Generating passive income streams is a key consideration for me when I’m searching for stocks to buy. Dividend shares with high yields are useful investments in this regard. However, I also prioritise consistency in a company’s distributions to its shareholders, as well as yield, with a particular focus on Dividend Aristocrats.

One FTSE 100 tech stock I have my eye on is enterprise resource planning (ERP) software outfit Sage Group plc (LSE: SGE). The Sage Group share price is down 25.5% in 2022, which makes me think this could be a great opportunity to buy the shares for my portfolio at a bargain rate. Here’s why.

A reliable passive income stock

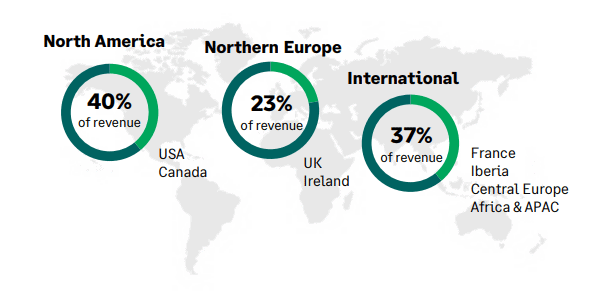

Sage Group is the world’s third-largest provider of ERP software, behind Oracle and SAP. The Newcastle-based business delivers cloud-based accounting, human resources, and payroll software solutions for small and medium-sized businesses. It has a truly global client base.

The stock’s current dividend yield is 2.9%, which is below the FTSE 100 average of 3.9%. Accordingly, it might not be first choice for investors seeking passive income, but I believe there are good reasons to consider this company for my portfolio.

The financial results for the first half of 2022 reveal a positive trajectory with a 5% year-on-year increase in organic total revenue to £924m. In addition, organic operating profit was up 4% to £184m. The company has issued guidance that recurring revenue growth will be in the region of 8% to 9% for FY22.

Strong finances are the foundation for reliable future dividend payments. For me, Sage Group doesn’t disappoint in this regard. What’s more, growing the dividend over time is one of the company’s stated capital allocation priorities.

I also like the company’s balance sheet. The group has an underlying cash conversion rate of 120% and £1.2bn in cash and available liquidity. Although they don’t offer a bumper yield, I view Sage Group shares as some of the most dependable passive income investment options in the stock market today.

Risks for Sage Group shares

The company is currently undergoing a transition. This involves a managed decline in software and software-related services as a revenue source. There was a 24% reduction in this revenue category in H1 2022.

Sage Group also recently disposed of its Australian and Swiss businesses, as well as its South African payroll outsourcing division.

Although the aim is to boost profitability by becoming a subscription-based software-as-a-service (SaaS) firm, it seems these plans have caused some concern among investors, depressing the Sage Group share price in the process.

A move away from its traditional licensing model could reduce cash flow and revenue, even if there are a myriad of opportunities for the company to capitalise on expanding its cloud offering.

Would I buy?

Tech stocks don’t immediately spring to mind when I think of the FTSE 100. Sage Group is a rare exception. I’m looking to expand my exposure to tech in the current stock market downturn in conjunction with my perennial search for good passive income investments.

Sage Group shares fit the bill on both fronts. While not without risks as the business model evolves, I’m drawn to the company’s solid finances and robust dividend history. I’d buy.