These days it can be difficult to find the money to invest for retirement. As inflation continues to squeeze budgets, it can be tempting to cut back on long-term savings plans. Short-term needs can seem far more compelling.

I get it, we’ve all been there at times, and for me it was especially true when I’d only just started working.

At the same time though, I also had plans to quit the rat race early to be able to travel more. With the average retirement age in the UK being just under 65 years old, I knew I’d have to start investing early to beat that.

Having now retired early in my 40s, these are the two top tips on investing for retirement that really helped make it happen.

Reinvesting dividends for a better retirement

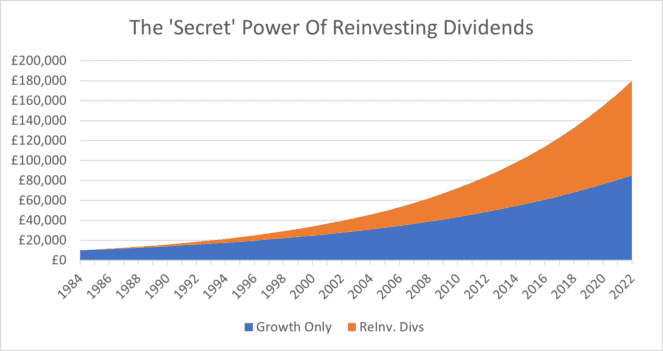

It can be eye-opening to see the impact of reinvesting dividends on market returns. Especially as time goes on and those reinvested dividends start to earn their own returns — the so-called snowball compounding effect.

For example, the FTSE 100 average return is usually quoted as around 7.9%. What people often don’t mention is that includes reinvesting dividends. Without doing that, the average rate drops to around 5.8%.

The difference may sound small, but if I had invested a lump sum of £10,000 back in 1984, the impact today would look like this:

After 10 years, the gap is small at just under £4k. But by the start of 2022, it’s a far more substantial amount at around £95k extra. That’s pretty much twice the final pot size between the two different methods of investing!

That difference comes from the FTSE 100 average dividend level of around 3.5% over the same time period. So imagine how that gap widens when I target dividend shares above that rate.

That could be Rio Tinto, M&G and Persimmon — if invested equally between them, I’d get an average blended dividend rate of around 11.5%. That’s only going to widen that gap with this reinvestment approach.

That’s great — but where I saved my cash mattered too. Time for tip two!

Planning matters when investing for retirement

When it comes to investing for retirement, planning ahead matters.

I’ve always invested in pension schemes first for the tax rebates they offered. But it’s my ISA investments that offer me far more flexibility.

By using a Stocks and Shares ISA, I can invest up to £20k each year free of any capital gains. And now, I’m also able to withdraw a regular tax-free income to fund my early retirement.

If I’d bought those three shares mentioned above, then after just 10 years of maxing out my ISA I’d have about £350k in total, ignoring any capital growth. That would give me a healthy annual tax-free income of almost £40k!

Picking the right investments for retirement

I honestly couldn’t have retired early without using these two tips for investing for retirement. But it’s worth saying that (unsurprisingly) it’s as important to pick the right underlying investments.

Dividend yields are prone to change and inflation needs accounting for — especially these days. But taking the time to research what’s best for my personal risk/reward appetite really paid off.

It’s not always been easy, but these two tips were definitely a big part of helping me achieve my dream retirement.