During a bear market, investing in dividend stocks are a great way for me to try to recover some short-term losses. Nonetheless, not all companies pay a steady and consistent dividend through good and bad times. So, here are two companies that do.

General Mills

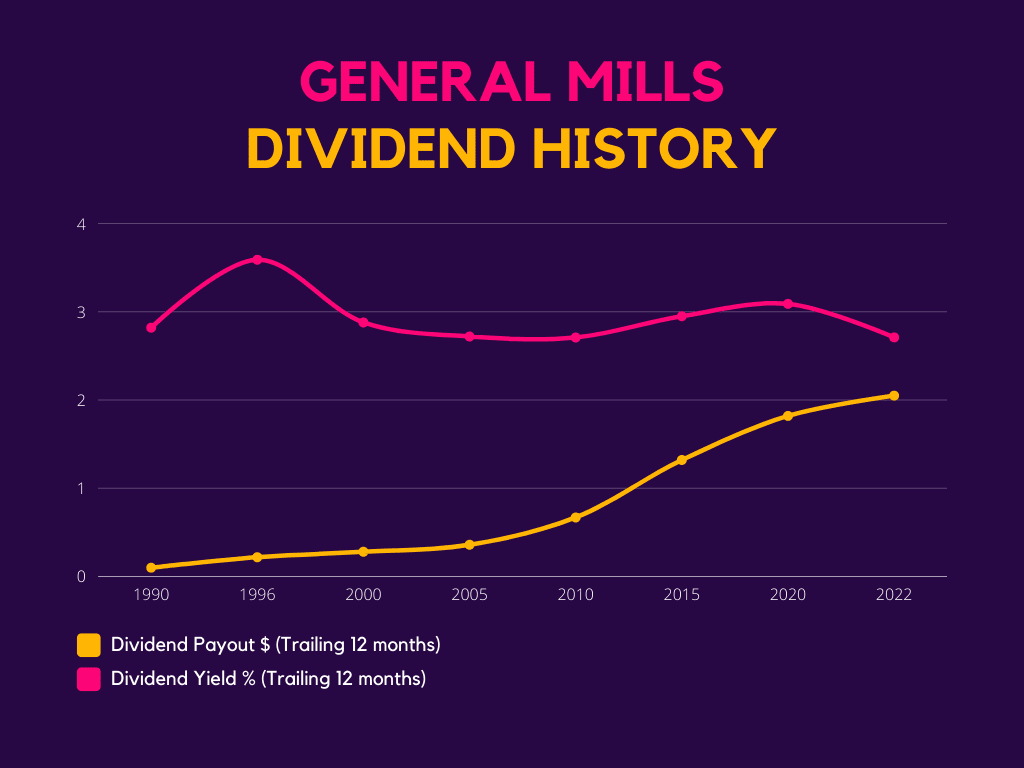

While the S&P 500 flirts with bear market territory, consumer foods company General Mills (NYSE: GIS) continues to hit all-time highs. On a year-to-date (YTD) basis, the stock is up 11%! Not only that, the board recently approved a 6% increase to its quarterly dividend, bringing its total dividend to $0.54 per share. Nevertheless, what makes it such a lucrative stock is its track record of consistent and growing dividends, which has lasted over 120 years!

