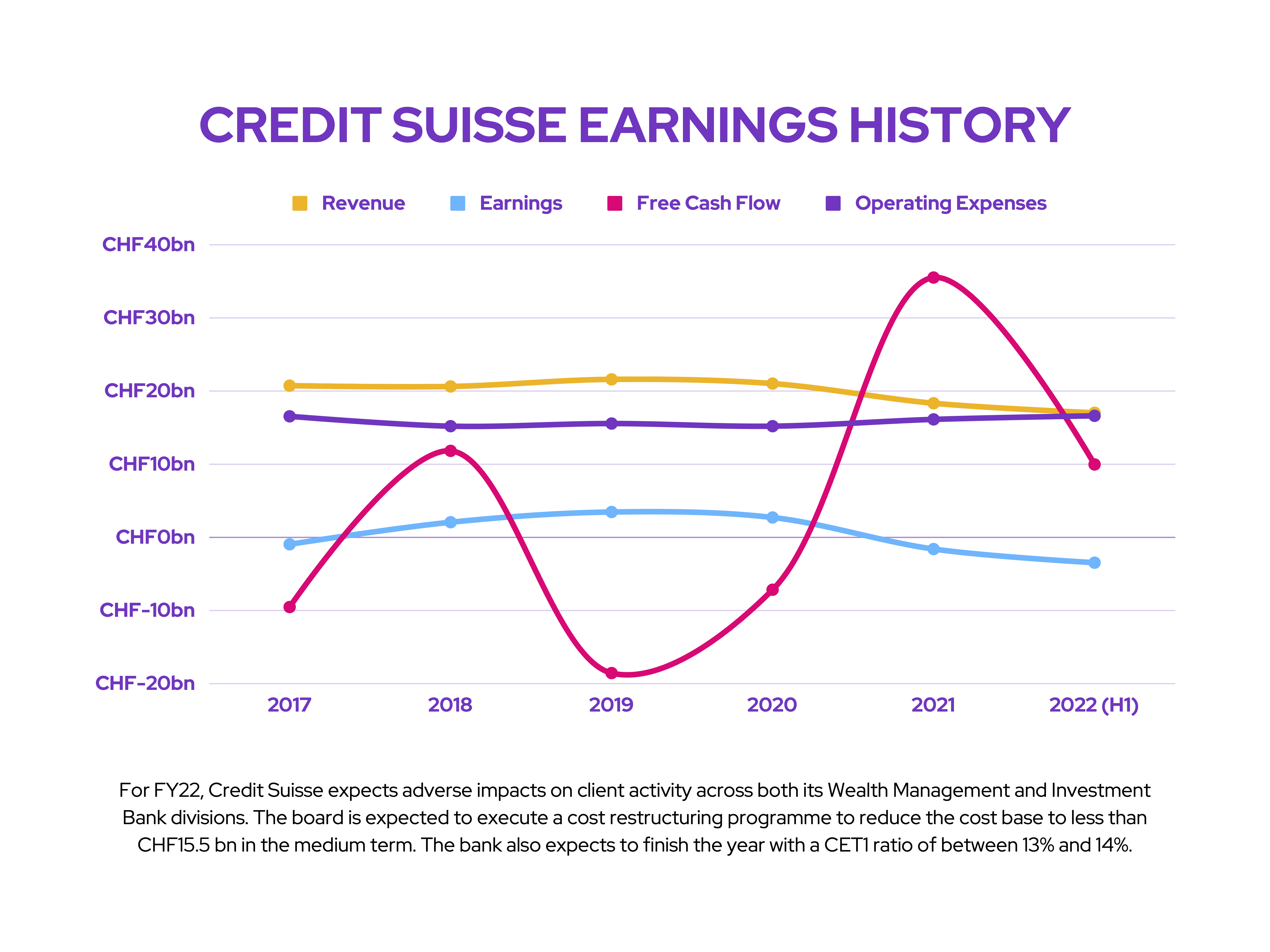

To begin with, Credit Suisse has been doing very badly. The Swiss bank has only been profitable for two of its last nine quarters. This is in large part due to its investment bank division which has made staggering losses from investing in collapsed hedge funds, plus money laundering scandals, and hefty fines. As a result, revenue and earnings have been gradually declining since 2017, while operating expenses have risen. Then there’s the weak outlook that indicates tough times are here to stay.

