The Deliveroo (LSE: ROO) share price has fallen off a cliff this year. Having said that, its latest trading update brought some much needed relief to its share price, boosting it by more than 15%. With that in mind, Deliveroo shares have piqued my interest.

Low jump in revenue

With stalling retail sales data in Q2 and consumer confidence levels hitting all-time lows, I was expecting revenue figures for the quarter to suffer. But Deliveroo surprised me with 4% growth in its gross transactional value (GTV) for Q2 and 8% growth in H1. I’d initially though that this was the result of inflated prices, but total orders grew too!

| GTV Growth | Q1 2022 | Q2 2022 | H1 2022 | H1 2021 |

|---|---|---|---|---|

| UK & Ireland | 12% | 4% | 8% | 110% |

| International | 11% | 1% | 6% | 88% |

| Group | 12% | 2% | 7% | 99% |

Nonetheless, there was a massive slowdown in growth when comparing Q2 2022 vs Q1 2022, and H1 2022 vs H1 2021 figures. According to management, Q2’s GTV per order was ‘down slightly’ on a year-to-date basis, due to pandemic comparisons. Additionally, the board revised its GTV growth outlook for the year from 15%-25% down to 4%-12%. So, why did the Deliveroo share price pop then?

Paddling back on cost

Well, the food delivery company’s full-year guidance for adjusted EBITDA remains strong, as the FTSE firm initially guided to finish the year with an adjusted EBITDA of -1.5% to -1.8%. If successful, this would show a steady improvement of profit margins, as Deliveroo went from -3.2% in H1 2021 to -2% in FY21.

Nevertheless, the company plans to deliver on its EBITDA promises by cutting costs throughout its business. It plans to implement gross margin improvements with more efficient marketing expenditure and tight costs control. More details will be available on 10 August 2022 when the firm releases its full earnings report.

Slower delivery?

I initially doubted Deliveroo’s ability to deliver on improved margins in this current macroeconomic environment, but CFO Adam Miller has proven me wrong thus far. If the company can deliver on its guidance and continue expanding once we’re out of a recession, it would still be on track to reach breakeven by 2024.

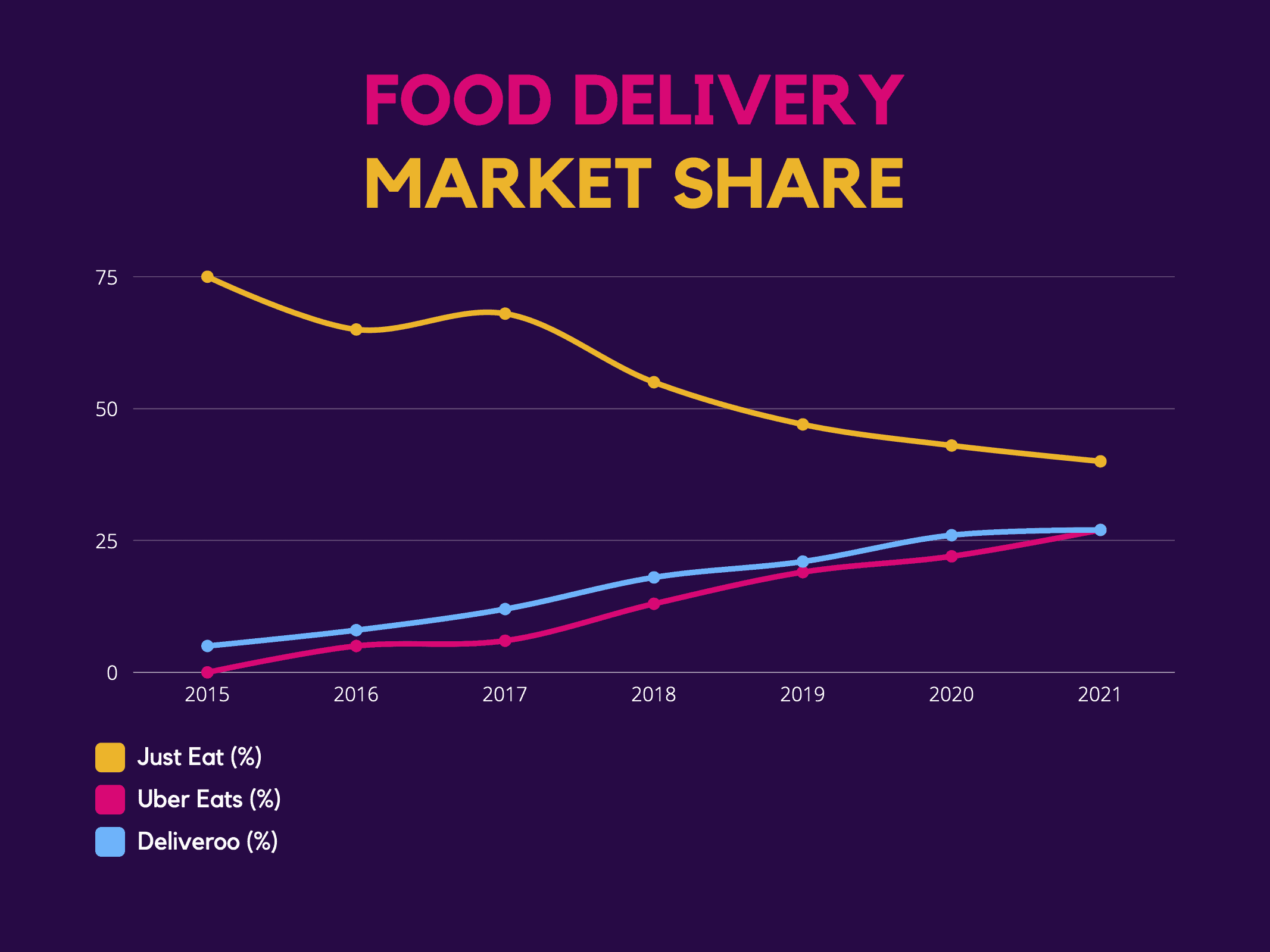

That being said, Deliveroo is having to forgo expanding its market share by protecting its margins. Doing so risks it losing its current position in the market. The blue kangaroo is still quite some way away to beating Just Eat, and has Uber‘s Uber Eats on its tail.

However, Deliveroo has an abundance of valuable partnerships that could help maintain its position in the market. These include key collaborations with companies such as Amazon, Sainsbury’s, WHSmith, Carrefour, and Waitrose. More interestingly though, its upcoming partnership with McDonald’s could help it passively capture market share, given the fast food chain’s contribution to revenue at Uber Eats.

Will I buy Deliveroo shares for my portfolio then? The company does have a solid set of financials — zero debt, £1.3bn in cash, and only £496m in total liabilities. Even so, I’m apprehensive, as an eventual 6% EBITDA margin is rather slim. Therefore, I’ll be keeping it on my watchlist for now, and may buy shares if there’s an improvement to its long-term guidance.