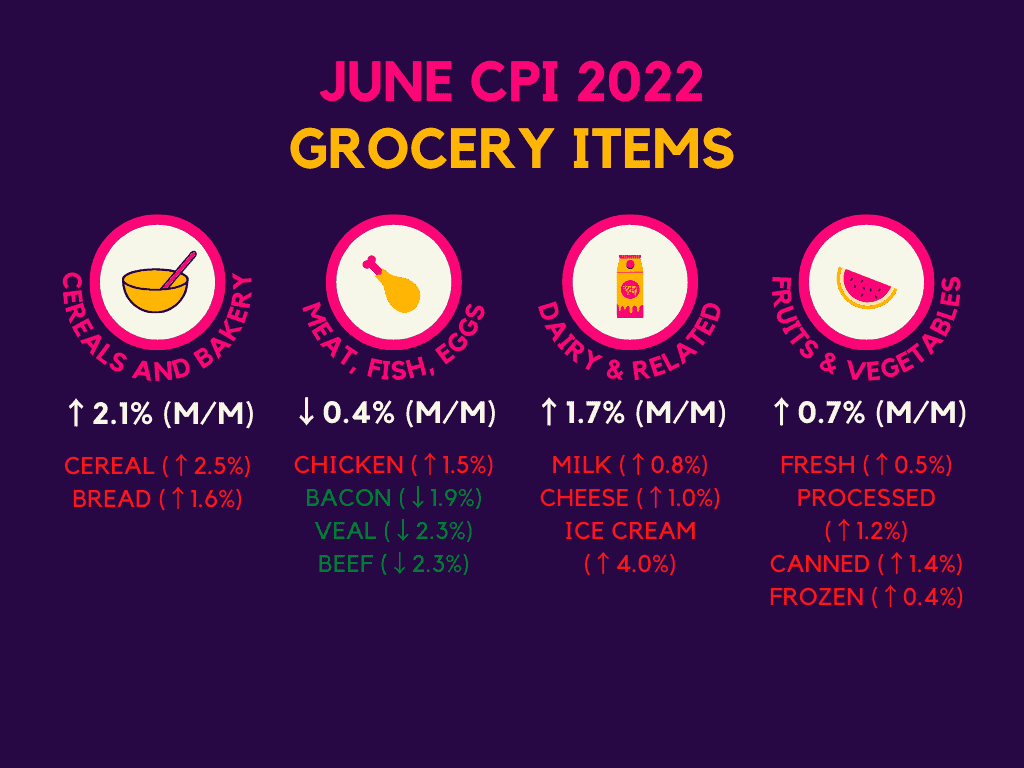

Aside from its dividend, however, the company continues to post steady and healthy margins (14.3%), despite ongoing inflationary pressures. General Mills’ top line shows no signs of cooling either when taking June’s Consumer Price Index report into account. Although cereal prices are up 2.5% on average, May’s retail sales data indicates that grocery sales are up 1.2% month-on-month (M/M). This aligns with what CEO Jeffrey Harmening mentioned, that General Mills is benefiting from consumers switching to at-home eating.

Rio Tinto

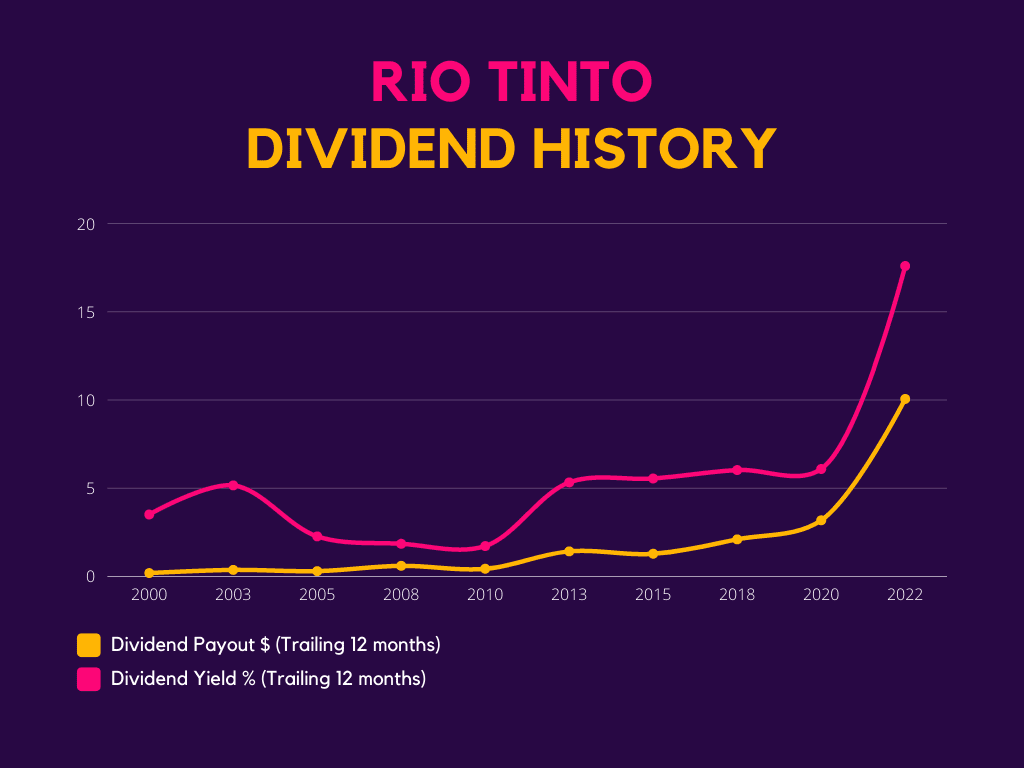

Another Dividend Aristocrat on my list is Rio Tinto (LSE: RIO). Like General Mills, Rio has been paying consistent dividends for the past few decades, even during the last three financial crises. Nonetheless, its share price is down 3% (YTD).

As the second biggest iron ore producer in the world, Rio exports the bulk of its iron to China. Therefore, lockdowns across China have resulted in a 15% decline in its share price over the last month. Consequently, I’m expecting Rio’s dividend to fall in the near term. But if history is any indicator, a post-Covid rebound in China’s economy will most likely boost Rio’s top line and dividend exponentially. I only need to refer to the difference in dividends from 2020 and 2022 (‘Peak-Covid’ vs ‘Post-Covid’) to make my case.

Additionally, the miner boasts excellent profit margins that average above 20%. With a healthy debt-to-equity ratio of 21.7%, and cash ($15.3bn) comfortably covering debt ($12.2bn), the FTSE 100 firm seems well equipped to handle a potential economic slowdown.

Worthy dividend?

Having said all that, these two dividend stocks have good track records. It suggests that they are able to provide some passive income through good and bad times. As a matter of fact, their average dividend yields outperform the S&P 500. But do I think these stocks are worth a buy?

Well, General Mills’ financials put me off investing in its shares. The manufacturer has a staggering amount of debt ($11.6bn) with a minuscule amount of cash ($819m) in its reserves. With interest rates set to continue rising, debt repayments could become more costly, and potentially lower its dividend. Furthermore, its average price target of $73.87 could indicate that the stock is overvalued at this time.

On the other hand, Rio Tinto has strong financials and earnings power. As a result, the current dip is a buying opportunity for me, as I aim to capitalise on an eventual rebound in the Chinese economy. After all, its average price target is £56.43. This presents me with a 24% upside if I were to invest today.