This all led to Chairman Axel Lehmann proposing a restructuring when he took over earlier this year. But what spooked investors was an employee memo from new CEO Ulrich Koerner in late September. The note stated that Credit Suisse is at a “critical moment”, although he said that the bank’s balance sheet remains robust.

This sent alarm bells ringing with echoes of the warnings heard from the likes of Lehmann Brothers and Bear Sterns before they collapsed during the 2008 global financial crisis. Subsequently, Credit Suisse stock went into freefall.

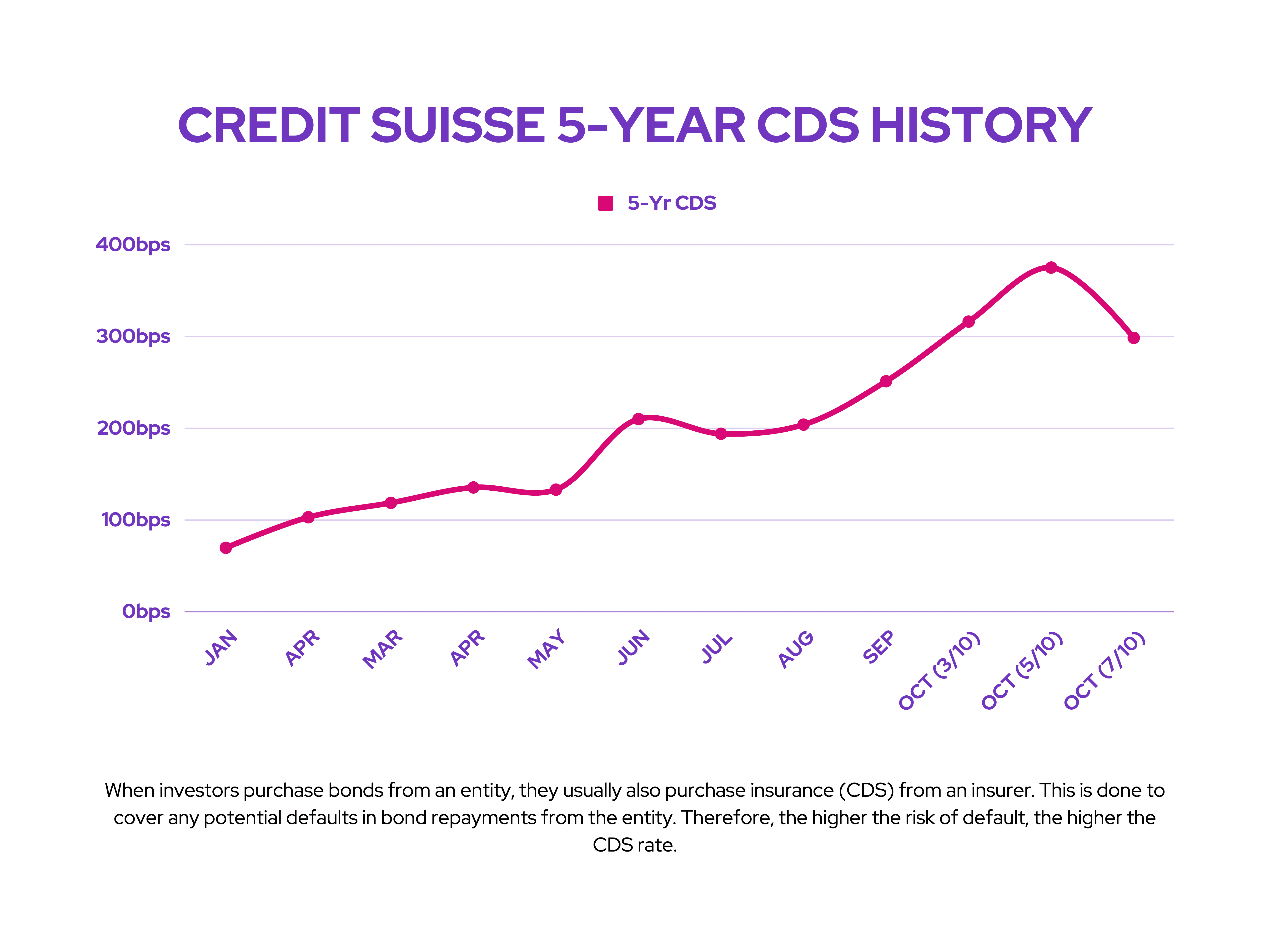

To mitigate this, the board spent a weekend trying to soothe nerves by calling its largest investors to reassure them. However, given the history of scandals, these calls alarmed them further. This then led to a further crash in the stock as credit default swaps (CDSs) for the company saw a sharp increase. In other words, this is how likely investors think a company is to default on its bond repayments.

Spreading it thin

Due to these alarming events, Credit Suisse saw its five-year CDSs jump to as high as 375 basis points. This is more than four times higher than what a standard CDS is or should be, thus hinting that there’s a high likelihood that the company may not be able to make its bond repayments in five years.

The rise in the bank’s CDSs sent shockwaves across financial markets. That’s because bank defaults don’t only affect the bank’s own creditors. They also affect its loans to other banks, which can impact overall solvency and create a domino effect throughout the entire financial system. And given the size of Credit Suisse, its collapse could potentially trigger another financial crisis.

But could fears of Credit Suisse collapsing be unfounded? Possibly. For context, most companies’ CDSs have risen this year on the back of the problematic global economy. Deutsche Bank and General Motors, for instance, have very high CDS spreads too.

From the Russia-Ukraine war to spiralling inflation and surging energy prices, the risk of defaults has risen as fears of a recession grow. Not to mention, currency headwinds from higher interest rates and a strong US dollar present an even bigger challenge for corporations seeking to report satisfactory earnings.

But what’s worth pointing out is that the spread between Credit Suisse’s one-year and five-year CDSs has now widened. This means that investors don’t think that a default is on the cards within the next year, although the likelihood of a default within five years remains elevated due to its increasingly worrying losses.

