I think these UK dividend stocks could be great ways to generate long-term passive income. Here’s why I’d buy them for my portfolio today.

Here comes the sun

Renewable energy stocks could prove to be highly lucrative investments over the next decade. It’s why I have bought shares in green energy giant The Renewable Infrastructure Fund in 2022.

We all know that demand for clean energy is set to boom in the coming decades as the climate emergency intensifies. The International Energy Agency thinks renewable energy capacity will rise 60% between 2020 and 2026, to 4,800 GW.

Funds that invest in green energy could deliver exceptional profits growth in this environment. But this isn’t the only reason why I like them. Because electricity is an essential commodity, these shares also have defensive qualities that provide excellent earnings stability. This is something that is particularly attractive to me as someone seeking reliable dividend income.

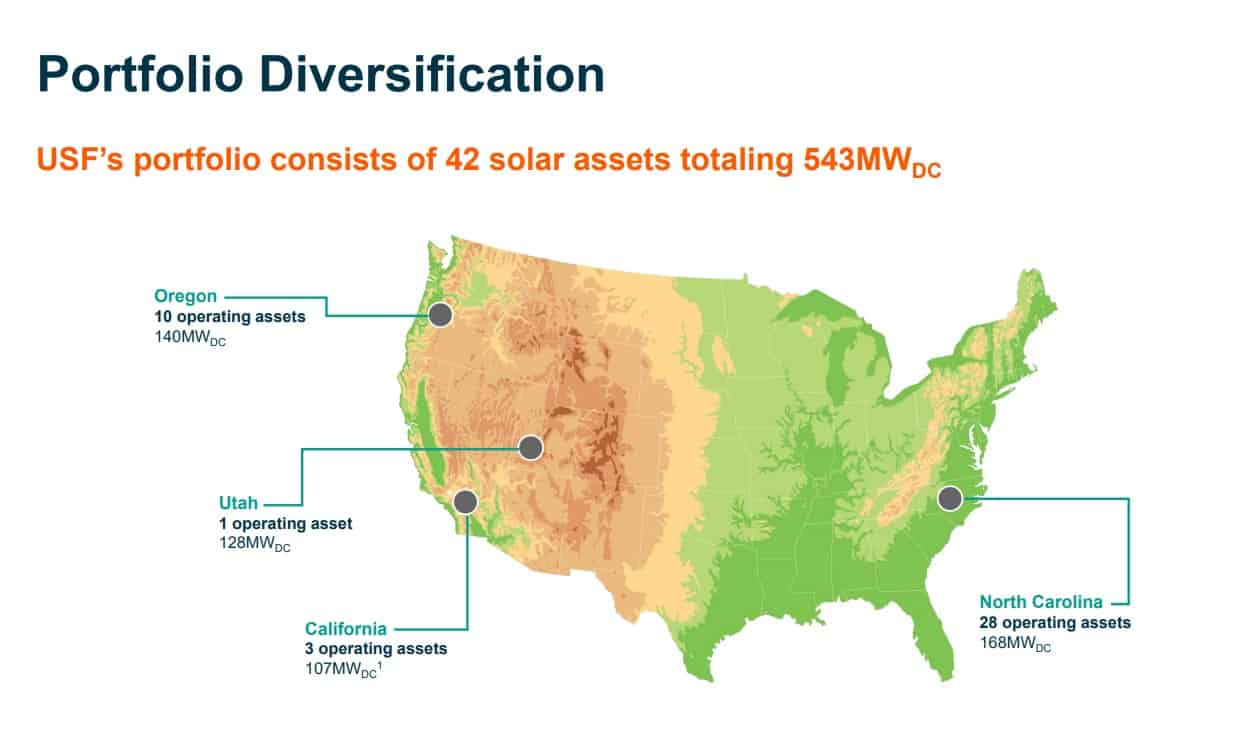

Today, I’m also considering increasing my exposure to renewable energy stocks. And I’m thinking of doing it by investing in US Solar Fund (LSE: USF).

The business met its dividend target of 5.5 US cents per share in 2021. It plans to raise the annual payment by a steady 1.5%-2% in the years ahead too.

Made in the USA

As its name suggests, this share is focussed on the United States. This is what makes it particularly attractive to me.

The US has long been one of the most favourable territories for renewable energy stocks to operate in. And things have got even better this week too when the Inflation Reduction Act became law. The act commits $370bn worth of spending on green energy infrastructure and will provide juicy tax credits to firms like US Solar Fund.

Renewable energy stocks like this of course carry risk. During periods of unfavourable, weather profits could take a hit if power generation slips. But over a long time horizon, I believe US Solar Fund should still prove a lucrative UK share to own.

High voltage

Gore Street Energy Storage Fund (LSE: GSF) could be another highly profitable way to play the green energy revolution. This is despite the company’s currently high debt levels.

Power generation from solar and wind is unpredicable. And so technology is needed to store electricity during productive periods. This enables a constant flow of electricity when the sun doesn’t shine and winds are low. This is what Gore Street specialises in.

The business owns a string of battery storage assets in Britain, the US, Germany and Ireland. And it is aggressively expanding its portfolio at the moment. Total battery capacity soared to 628.5MW as of March, up 65% year-on-year.

I also like Gore Street because of its potentially lucrative dividend policy. The company is targeting annual dividend payments based on a 7% yield on the average NAV per share. This is subject to a minimum payout target of 7p per share. That 7p minimum yields a healthy 5.9% at current prices, by the way.