Strong credit

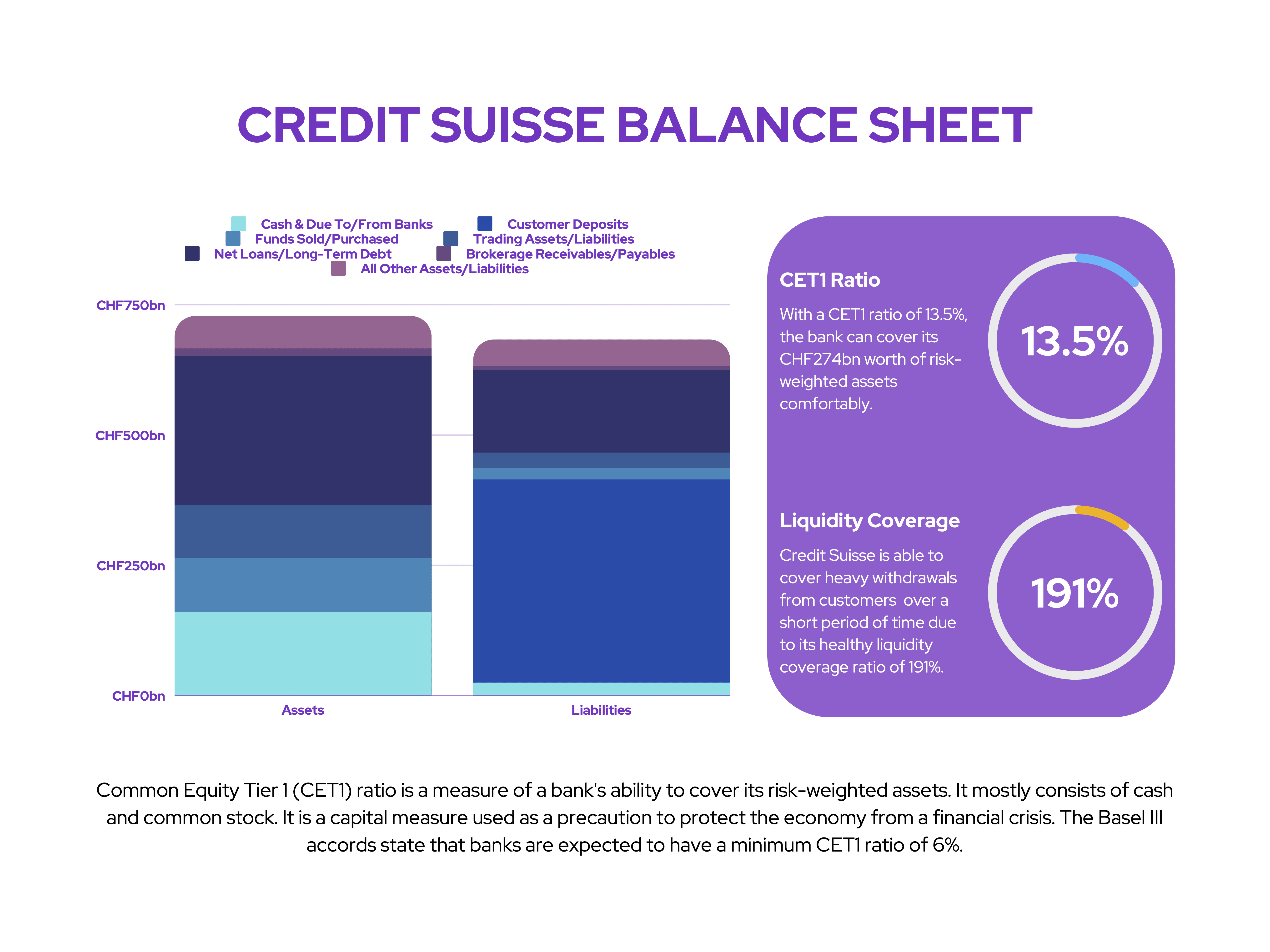

If I were to filter out the news and the panic of recent weeks, Credit Suisse doesn’t look too bad financially. Despite loss-making ventures, the institution’s balance sheet remains fairly robust. Here’s why.

- Assets cover liabilities comfortably.

- Its CET1 ratio and tier 1 capital are within minimum regulatory requirements and remain at healthy levels.

- The liquidity coverage ratio (LCR) is strong enough to cover any short-term liquidity shocks from client withdrawals.

That being said, there are still risks involved that aren’t included on the firm’s balance sheet. Credit Suisse has CHF136bn worth of off-balance sheet exposures that are considered to be risky. These instruments could impact the balance sheet if they drop in value.

Nonetheless, the level of risk surrounding these instruments isn’t known as the bank doesn’t disclose them entirely, so any fears remain speculative. But given the bank’s track record, the state of its balance sheet could have fundamentally changed as a result of these instruments, since its last earnings report. On that account, its financials could be in a precarious position when it reports its Q3 results later this month. Only time will tell.

A much-needed plus

Having said all that, the past couple of days have been a little more soothing for investors. This is because Credit Suisse opted to buy back $3bn worth of bonds in a show of financial strength. Since then, its stock has recovered by approximately 20% from its all-time low. Moreover, its five-year CDSs are back down to 298 basis points at the time of writing.

Nevertheless, Credit Suisse isn’t in the clear. Poorly rated bonds and a very low stock price mean raising capital will be hard. And with the sale of one of its Zurich hotels, it’s clearly still in need of an injection of liquidity.

Investment worthy?

So would I buy Credit Suisse stock? Well, despite a decent balance sheet, is remains loss-making and has a record of poor capital management and scandals. Therefore, its leadership team has a tough task on its hands.

There’s talk of Credit Suisse potentially spinning off its troubled investment bank division. This could relieve Credit Suisse of some dead weight and allow it to recover profitability. But until such a move is confirmed, I won’t invest my money in it.

I will, however, be paying close attention to it and what happens leading up to its Q3 results on 27 October. After all, the state of the global economy and our stocks could very well be resting on the shoulders of Credit Suisse.